S&P futures extended their Wednesday decline, dropping in the overnight session with banking shares in focus ahead of results from JPMorgan and Citigroup. European stocks likewise retreated along with the dollar, while Asian shares were mixed.

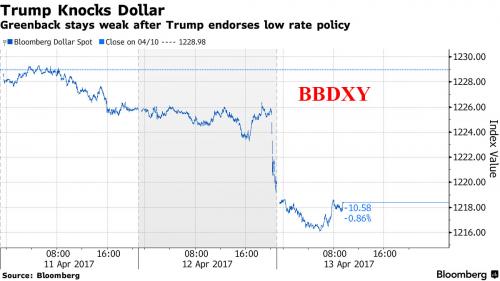

The dollar continued to face headwinds in the wake of U.S. President Donald Trump’s denouncement of the greenback’s strength and championing of lower interest rates.U.S. Treasury yields also dropped a fourth day as European bonds gained across the board, compounding a retreat in yields which battered banking stocks. The dollar index, which tracks the greenback against a basket of six trade-weighted peers, fell 0.6 percent to 100.07. The benchmark 10-year U.S. Treasury yield slid to a five-month low of 2.22 percent.

Bloomberg’s Dollar Spot Index headed for a fourth day of declines after falling below its 200-day moving average on Wednesday. Lenders led the retreat as the Stoxx Europe 600 Index slid, and futures of the S&P 500 also pointed lower.

Crude oil was little changed after yesterday’s EIA report showed record Cushing inventories and another rise in US crude production. Thursday’s economic data include initial jobless claims and University of Michigan Consumer Sentiment. Citigroup, JPMorgan and Wells Fargo are among companies scheduled to publish results.

“The dollar slid after Trump commented that the currency had risen too high … (and) saying that he was in favor of low interest rates policy,” Mizuho strategists wrote in a note to clients on Thursday.

“The U.S. president also appeared to move away from a more confrontational tone against China by acknowledging the country has not intervened to weaken its currency. Following his comments, Treasury yields fell to their lowest this year.”

Escalating fears of a new weapons test by North Korea kept investors on edge too, as a U.S. carrier group sails toward the area. Concern over the situation in the area has sent the cost to protect South Korean government debt against default soaring to 9-1/2 month highs.

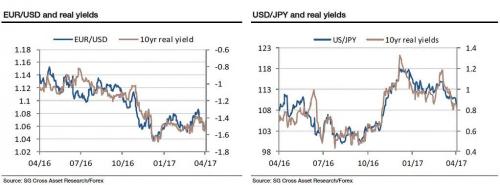

Taking another look at Trump’s jarring Wednesday flipflop, the day’s main event, SocGen’s Kit Juckes summarizes it as follows: “President Trump doesn’t like a strong dollar, does like low interest rates, may yet offer Janet Yellen a second term, recognises that China isn’t a currency manipulator, and is struggling to enact policies that will boost US growth. Looked at in that light, perhaps it’s only to be expected that the dollar is drifting lower. The medium-term case for the euro to usurp it as strongest of the major currencies grows steadily even if European political uncertainty holds it back in the short term.”

10-year Treasury yields are now 22bp lower than they were at the start of 2017. The failure of the healthcare bill and mixed economic data have done most of the damage, though geopolitical uncertainty has played a part and the weight of positioning was a major factor too. Federal Reserve economists publishing a paper arguing we may see rates at the zero bound more frequently in the future, and Ben Bernanke writing an article wondering why inflation expectations haven’t fallen as a result (since the Fed will struggle to keep inflation up at 2%) helps the case for ‘normal’ yield normalisation, either. With JGB yields down just 4bp and Bund yields down only 1bp, relative yields have been a major driver of dollar weakness against the yen, and a reason for it to fail to make gains against the politically-anchored euro. Even more importantly, lower US yields have provided support for emerging and higher-yielding currencies, despite a series of political risks shaking several EM currencies. The Mexican peso is 2017’s strongest currency and the dollar is only up against a handful of stragglers

Big moves in the aftermath of Trump’s remarks, which also signaled a softening stance on China’s currency practices and took in the future of Fed Chair Janet Yellen, added momentum to a jump in volatility across global stock markets. After weeks of relative calm, traders are attempting to get a handle on the president’s unpredictable interventions, rising geopolitical risks, the end of easy central bank cash and key elections in Europe. According to Bloomberg, lower volumes in the shorter trading week before Easter may have compounded the swings.

“Markets look distracted by a whole bunch of contradictory bluster,” Bill Blain, a strategist of Mint Partners in London, wrote in a note. “Let’s not forget we’re facing four days of closed markets. Most institutional investors and the banks have already bedded down their positions ahead of the holidays.”

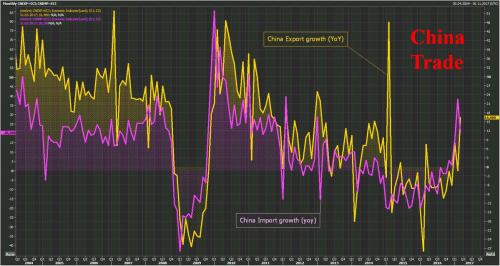

Surprisingly strong Chinese trade figures, which showed exports surging the most in two years, and Trump’s remarks that the United States will not name China a currency manipulator helped boost Asian stocks. A quick recap of Chinese trade data:

Chinese Trade Balance (USD)(Mar) 23.9B vs. Exp. 12.5B (Prey. -9.15B).

China Trade Balance (CNY)(Q1) 455b1n.

Asia MSCI’s broadest index of Asia-Pacific shares outside Japan was up about 0.5 percent, while the yen’s earlier strength helped push Japan’s Nikkei down 0.7 percent. Japanese shares fell for a third day, though they pared the day’s steepest losses as the yen erased an earlier gain. The Australian dollar jumped as employment surged more than expected in March, while South Korean stocks and the won continued a recovery.Hong Kong stocks fluctuated after China’s overseas shipments last month jumped the most in two years as global demand held up.

European stocks were lower on Thursday. The pan-European index of leading 300 stocks fell 0.5 percent to 1,496 points, Germany’s DAX was down 0.4 percent and Britain’s FTSE 100 was down 0.6 percent. European bank stocks were among the hardest hit, down more than 1 percent as the fall in longer-dated bond yields flattened the yield curve. The shrinking premium of long-dated yields over shorter-dated ones hurts banks’ profitability.

Leave A Comment