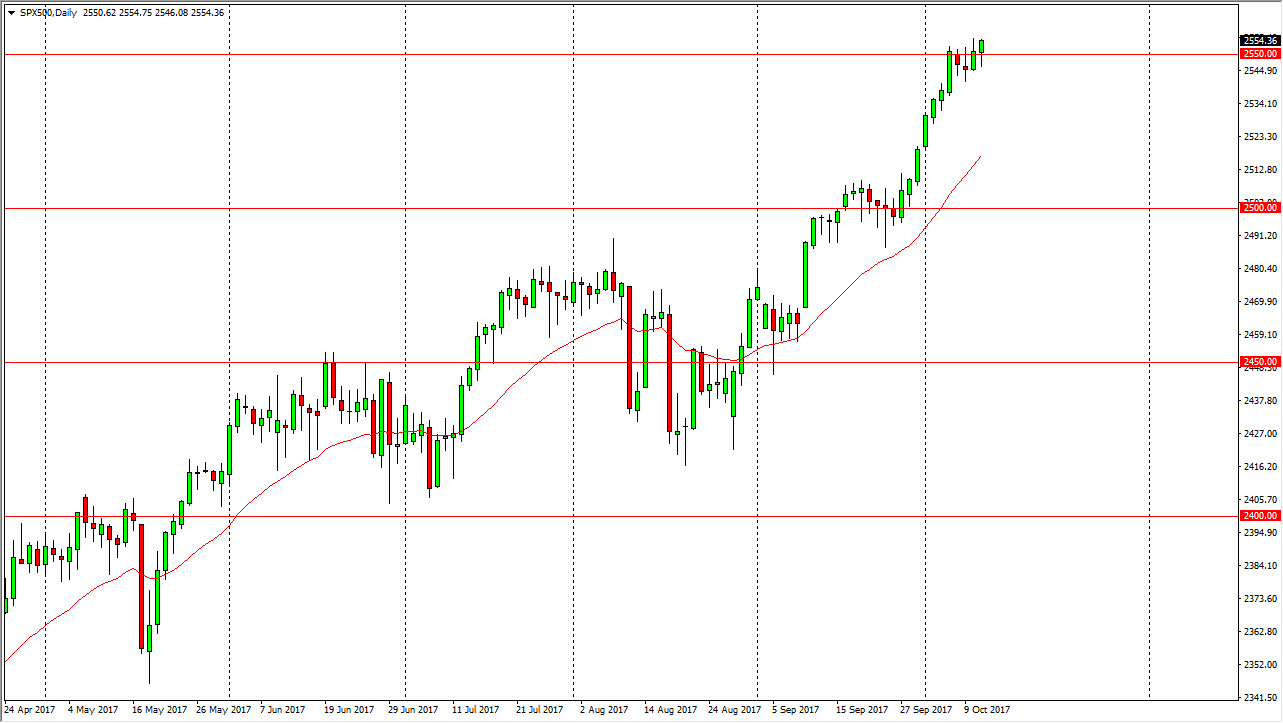

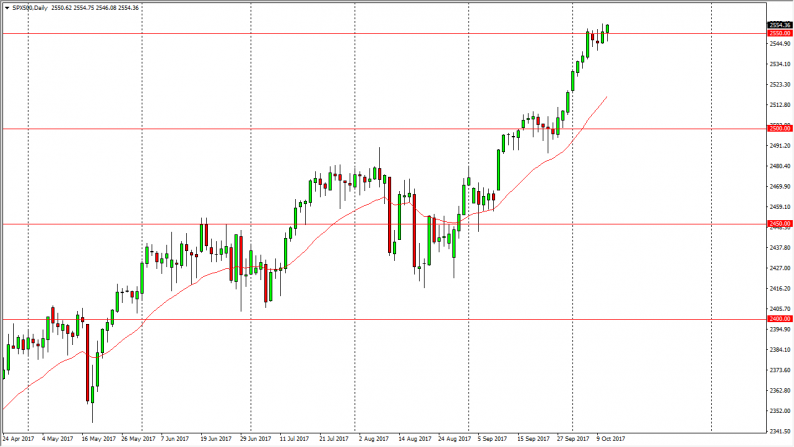

S&P 500

The S&P 500 initially fell on Wednesday but turned around to show signs of strength after the FOMC Meeting Minutes came out, showing that the markets can still expect the same amount of hawkishness out of the Federal Reserve that we have seen recently. Because of this, I think that it’s only a matter of time before the buyers continue to push this market higher, perhaps reaching towards the 2600 level above. I believe the pullbacks continue to offer buying opportunities as they have in the past, and now that we are passed this potential hurdle, we have earnings season to look forward to, and with the financials reporting this week, it’s likely that we will continue to see money flow into the S&P 500 as it is such a large percentage of that index. I like buying this market on dips, and I believe that we are going to go much further.

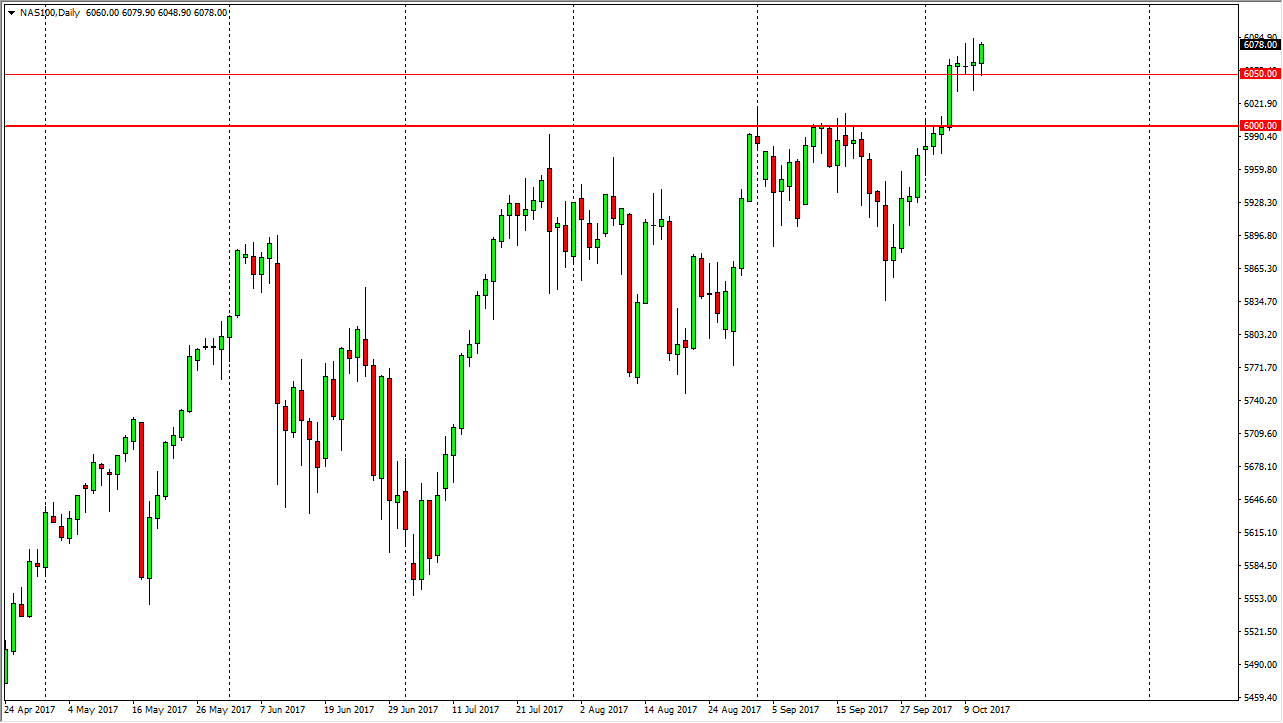

Nasdaq 100

The Nasdaq 100 initially fell during the day on Wednesday, finding support at the 6050 handle, and then bouncing significantly. I believe that the market is ready to continue going higher, and based upon the previous ascending triangle being broken at the 6000 handle, I still think that we have a target of 6200 ahead of us. I like buying dips as it shows value in a market that has been very strong over the longer term, leading the way for the other indices in America. I think that selling is all but impossible until we break down below the 6000 handle, which seems to be very unlikely after the recent action that we have had over the last couple of days. Ultimately, I think that the buyers will continue to be attracted to the technology sector.

Leave A Comment