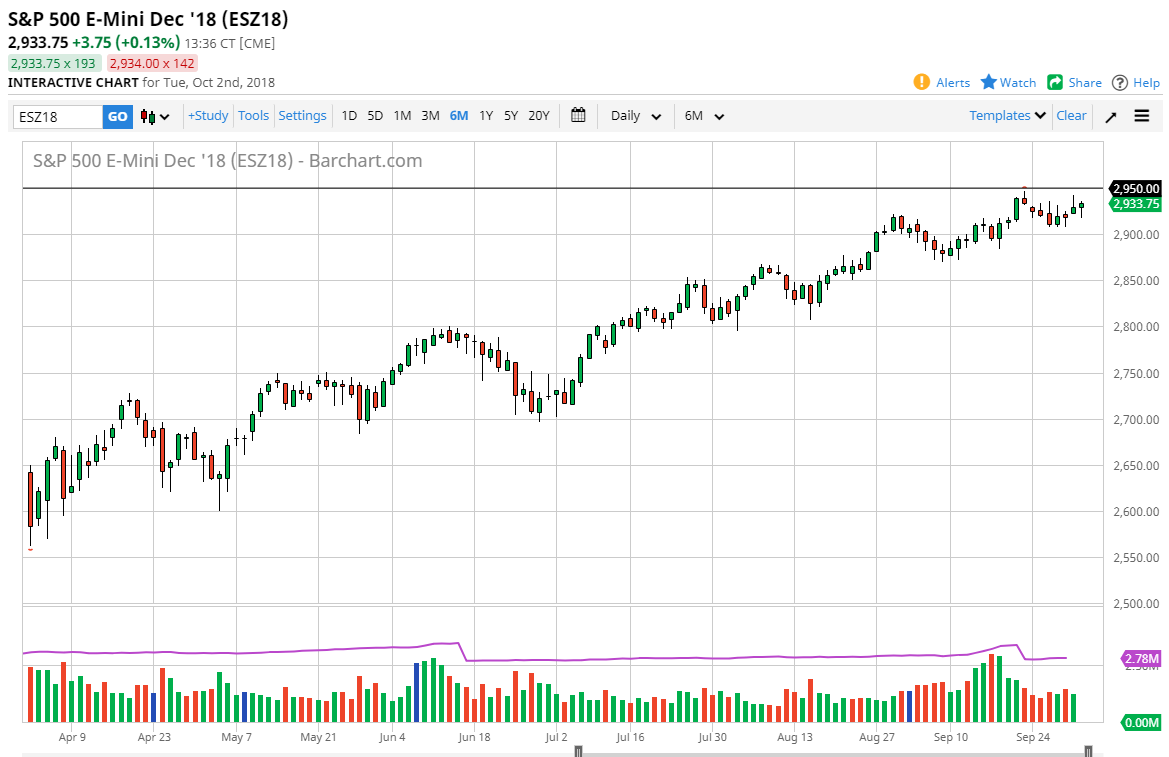

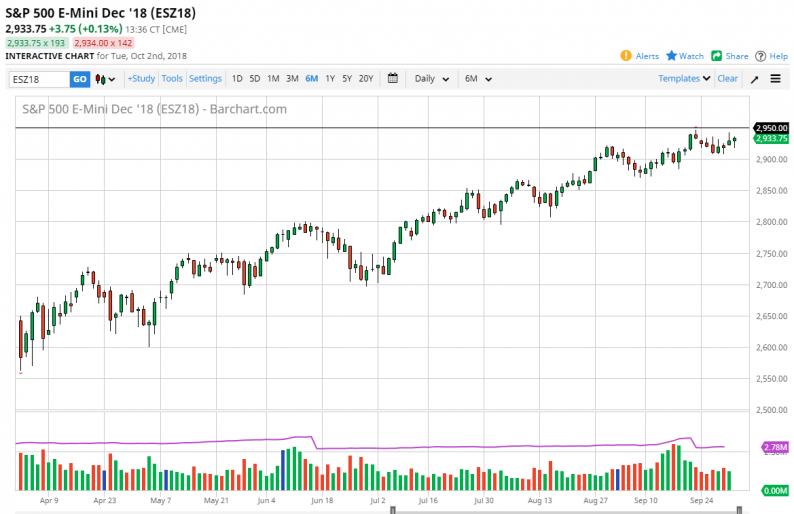

S&P 500

The S&P 500 initially fell during trading on Tuesday but found enough buying pressure underneath the turn things around and form a hammer. I think we are going to grind sideways for the next couple of days, mainly because we have the jobs number coming out on Friday, although we already know that the Federal Reserve is hawkish and should continue to be so. The 2950 level above is significant resistance, but I think eventually we will break above there. Once we do, I believe that the S&P 500 should then go to the $3000 level. I think there is a serious fight just waiting to happen in that region, as it is the yearly target for many people out there, myself included. I think the 2900 level will offer support between now and then, and I do in fact like buying short-term pullbacks. However, we have a lot of work to do to continue going higher.

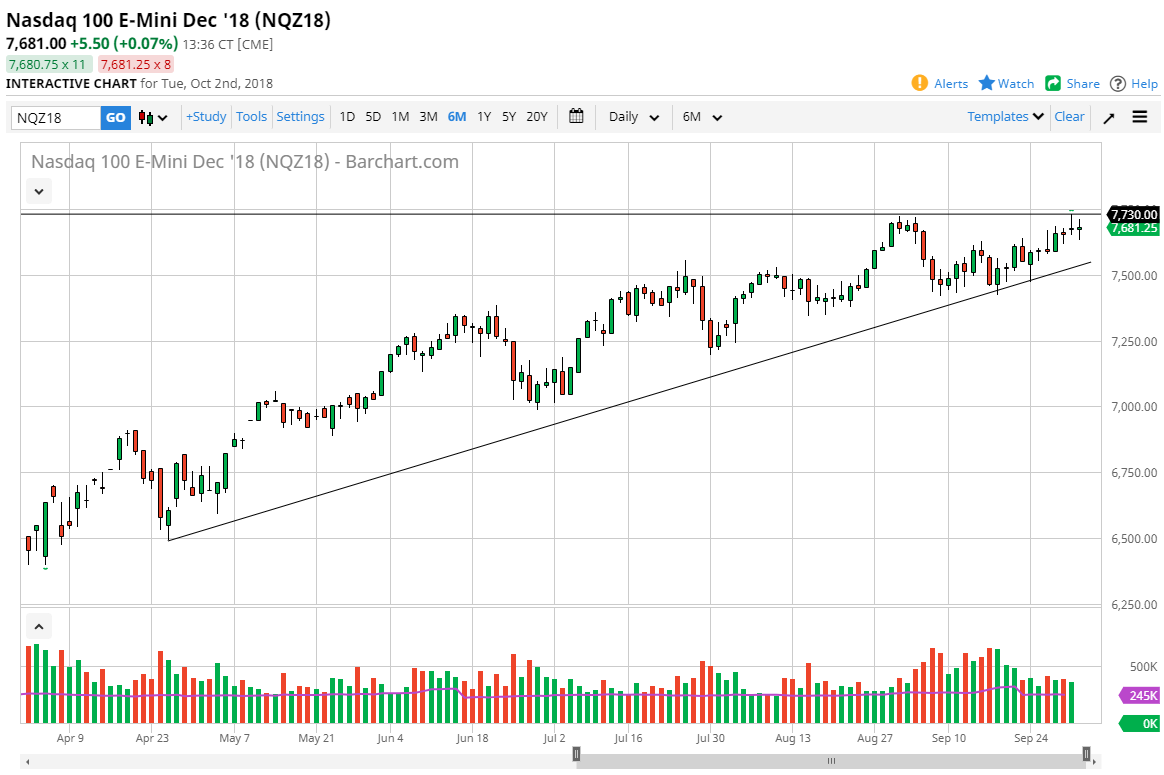

Nasdaq 100

The Nasdaq 100 went back and forth during the session on Tuesday, showing a lack of momentum. The shooting star that formed on Monday suggested that we had reached major resistance, and now it looks as if the market needs to build up enough momentum to finally go higher. I think at this point, it’s likely that if we can break above the 7730 level, the market is likely to continue going higher. At that point, I would anticipate that we are opening the door to 7800 level, and then eventually the 8000 level after that. Short-term pullbacks should continue to see plenty of support underneath, especially at the uptrend line underneath. Ultimately, I have no interest in shorting the Nasdaq 100 quite yet, and I’m not worried about it until we break down below the 7500 level.

Leave A Comment