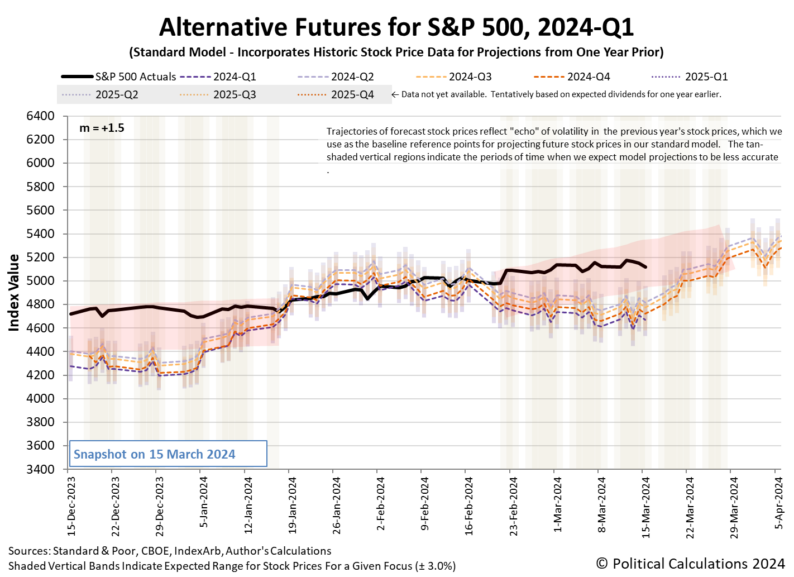

As trading weeks go, the second week of March 2024 resembled a disappointing roller coaster ride for investors. The S&P 500 (Index: SPX) climbed to a new record high of 5,175.27 on Tuesday, 12 March 2024, but then went on to lose 1.1% of that new high value by the end of the week on the downhill part of its ride. The index closed at 5,117.09, a small 0.13% decline from the previous week’s close.What made the week disappointing for investors is a shift in expectations for how frequent interest rate cuts will be during 2024. Higher than expected inflation reports drove the change. While the CME Group’s FedWatch Tool continues to project the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% until 12 June 2024 (2024-Q2) when it is expected to begin a series of quarter point rate cuts starting on that date, the FedWatch Tool’s outlook changed to indicate investors are now anticipating these rate cuts will proceed at twelve week intervals, occurring less often than was projected just last week.The downward leg of the S&P 500’s roller coaster ride during the past week puts the index’ trajectory closer to the middle of the redzone forecast range, as indicated in the latest update in the alternative futures chart. latest updateSpeaking about the future for interest rates, there were two other big economic news headlines involving them during the week that was. First, the European Central Bank (ECB) signaled it will almost certainly begin cutting Eurozone interest rates by the end of the this month. But in Japan, the Bank of Japan will take the opposite action as inflation ramps up in that country, marking the end of its long-running negative interest rate policy.Those headlines, and more, are included in the following summary of the week’s market-moving headlines: Monday, 11 March 2024

-

Oil prices steady as Middle Eastern supply concerns ease

- US leads global oil production for sixth straight year- EIA

- US labor market cooling; unemployment rate rises to two-year high of 3.9%

- Emergency Fed bank effort ends lending, as eyes turn to discount window

- Fed to start rate cuts in June; risk fewer delivered this year: Reuters poll

- Exclusive: Chinese regulators ask large banks to step up support for Vanke

- China warns overall pressure on employment yet to ease

- China’s consumer prices swing up on seasonal Lunar New Year gains

- Japan Q4 GDP revised up to slight expansion, economy avoids recession

- ECB rate cut coming, but not just yet, says Governing Council’s Kazimir

- Only two of the Mag 7 names have outperformed the S&P 500 since January – RBC Capital Markets

Tuesday, 12 March 2024

- Oil prices settle slightly down after US boosts crude output forecast

- US natgas output to decline in 2024 while demand rises to record high, EIA says

- Fed seen on hold until June, with rate-cut pace in focus

- BOJ to offer guidance on bond buying pace upon ending YCC – sources

- BOJ chief Ueda slightly tones down optimism on economy

- Explainer: ECB to change how it supplies banks with vital liquidity

Wednesday, 13 March 2024

- China’s booming air con use lifts mid-year power emissions

- BOJ to debate ending negative rates in March if wage survey strong – sources

- ECB to wean banks off free cash at gentlest pace

- ECB’s Villeroy: spring interest rate cut remains probable

- ECB should ‘make a bet’ on rates before long, says Wunsch

Thursday, 14 March 2024

- Gasoline, food boost US producer prices in February

-

Oil prices climb as revised IEA outlook signals tighter market

- US pump prices set to jump as refinery outages nip supply, analysts say

- China’s efforts to prop up its ailing stock market

- China c.bank leaves key policy rate unchanged, as expected

- China’s plan to cut downpayments for cars likely to fall flat, analysts say

- BOJ preparing to end negative interest rate policy at March meeting, Jiji reports

- BOJ to go slow in hiking rates after ending negative rates, says ex-c.bank executive

- ECB policymakers offer contrasting timeline for rate cuts

- ECB could cut rates at least three times from June, Knot says

- Stock rally pauses as US inflation douses rate cut hopes

Friday, 15 March 2024

- US consumers still reeling from earlier price rises even as inflation slows

- Peak rates boost U.S. demand for riskier form of corporate debt

- Fed’s new neutral may be one FOMC takeaway

- China’s home prices extend declines despite support measures

- Japan on cusp of ending negative interest rates, chance of March BOJ exit heightens

-

Japan’s Feb inflation likely quickened as BOJ weighs ditching negative rates: Reuters poll

- Japan union group announces biggest wage hikes in 33 years, presaging shift at central bank

- ECB started discussing rate cut, Rehn says

- Wall St drops with tech-related shares, investors assess rate outlook

More By This Author:Atmospheric CO2 Increases With Chinese Coal-Fired EmissionsPolitics And Trade In 2024 Sand Piles And Herd Behavior In The Stock Market

Leave A Comment