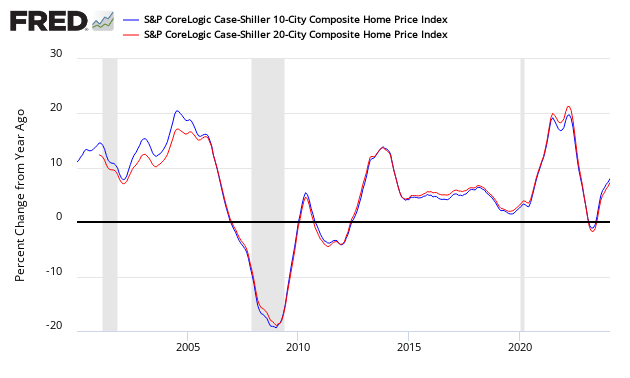

The non-seasonally adjusted S and P CoreLogic Case-Shiller home price index (20 cities) year-over-year rate of home price growth decelerated from 5.9 % to 5.5 %. The index authors stated “Today, the mortgage default rates reported by the SandP/Experian Consumer Credit Default Indices are stable. Without a collapse in housing finance like the one seen 12 years ago, a crash in home prices is unlikely”.

Analyst Opinion of Case-Shiller HPI

I continue to see this a situation of supply and demand. It is the affordability of the homes which is becoming an issue for the lower segments of consumers. With the rise in mortgage rates, it is pricing more and more consumers out of the market. If mortgage rates continue to rise – we may see some retrenchment in home prices.

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing the NAR and Case-Shiller home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index – and no index is perfect.

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to stabilize (rate of growth not rising or falling).

There are some differences between the indices on the rate of “recovery” of home prices.

A synopsis of Authors of the Leading Indices:

Leave A Comment