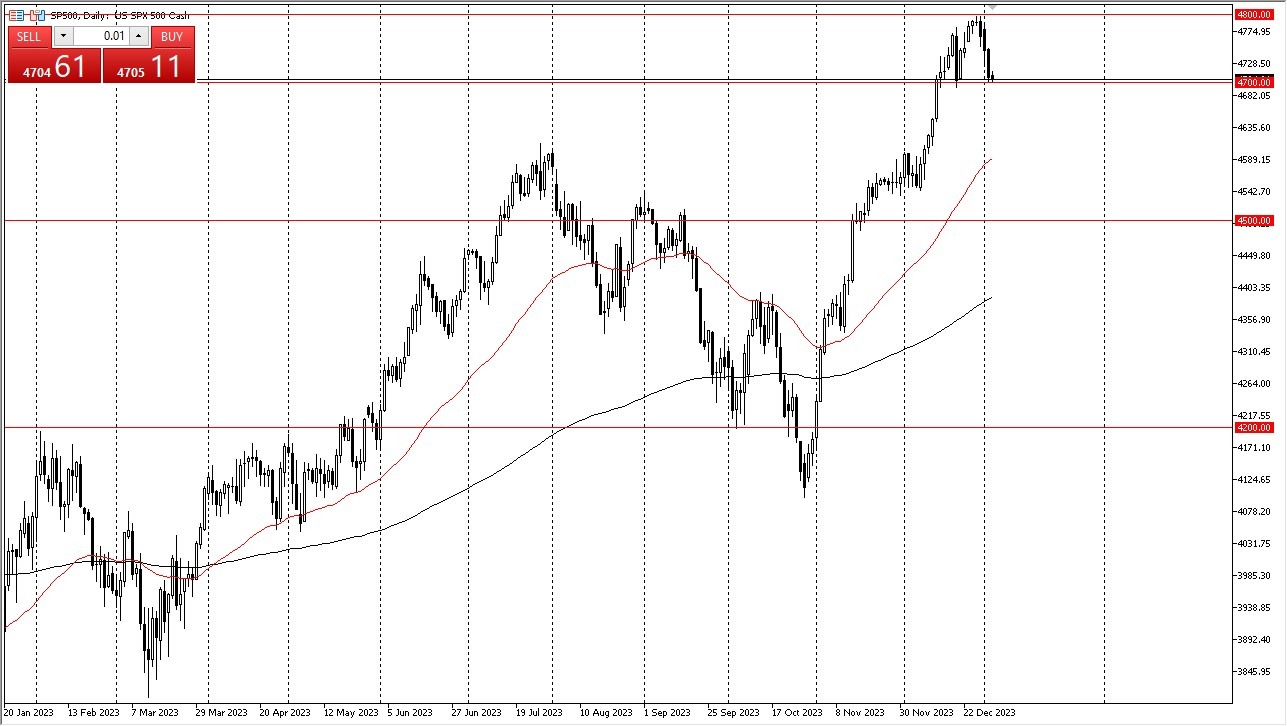

In the end, the S&P 500’s recent performance has kept it close to the 4,700 level, which has garnered attention due to its recurrent significance.

The primary question currently revolves around whether the market will continue its sideways trend or potentially experience a more pronounced downturn. Many analysts believe that stock markets, including the S&P 500, have experienced rapid gains, leading to a situation where a significant pullback might be seen as necessary and even beneficial for both bearish and bullish traders. If the 4,700 level is breached, the next target would likely be 4,600, marked as a previous resistance zone. Additionally, the 50-day Exponential Moving Average hovers around this region. Friday is the first NFP Friday of the yearThe upcoming Friday session holds particular interest as it marks the first jobs report of the year from the United States. This report is expected to have a notable impact on market sentiment, potentially introducing some short-term volatility. However, whether it will trigger significant long-term changes remains uncertain.  Some market participants view a potential pullback as an opportunity to acquire assets at lower prices, a perspective that aligns with value investing principles. Conversely, an alternate scenario involves the market consolidating within a range, oscillating between 4,700 and 4,800 levels, as a means to moderate the enthusiasm that characterized the Santa Claus rally at the end of 2023. I suspect that a lot of people are going to be fully enough to hang on to all of their gains, only to see them turn around and evaporate into some type of sudden selloff. This isn’t to say that I think the market is suddenly going to be bearish, just that sooner or later something is going to occur to cause profit-taking.In the end, the S&P 500’s recent performance has kept it close to the 4,700 level, which has garnered attention due to its recurrent significance. The key question revolves around the direction of the market, with some anticipating a possible pullback to address the rapid gains seen in recent times. The impending jobs report from the United States on Friday is expected to introduce short-term volatility. However, achieving market equilibrium and a stable trading range may require continued efforts from both buyers and sellers. Despite the perception of “cheap money” in the financial landscape, inflationary pressures in the broader economy persist, adding layer of complexity to the situation.More By This Author:Crude Oil Signal: Trades In A Range Bitcoin Forecast: Stands Firm Despite Recent SelloffEthereum Forecast: Suffers Massive Volatility During Wednesday Session

Some market participants view a potential pullback as an opportunity to acquire assets at lower prices, a perspective that aligns with value investing principles. Conversely, an alternate scenario involves the market consolidating within a range, oscillating between 4,700 and 4,800 levels, as a means to moderate the enthusiasm that characterized the Santa Claus rally at the end of 2023. I suspect that a lot of people are going to be fully enough to hang on to all of their gains, only to see them turn around and evaporate into some type of sudden selloff. This isn’t to say that I think the market is suddenly going to be bearish, just that sooner or later something is going to occur to cause profit-taking.In the end, the S&P 500’s recent performance has kept it close to the 4,700 level, which has garnered attention due to its recurrent significance. The key question revolves around the direction of the market, with some anticipating a possible pullback to address the rapid gains seen in recent times. The impending jobs report from the United States on Friday is expected to introduce short-term volatility. However, achieving market equilibrium and a stable trading range may require continued efforts from both buyers and sellers. Despite the perception of “cheap money” in the financial landscape, inflationary pressures in the broader economy persist, adding layer of complexity to the situation.More By This Author:Crude Oil Signal: Trades In A Range Bitcoin Forecast: Stands Firm Despite Recent SelloffEthereum Forecast: Suffers Massive Volatility During Wednesday Session

Leave A Comment