European and Asian shares rise along with a jump in S&P futures which are pointing to a solidly green open on US payrolls day. The dollar, trading somewhat weaker against the euro was stronger against the yen, and was on track for its firth week of gains, while the rout in global Treasuries continued following a Mario Draghi conference that was interpreted as more hawkish than expected.

Today’s key event is the February nonfarm payrolls, where consensus expects a solid gain of 190,000 jobs after Wednesday’s blockbuster ADP report, and with whisper expectations around 220,000, the number can at most disappoint as previewed earlier, especially in the closely followed average hourly earning dataset which will provide details about the pace of future Fed rate hikes. A tighter labor market, stock market boom and rising inflation amid a strengthening global economy have left some economists expecting that the Fed, whose March rate is seen by the market as a 100% probability event, could increase interest rates much faster than is currently anticipated by financial markets.

Consensus calls for an increase of 193K jobs in February, with the unemployment rate falling to 4.7% from 4.8%. Much of the focus could be on average hourly earnings for signs of inflationary pressure. Last month, average hourly earnings disappointed with Y/Y wage growth slowing to 2.5% from 2.9%. This month, average hourly earnings are expected to pick up to 2.7% Y/Y with monthly growth of 0.3%.

“Global and local inflationary pressures could soon make markets reprice Fed rate hike expectations going into 2018 and beyond, which we think would be bullish for the USD,” said Morgan Stanley forex strategists in a note to clients.

While the dollar index was little changed, the euro extended its overnight gains on read throughs into the ECB’s Thursday announcement which is being interpreted as more hawkish than expected. The euro, and the regional banking index, enjoyed a lift after European Central Bank head Mario Draghi’s suggestion on Thursday it was less necessary to prop up the market through ultra-loose monetary policy.Indeed, optimism about an economic recovery in Europe gaining traction helped the European equity indexes claw back much of their weekly losses. The Stoxx 500 index rose 0.4 percent helped by financials and energy shares. Shares of European banks rose nearly two percent to their highest in more than a year while BT Group jumped more than 4 percent after the telecoms giant after ending a two-year row with the UK regulator.

In commodity markets, crude prices inched up after dropping to their lowest in more than three months in the previous session on worries about a global supply glut. U.S. West Texas Intermediate crude was up 0.5 percent while Brent crude rose 0.4 percent. Gold fell below the key level of $1,200 an ounce on Friday and was on track for its worst week in four months, pressured by a stronger dollar.

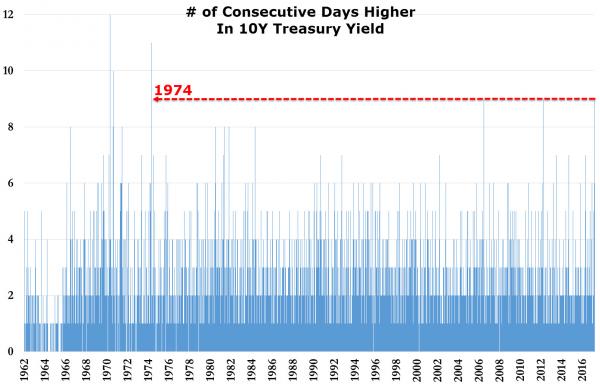

In the all important rates market, the yield on the 10Y Treasury continued to rise and were at the post-election high of 2.61%. That is the first time that Treasuries have closed above 2.600% since September 2014 although on an intraday basis yields did hit 2.639% back in December last year.As a reminder, Bill Gross has predicted that a yield of 2.60% will start a bear market, should it hold on a weekly basis. The selloff in US paper is approaching historic proportions, with the losing streak in US Treasuries now the longest in 43 years. As discussed yesterday, following yesterday’s close, Treasury yields had risen for 9 straight days, the longest streak of losses since April 1974. A red close today would extend the losing streak to 10 days.

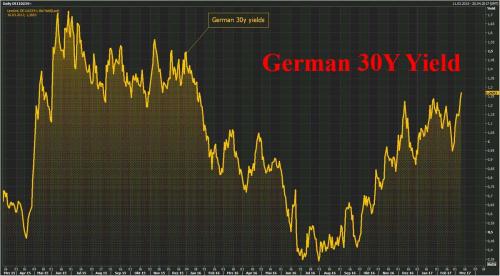

The yield on the 10-year German bund jumped six basis points to 0.421 percent, while the German long-end has seen the 30Y rise to the highest since January 2016, leading to substantial absolute value losses for those who bought duration last summer, with P&L losses approaching 20%. 10y Bund yields ended Thursday 5.6bps higher at 0.421% and so putting them to within just 6bps of the 2017 high. Similar maturity yields in France (+5.8bps), Netherlands (+4.3bps), Italy (+5.7bps), Spain (+2.8bps) and Portugal (+3.7bps) were up a similar amount.

Bulletin Headline Summary from RanSquawk

Market Snapshot

Leave A Comment