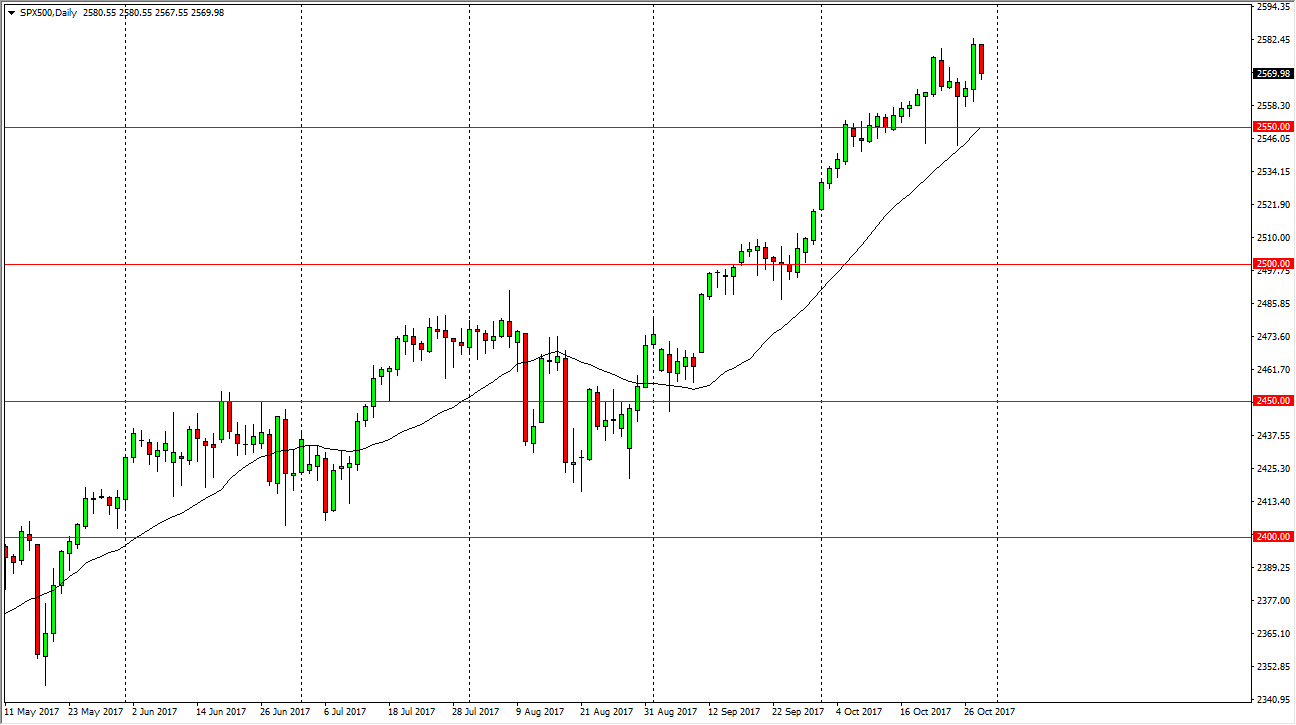

S&P 500

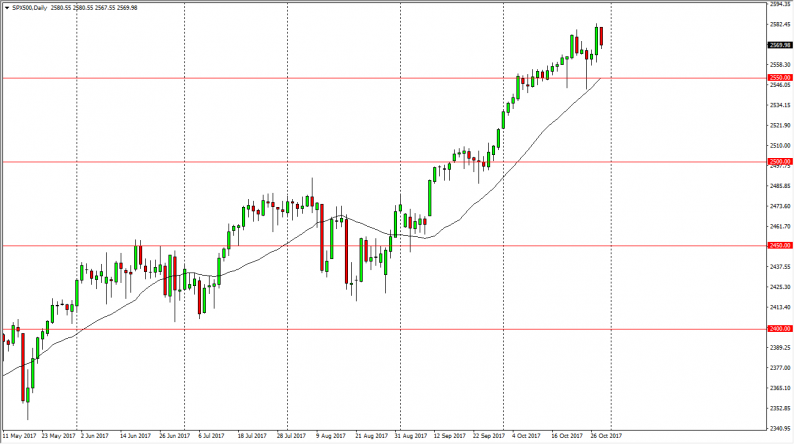

The S&P 500 fell during the trading session on Monday, reaching towards the 2570 handle. The market has a significant amount of support at the 2550 level, and that being the case I think it’s only a matter of time before the buyers return on these pullbacks. Eventually, I think the market will then go to the 2600 level, as it is the next large, round, psychologically significant number. Having said that, it looks likely that we will continue to see algorithmic traders come back in and pick up the value on these pullbacks, which has been the case for some time. I believe if we can stay above the 2500 level, the longer-term uptrend should continue to be intact, and therefore I think that the market should continue to find plenty of reasons to go higher, especially if earnings season continues to do well.

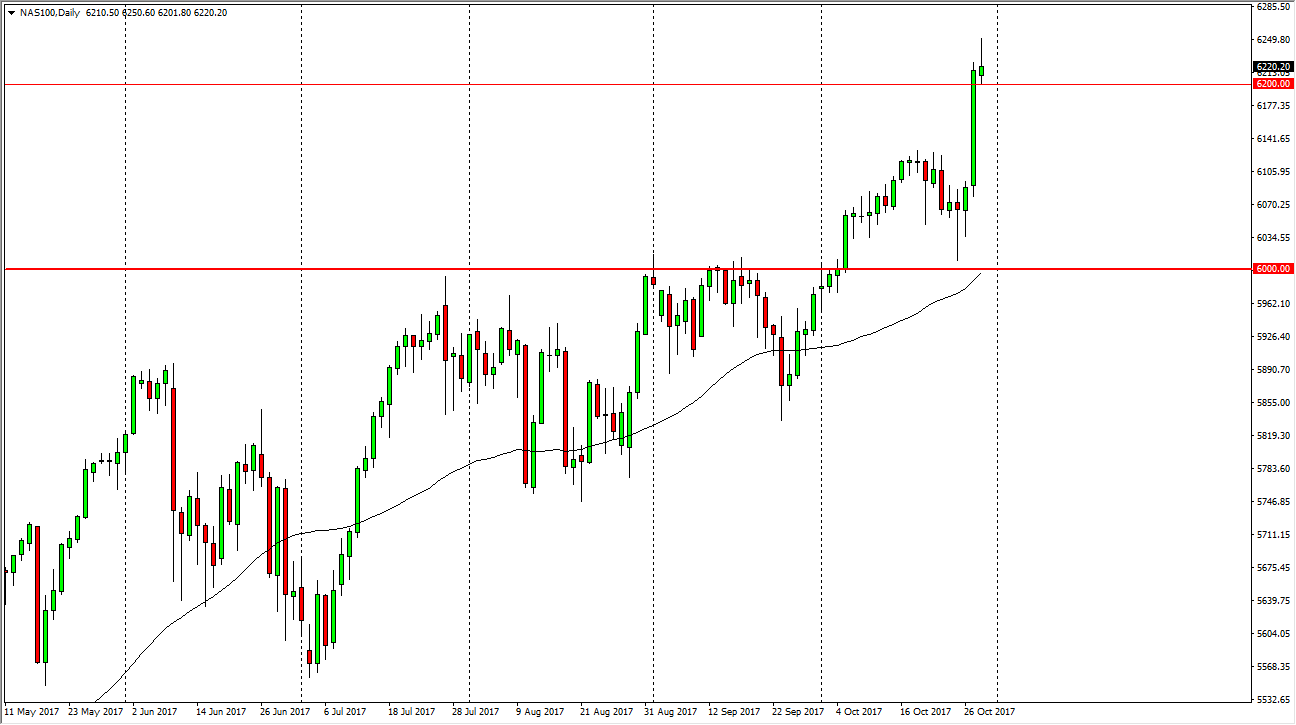

Nasdaq 100

The Nasdaq 100 shot higher initially during the day on Monday but turned around to form a shooting star. The shooting star sits at the vinyl 6200 level, and if we can break down below there, the market could very easily fall significantly, perhaps down to the 6100 level. I think that there is a “floor” in the market at the 6000 handle, so having said that it’s likely that the buyers will return eventually. Longer-term, I believe that the Nasdaq 100 does go higher, and if we can break above the shooting star, it’s likely that the impulsive move will continue. However, I prefer a pullback, so I can find value. Ultimately, this is a market that should continue to be bullish over the longer term, and ultimately, I believe that eventually, the market will go looking for 6500.

Leave A Comment