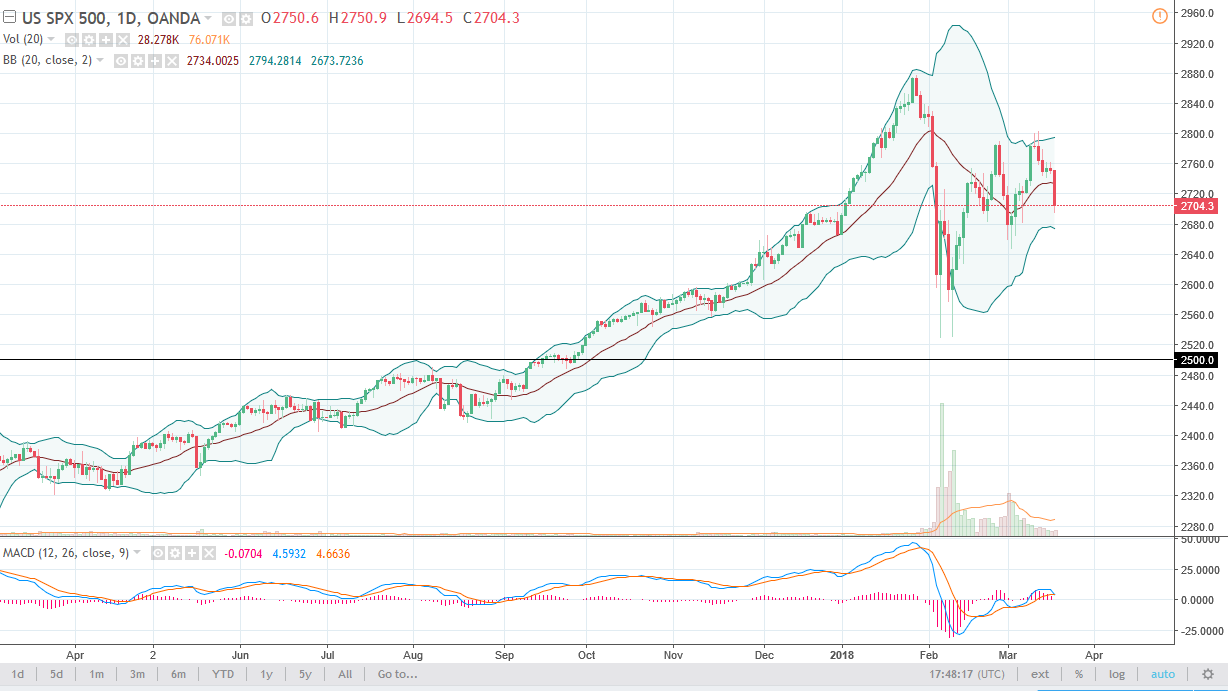

S&P 500

The S&P 500 has sold off rather drastically during trading on Monday, as the world awaits the Federal Reserve statement this week. If they sound like they are going to raise interest rates 4 times, that will be negative for the markets, and when you look at this chart, you can certainly see that suddenly we have a significant amount of volatility in what had been a very quiet market. The question now is whether this will be a trend change? I think it’s a little early to call back, but if we were to break down below the 2640 handle, it would make a “lower low”, which would be the first sign that we did in fact change the trend. At this point, it will be very interesting to see how we close at the end of the day, because that could be today. On the other hand, we could turn right back around and find ourselves consolidating between there and 2800 above. It is not until we get a clear reaction to the Federal Reserve statement that it will be a market that you can trade with any type of certainty.

Nasdaq 100

The Nasdaq 100 also broke down significantly below the 7000 level, the area that was previous resistance, and would expected to be support. That obviously is not happen, and now it looks as if the 6800 level is being tested for support. There’s even more support at the 6700 level, and I suspect that after this massive be down that we have seen on Monday, there probably will be some follow-through. At the very least, it won’t take much to spook the market today. I think that we have more of a risk to the downside than anything else over the next couple of sessions.

Leave A Comment