It has been a session of two halves in which Emerging markets, Asian stocks and Chinese indexes all slumped in early trading followed by a rebound in European shares led by Italian markets over optimism about Rome’s budget process while US equity futures erased most of Friday’s losses as trade concerns appeared to fade after Trump failed to enact the anticipated $200BN in new Chinese import tariffs.

Ahead of the US open, world shares flirted with their longest run of declines since early 2016 on Monday, hit by rising anxiety about the U.S.-China trade war as traders braced for a potential escalation in the China-U.S. tariff row after Trump said on Friday he was ready to impose tariffs on virtually all Chinese imports into the United States, threatening duties on another $267 billion of goods in addition to the $200 billion already facing threatened tariffs. Meanwhile a sharp rise in average hourly earnings reported by the BLS on Friday bolstered bets on a higher dollar on expectations the Federal Reserve will keep raising U.S. interest rates.

“It’s more of the same, markets continue to be under pressure from a whole host of headwinds,” said GAM’s Investment Director of emerging market equities, Tim Love. He highlighted the latest fall in China’s yuan, which is now down almost 9% versus the dollar since April and asked “You are back to the highly politically charged question – is this currency manipulation or not?”

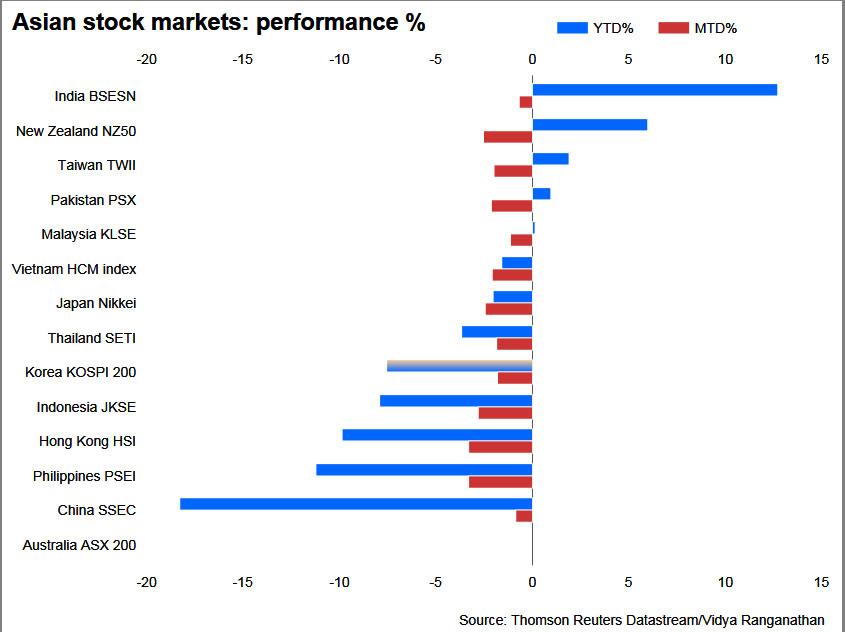

The previously profiled Chinese plunge-protecting “National Team” was nowhere to be found as equities sank in Shanghai and Hong Kong, with the latter’s benchmark index nearing bear-market territory amid trade concerns. Beijing once again warned of retaliation if Washington launches any new trade measures, but as Reuters notes China is running out of room to match US actions dollar-for-dollar, raising concern it would resort to other measures, such as weakening the yuan or taking action against U.S. companies – such as Apple – in China. Chinese shares were battered with the blue-chip index off 1.4%. The Shanghai Composite fell 1.2% and Hong Kong’s Hang Seng index shed 1.3% as the offshore yuan traded mixed.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.9% to the lowest since July 2017, extending losses from last week when it dropped 3.5 percent for its worst weekly showing since mid-March.

It was not all gloom in Asia as Japan’s Nikkei closed 0.3% higher after revised Q2 GDP data showed the world’s third-biggest economy grew at its fastest pace since 2016. This may change, however, after Trump also expressed displeasure about the large U.S. trade deficit with Japan. Stocks also climbed South Korea and were little changed in Australia.

Meanwhile, the emerging market rout continued, as EM stocks hit a fresh 14-month low amid turbulence in Argentina, Turkey, Brazil, Russia and South Africa, where currencies have been routed recently. The Australian dollar, a proxy for Chinese growth, hovered near its lowest in 2 1/2 years and was last at $0.7115 despite stronger than expected Chinese CPI and PPI data reported overnight (Chinese CPI Y/Y 2.3% vs. Exp. 2.2%, and Prev. 2.1%; Chinese PPI Y/Y 4.1% vs. Exp. 4.0% and Prev. 4.6%).

The Indian rupee hit a record low of 72.50 per dollar and Indonesia’s rupiah, Asia’s second-worst performer this year, weakened 0.4%, near an all-time low.

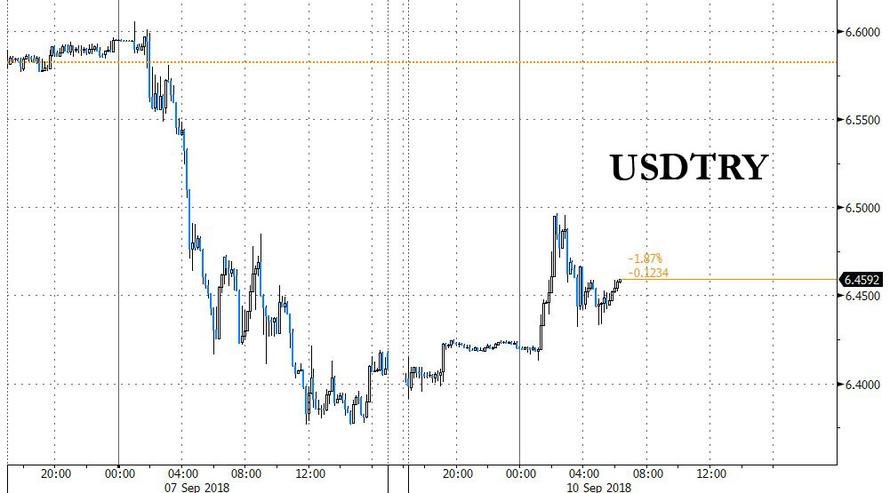

Also in EM, after a sharp rally on Friday ahead of the upcoming rate hike in Ankara, the Turkish Lira resumed its slide after Q2 GDP disappointed, sliding from a downward revised 7.3% in Q1 to 5.2% in the second quarter.

For now, there remains no end in sight for the EM rout as the rising dollar is set for more gains as the Fed tightening cycle is expected to continue well into 2019: “Given the latest comments from Trump, investors are likely to see the potential for further depreciation in EM currencies with the trade war cranking up yet another notch,” said Nick Twidale at Rakuten Securities Australia.

Worries about trade war and tariffs have led to the latest bout of emerging-market turmoil, which not only mars the outlook for global equities, but last week the contagion spread to U.S. stocks after Trump’s signaled that he’s ready to target a sum of goods more than all imports from China while the BLS showed a healthy – if even overheating – American labor market with signs of wage inflation that could clear the way for two more Federal Reserve interest rate hikes this year, and more into 2019.

“Defensive positioning is still warranted at the moment,” said Tribeca Investment Partners direct Sean Fenton on Bloomberg Television. On trade, “markets had some hope that as we got to that deadline there would be some concessions, but there’s really escalation.”

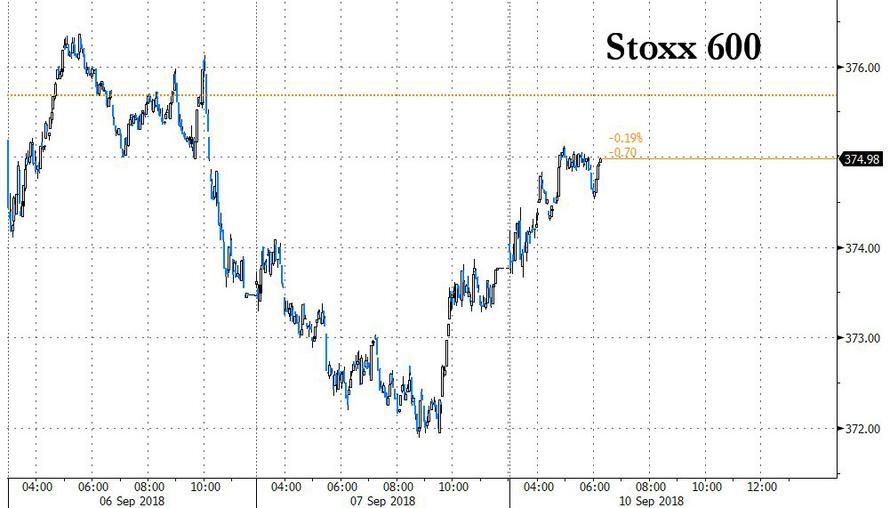

There was little defensive positioning in Europe, however, as the Stoxx Europe 600 Index fluctuated in early trading before rebounding to session highs, up as much as 0.4%, driven higher by banks, utilities and telecom companies.

Europe’s rebound to Asia’s gloom was led by Milan, which jumped 1.5% following soothing comments on Italy’s upcoming budget by Economy Minister Giovanni Tria pushed down the country’s borrowing costs in the bond markets. “The Italian budget law should be more market friendly than initially feared from investors, leading to a narrowing bond spread versus Germany, while ‘it’s too early to celebrate,” according to comments to clients from Mediobanca Head of Equity Markets Antonio Guglielmi.

Stockholm also strengthened along with the Swedish crown amid broad short covering in Swedish assets after the nationalist Sweden Democrats gained less ground than expected in weekend elections. The Swedish crona rose about 0.6% against the euro to 10.43 crowns. The euro was up 0.1 percent against the dollar at $1.1566 after falling more than half a percent on Friday following the U.S. jobs data.

Leave A Comment