After three straight months of selling, the major US stock indices are pausing for breath having bounced back in pretty extraordinary fashion

This has come about due to the turn in bond markets and Fed rate expectations.

This has come about due to the turn in bond markets and Fed rate expectations.

Softer inflation data plus other important employment figures like the monthly non-farm payrolls report have seen markets quickly shift their sight on policy easing by the Fed as soon as March next year.

Risk sentiment has embraced this change in market mentality with US stocks virtually making back all the losses from the summer sell-off.A solid third quarter results season, with margin expansion and more positive earnings revisions than forecast, has also underpinned support for equities.

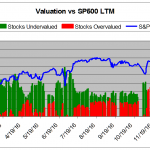

Magnificent Seven still shineEncouragingly, market breadth has expanded, with the small cap Russell 2000 index participating in the rally, even though the “Magnificent Seven” still rule. These seven megacap tech stocks – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla – have reasserted the gap in their stock performance over the rest of the biggest companies Stateside.Those seven megacaps, which account for nearly 29% of the S&P 500, around 80% this year versus flat for the remaining 493 companies in the benchmark index.

This has seen their valuations rise and those handful of tech titans now collectively compare to previous well-known stock market bubbles seen in 1972 and 2000.

Inflation data and Powell’s speech may direct the S&P 500

The Fed’s favored inflation gauge will be released later today. The US core PCE data is a broader gauge of prices than the CPI report and dynamically adjusts to changes in the spending basket.

The median consensus call is for 0.2% m/m which is what is needed over a period of time to bring CPI back to the Fed’s 2% target.

More By This Author:USD Hits Three-Month Lows Ahead Of US CPI

BTC Is Testing 21-SMA Support Level

This Week: EURUSD Traders Await ECB Inflation Reading

Leave A Comment