Expectations of a Santa Rally went further on hold this week. Our benchmark S&P 500 plunged at the open, triggered to some extent by a savage selloff in oil (WTIC is down -14.5% month-to-date). The 500 proceeded to slide deeper into the red, hitting its -2.13% intraday low early in the final hour. The index closed with a -1.94% Friday loss, and a weekly loss of -3.79%.

The yield on the 10-year note dropped to 2.13%, down 15 bps from last Friday’s close.

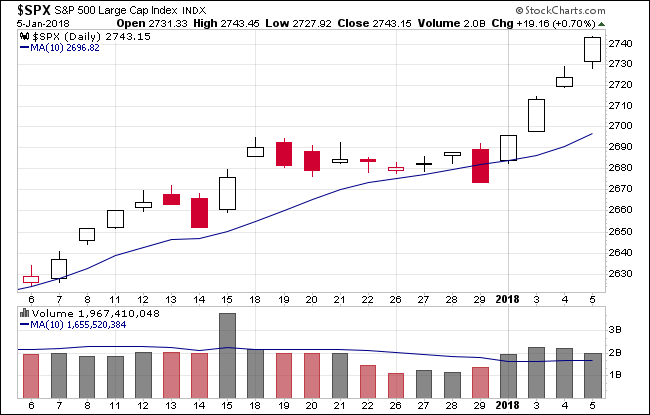

Here is a snapshot of past five sessions.

Here is a daily chart of the index. Volume picked up on today’s selloff.

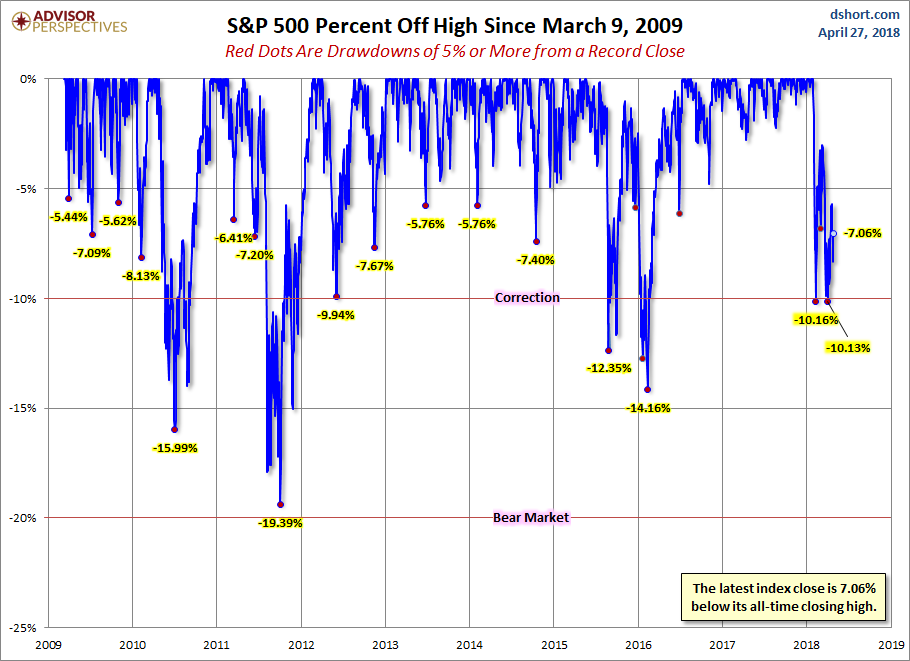

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

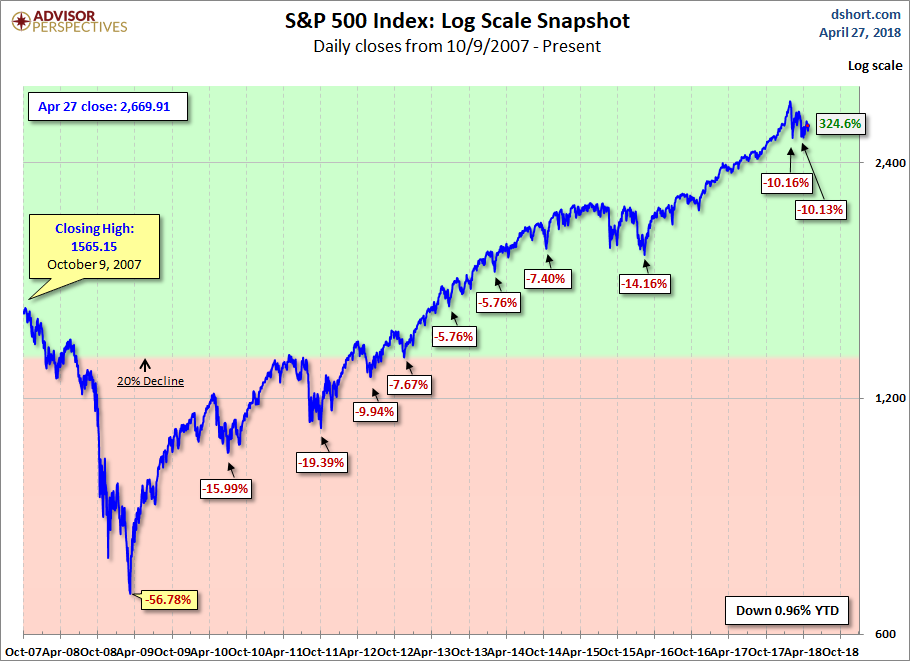

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

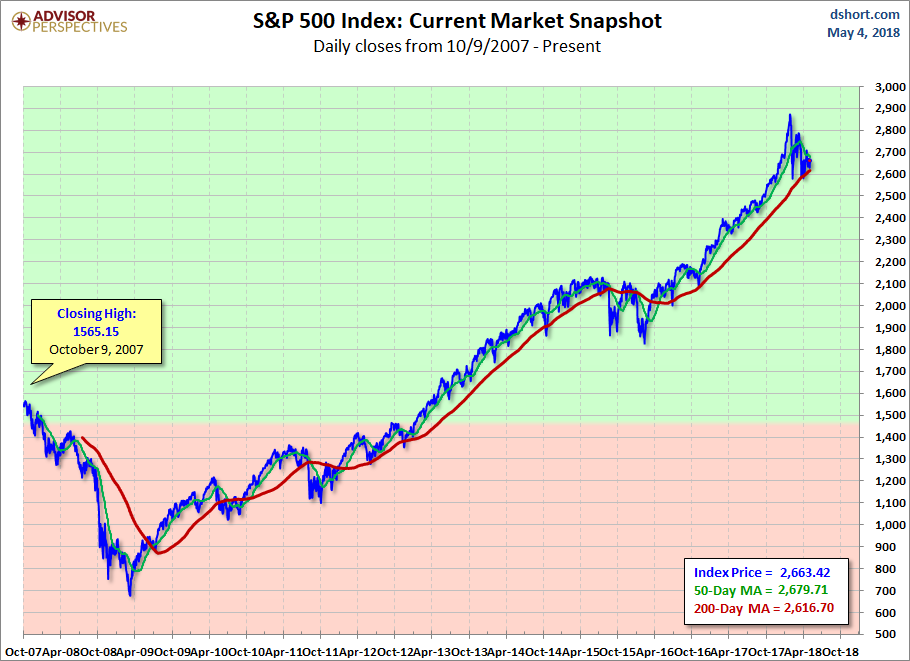

Here is the same chart with the 50- and 200-day moving averages. The 50 crossed below the 200 on August 28th.

Leave A Comment