Ten years ago this week, Lehman Brothers filed for bankruptcy setting off a six-month run where US and global financial markets cratered. Given the six-months that followed Lehman’s demise, one could reasonably argue that anyone who bought US equities right before Lehman filed for bankruptcy made perhaps one of the worst timed investment decisions in market history. The chart below shows the S&P 500’s forward six-month return going back to 1928. In the six-month period that follower from right before Lehman filed for bankruptcy, the S&P 500 declined 46.7%, which was the worst six-month decline for US equities since the depths of the Depression in late 1931!

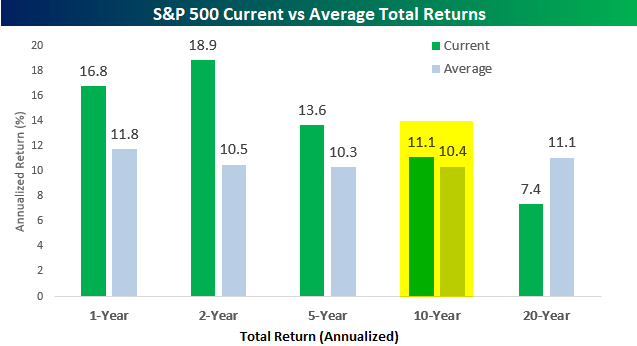

Longer-term, though, that poorly times decision doesn’t look so bad. Amazingly, US equity returns over the last ten years have actually been slightly above their long-term average. Since the close on 9/11/08, the S&P 500? has seen an annualized return of 11.1% compared to a historical average ten-year annualized return of 10.4%. While time heals all wounds, there’s nothing like a raging bull to speed the process up!

Leave A Comment