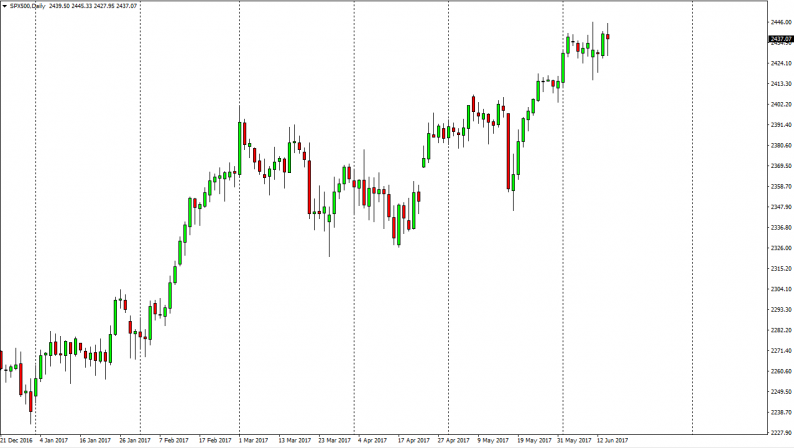

S&P 500

The S&P 500 went back and forth during the day on Wednesday, as the markets try to position themselves due to the Federal Reserve announcement. The market continues to look bullish overall though, because quite frankly when it up forming a bit of a hammer. The hammer sits on top of a previous hammer, and I think that the longer-term uptrend is still very much intact. I have a longer-term target of 2500, which of course is a large, round, psychologically significant number. I believe that it will take some work to break above their, but eventually we could. It may take several attempts to do so, but I do think that we break above that level. Pullbacks should find support quickly, and I believe that the 2400 level is essentially the “floor” in the market.

Nasdaq 100

I find the Nasdaq 100 interesting at the moment, because we continue to find the support at the 5700 level. I believe that the market has already seen the worst of the various pressure, and therefore it’s only a matter of time before we reach towards the 5900 level again. To break above their shirts in this market looking for the 6000 level, which has been my longer-term target for quite some time. I believe that pullbacks were present value, and although the Nasdaq 100 sold off viciously, the reality is that most of the selloff was due to a handful of stocks. I think value investors have come back to push this market to the upside, and we are starting to see the results of that. Ultimately, I have no interest whatsoever in selling anytime soon, because the market certainly continues to show a significant amount of buying underneath, and I think that will continue to be the way over the next several months.

Leave A Comment