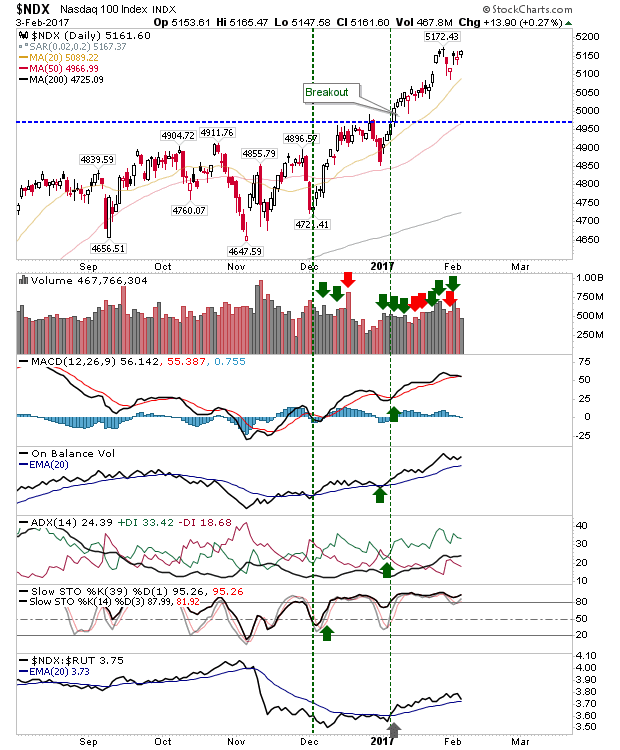

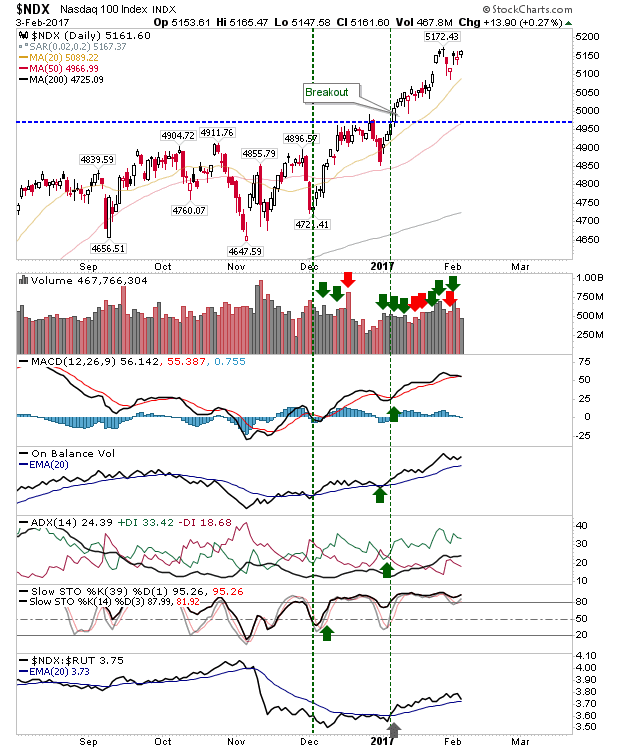

Aside from the light volume it was a solid finish to the week for indices. Tech Indices are very close to new all-time highs as the post-Trump rally continued its unabated ascent; the rally in the Nasdaq 100 has even managed to stay ahead even of its 20-day MA.

The only concern for Nasdaq 100 is the loss in relative strength against the Russell 2000, although this hasn’t flipped negative. Despite this, a push above 5,172 is likely to trigger short covering and another buying surge.

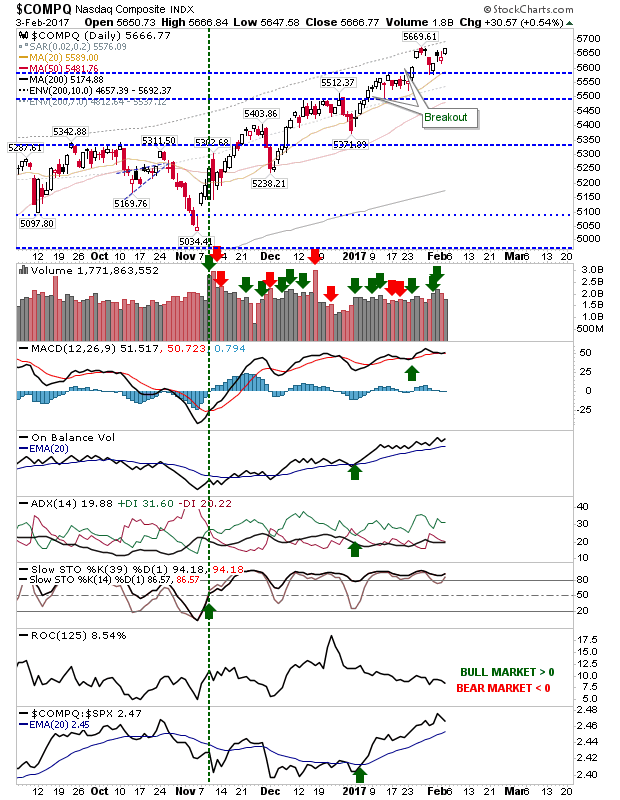

Gains in the Nasdaq have been a little slower as it has tagged its 20-day MA a couple of times since November’s election result. As with the Nasdaq 100, a push above 5,669 is likely to attract short covering.

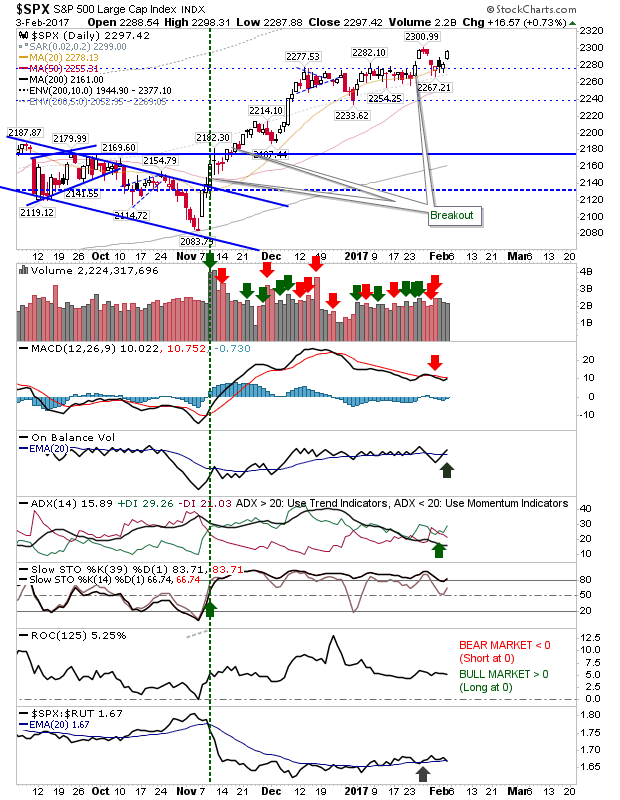

The S&P successfully defended former resistance, now new support, at 2,280. The MACD is holding on to a ‘sell’ trigger, but it’s very close to a fresh trigger ‘buy’. Given the prior consolidation, this is perhaps best placed to enjoy more sustained gains.

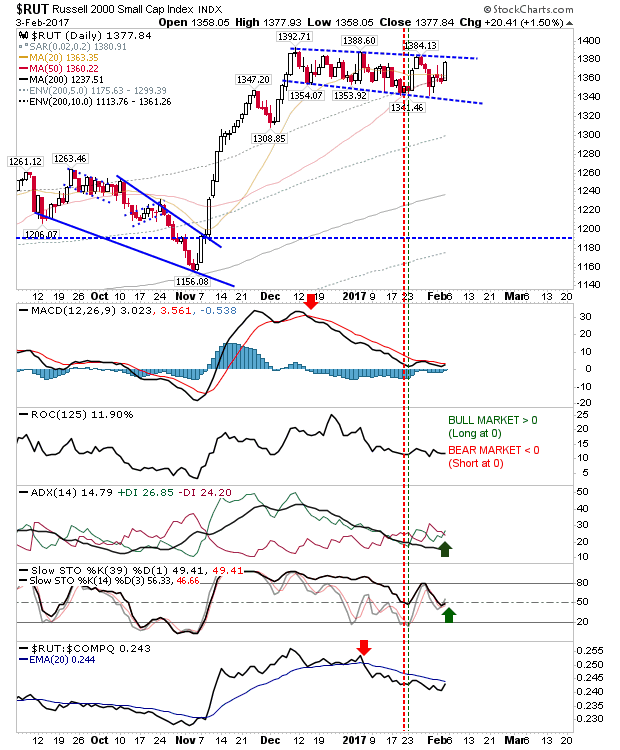

The Russell 2000 had the best of Friday’s action with a 1.50% gain. The gain was enough to finish the tit-for-tat bull/bear trap and redirected the index to a broad consolidation. Buyers have defended the 50-day MA; watch for fresh buyers on the pending MACD trigger ‘buy’.

For Monday, the S&P is the index to watch as it works to build a new rally. However, the Russell 2000 could surprise if it can break above 1,380 and out of the 2-month consolidation. Day Traders can look to the Tech Indices to take advantage of short covering.

Leave A Comment