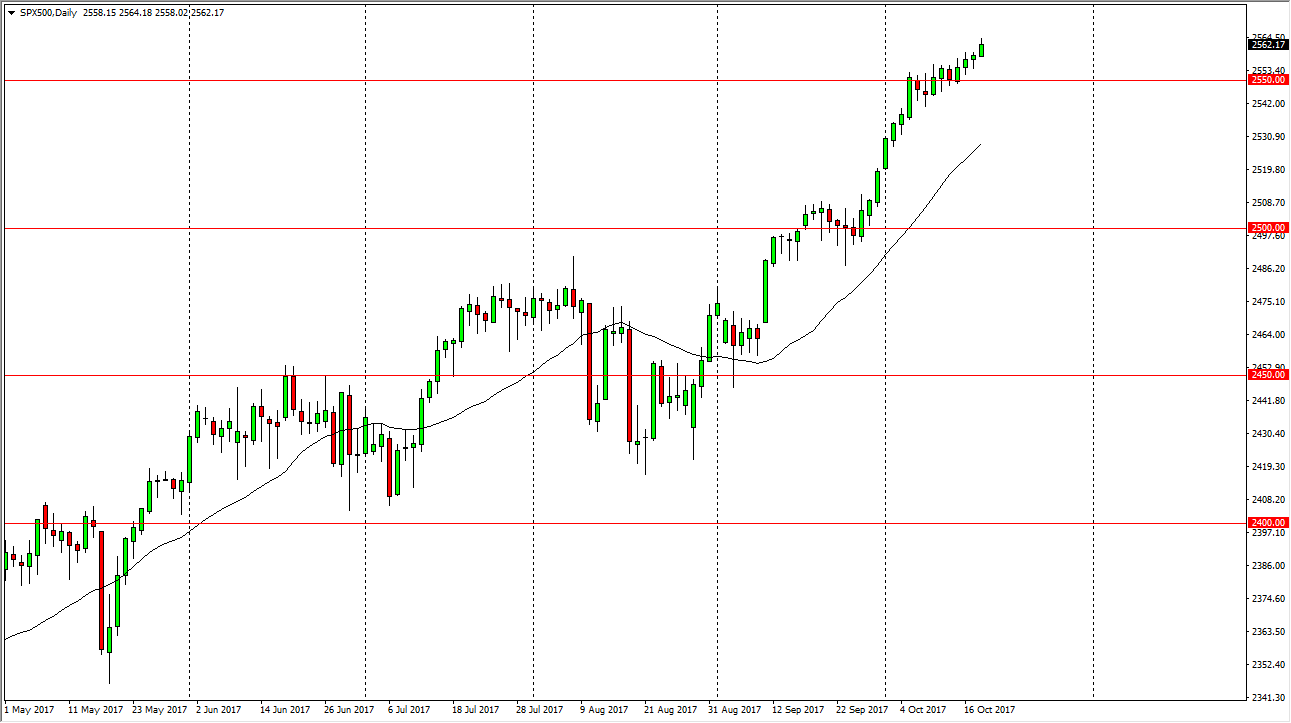

S&P 500

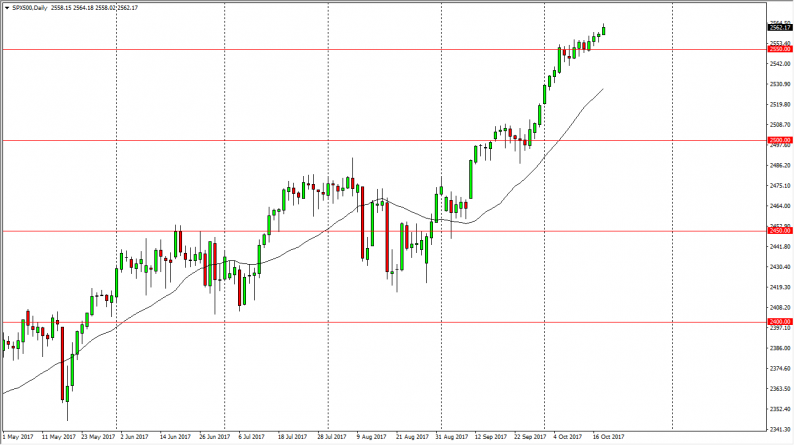

The S&P 500 rallied during the day on Wednesday, reaching towards the 2560 level. We still have plenty of support below at the 2550 handle, and it’s likely that the markets continue to find buyers in that general vicinity. Stock markets are very bullish, and in the middle of earnings season, we are seeing quite a bit of optimism. I think that the market will go looking towards the 2600 level over time, but we may get some volatility in the meantime, but I look at that as a potential buying opportunity. Because of this, I think that the markets will ultimately find plenty of reason to go higher, but I suspect that we may have a few bumps along the way. I think that the bottom of the uptrend is the 2500 level, and as a result, I have no interest in shorting.

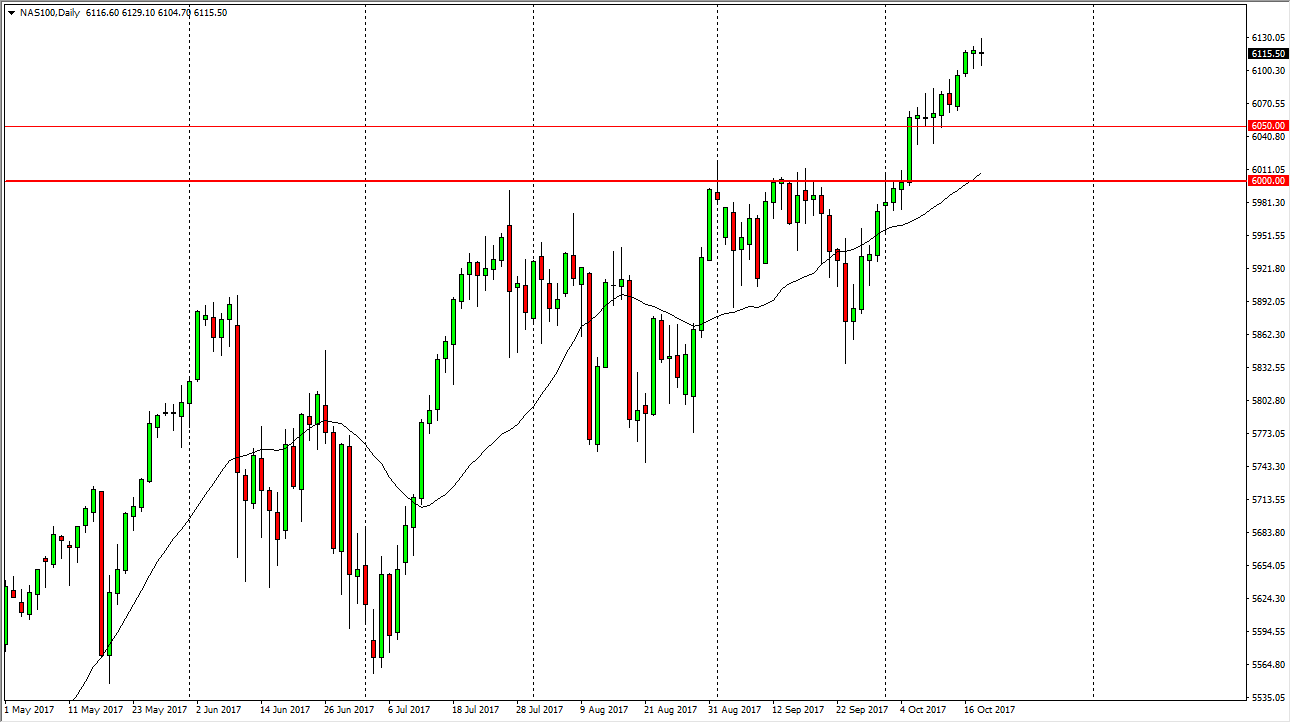

Nasdaq 100

The Nasdaq 100 went back and forth during the day but is a bit overbought anyway. I believe that a pullback is healthy, and probably brings buyers back into the market. There’s a hammer from the Tuesday session, so it’s very likely we may just go sideways. We need to build up momentum to continue going higher, and I do have a longer-term target of 6200. That being said, I think there are massive amounts of support at the 6050 handle, and possibly even at the 6100 level. The 6200 figure comes from the ascending triangle that recently was broken, and measures for a 200-point move. Longer-term, I believe that buying on the dips continues to be the way to play the Nasdaq 100, because of the algorithmic traders that have no other play.

Leave A Comment