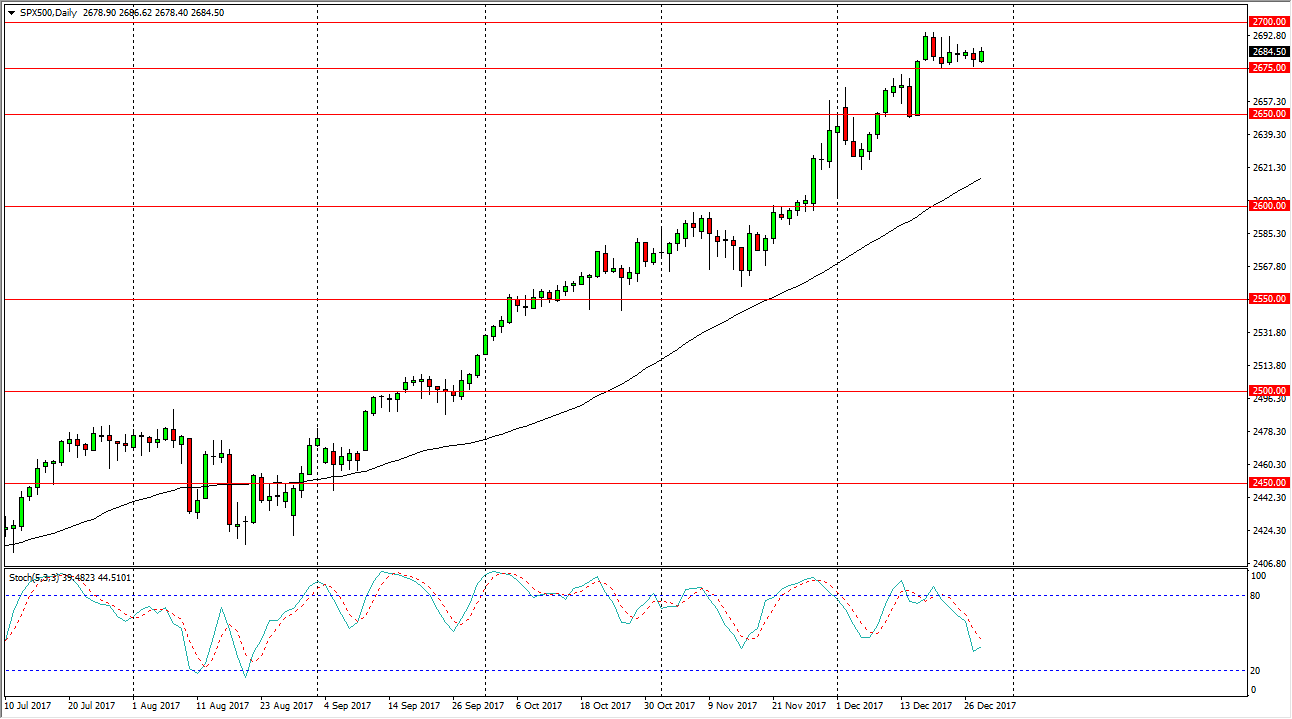

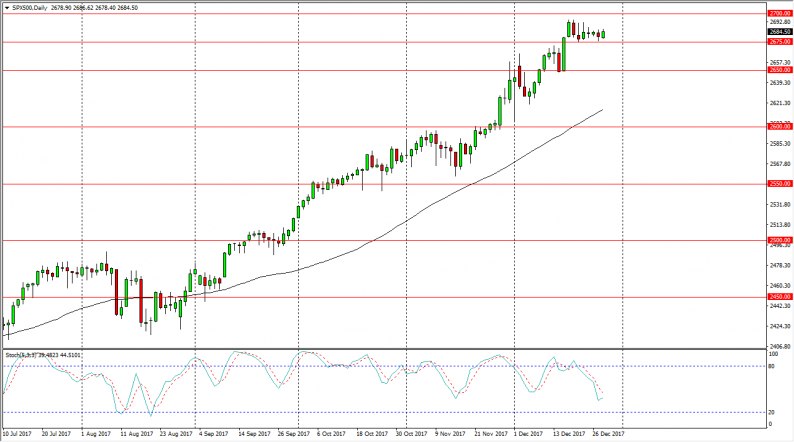

S&P 500

The S&P 500 rallied slightly during the trading session on Thursday, using the 2675 level as a bit of a floor. However, we have very little in the way of volume and I think at this point you are probably in the look for pullbacks to take advantage of, more than anything else. If we broke above the 2700 level, then I would be willing to jump into the market. Otherwise, I would love to see a pull back to the 2650 level to get involved. I think with the jobs number coming out in a few trading sessions, it’s likely that we may be a bit quiet, not to mention the fact that most larger traders are doing just about anything the trading right now, as we are between the 2 biggest holidays of the year.

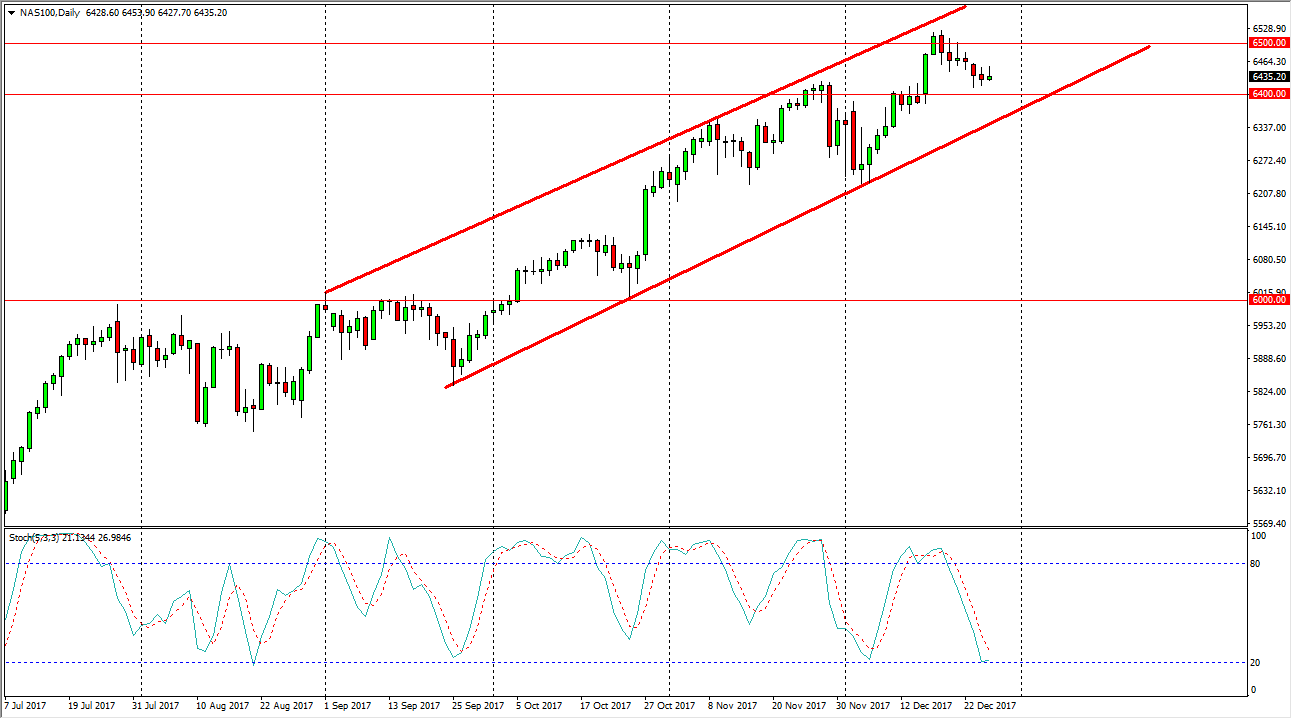

Nasdaq 100

The Nasdaq 100 initially tried to rally during the trading session on Thursday, but turned around to form a shooting star. I see a significant amount of support at the 6400-level underneath, and I have course drawn a decent up trending channel, and I believe that there are a couple of different reasons why we may rally from here. Ultimately, I think that we will break above the 6500 level, and continue the overall trend. However, the Nasdaq 100 has been a bit of a laggard when it comes to US stock markets in general, but I think that all of them are going to rise as soon as volume comes back, and the Nasdaq 100 will of course be the same. If we broke down below the uptrend line, then we may go looking towards the 6200 level for more support. Keep your position size small in the meantime, we could get volatile conditions.

Leave A Comment