As the seasons change so to do the habits and actions of all things from the smallest critter all the way up to the Wall Street trader. We see seasonal tendencies in price movement across a number of different assets, but perhaps the most talked about – or what perhaps should be the most talked about right now – is seasonality in stock prices.

This article reviews the curious tendency for the S&P500 (and the CBOE VIX) to go through a seasonal pattern of price action across the year. The key point is historically you tend to see a seasonal surge around this time of the year. Now it’s important to note right at the start that seasonality does not always work… and can break when you need it the most. But it certainly adds another piece of information to the puzzle, and given the adjustment to valuations and increasingly oversold conditions, it is perhaps a more interesting piece of information than usual…

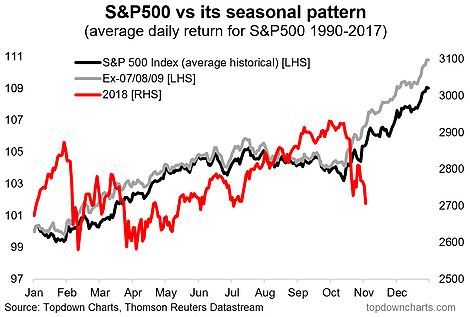

1. Stockmarket Seasonality: First chart shows the S&P500 against its historical seasonal pattern across the period 1990-2017. You can see that the correction came perhaps slightly overdue from a seasonal standpoint, but likewise you can see that it’s about this time of the year where things pickup again – strictly going off the historical averages.

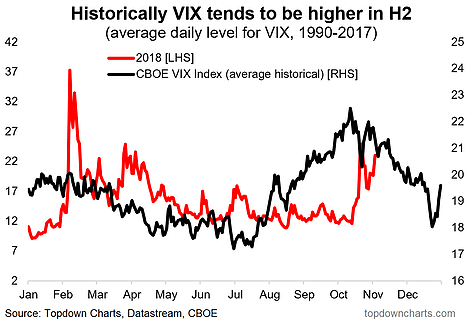

2. VIX Seasonality: Perhaps unsurprisingly you see a similar pattern in the average level of the VIX. Usually the VIX trends up from around August and tends to peak in October. So it’s not at all unusual to see some elevated readings of the VIX or volatility index around this time of the year. But it’s likewise not unusual to see the VIX start to taper off around now too.

3. Stockmarket Seasonality Map: Just to hit that previous point home – here’s how the seasonal pattern looks for the S&P500 and the VIX. As alluded to, it’s almost a mirror image of each other, and bulls and bears alike should take note of this chart, just in general – given it is a timeless chart – but also particularly given the price action of the last few weeks.

Leave A Comment