The S&P closed the July 4th holiday week with a mere gain of 0.07%. The index opened above yesterday’s close and spent the first half of the day climbing, only to level off and close with a gain of 0.64%.

The U.S. Treasury puts the closing yield on the 10-year note at 2.39%.

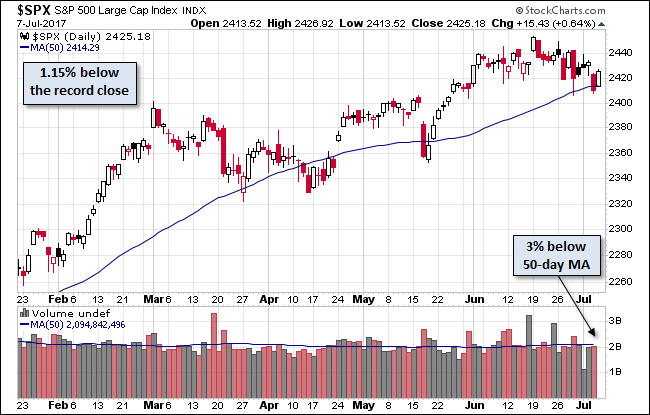

Here is a daily chart of the S&P 500. Today’s selling puts the volume 3% below its 50-day moving average.

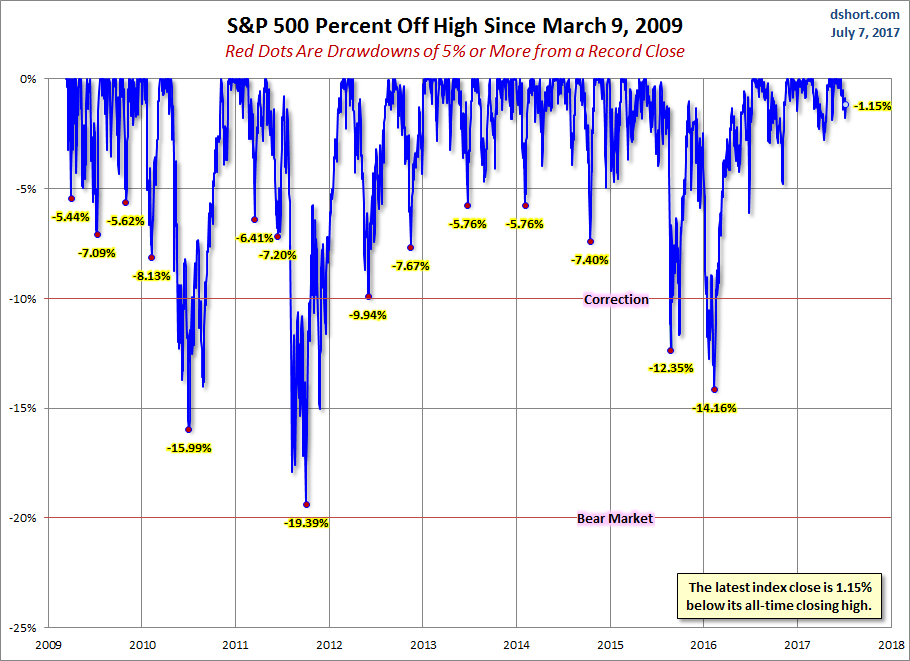

A Perspective on Drawdowns

Here’s a snapshot of record highs and selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

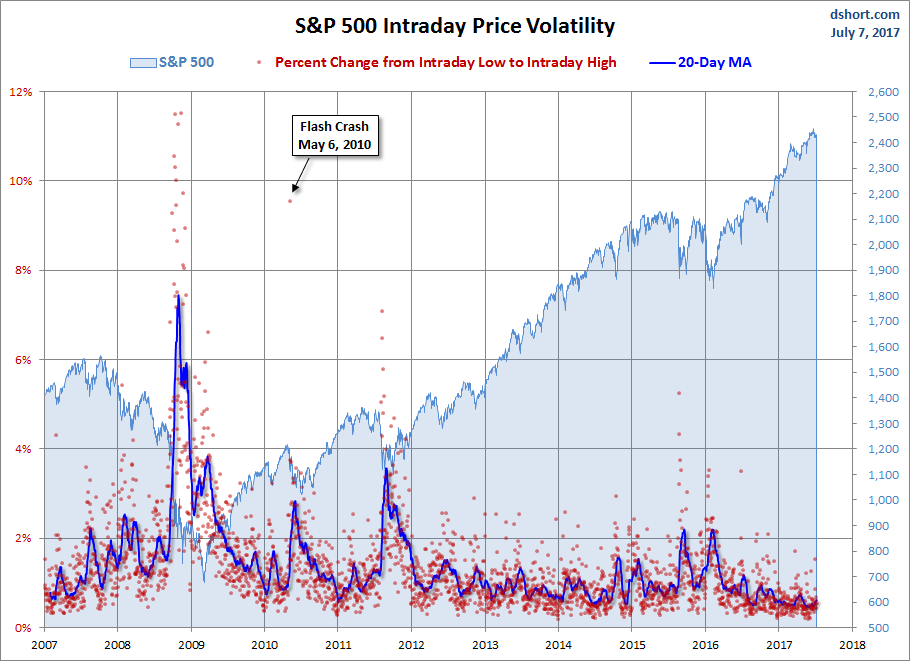

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.

Leave A Comment