For several weeks the popular financial has been building a sense of drama in advance of today’s Fed announcement: Rate hike? No rate hike? Hawkish tone? Dovish tone? The S&P 500 moved cautiously during the morning with an absence of volatility. The index drifted higher to the 2 PM news of no hike. And of course we saw a typical price head fake in both directions followed by a spike to the 1.28% intraday high, which was then followed by a swift drop to the -0.43% intraday low. The index then trimmed loss to a modest -0.26% at the close.

The yield on the 10-year note closed the day at 2.21%, down 9 bps from the previous close.

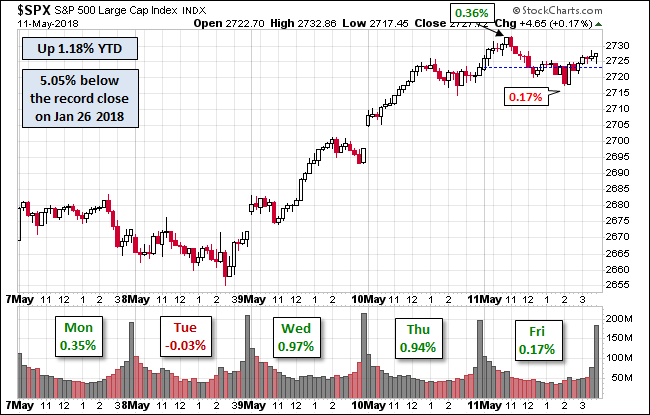

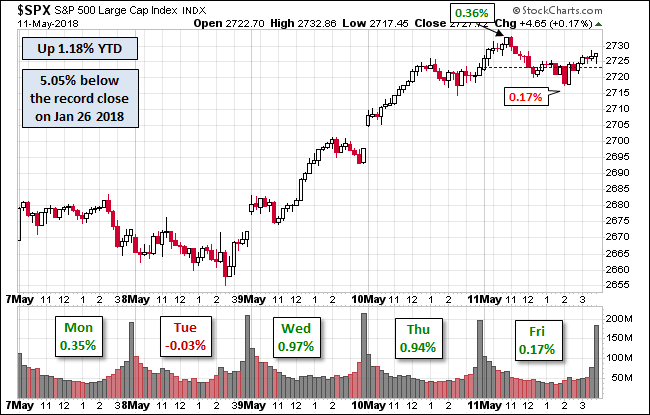

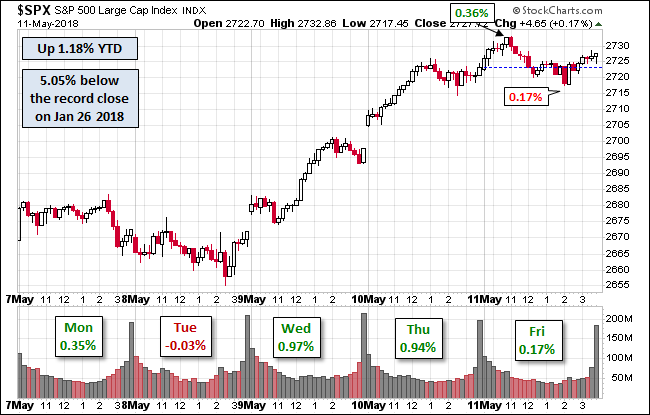

Here is a snapshot of past five sessions.

Here is a daily chart with the volume highlighted. The afternoon “tempest in a teapot” saw a relatively small increase in volume.

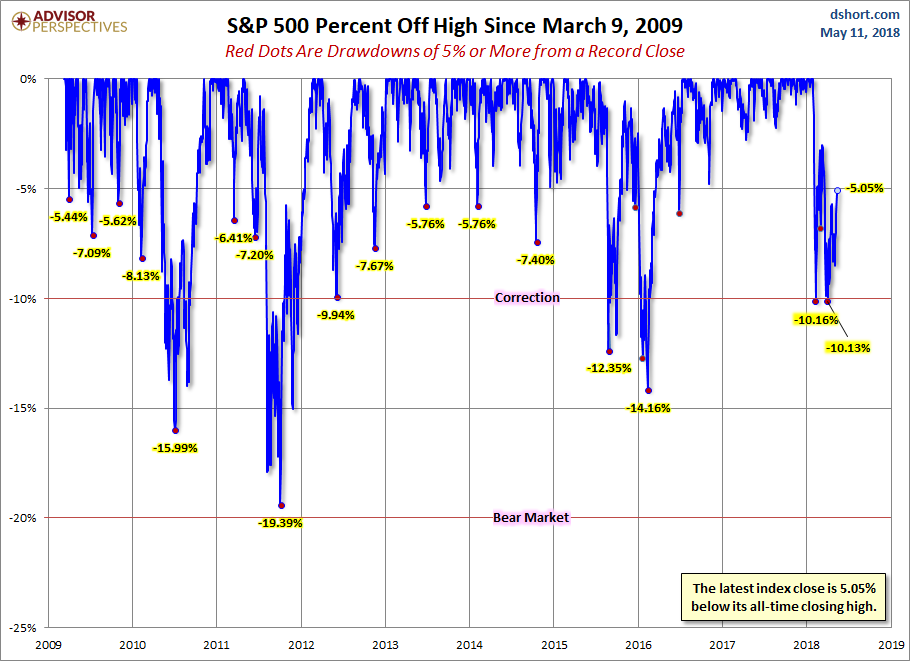

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

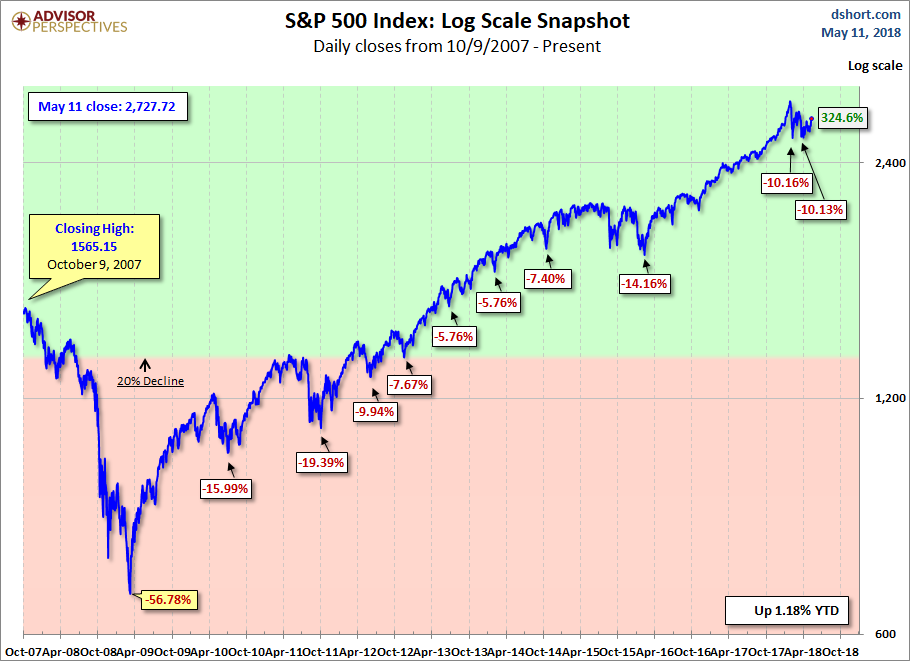

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Leave A Comment