The US Dollar edged lower during Asian trade on Tuesday, largely as a result of growing tensions between the United States and Syria and North Korea. On Monday, South Korea and China agreed that tougher sanctions would be imposed on North Korea if either long-range or nuclear missile tests were carried out. Those concerns of greater geopolitical risk more than offset investors’ expectations of forthcoming interest rate increases from the Federal Reserve. Against the Japanese Yen, a safe haven currency, the greenback lost about 0.2% of its value and edged well off the overnight peak of 111.57 Yen.

As reported at 10:16 am (JST) in Tokyo, the USD/JPY pair was trading lower at 110.759 Yen, down 0.09%; earlier, the pair had hit a low of 110.655 Yen while the high sat at 110.953 Yen. The EUR/JPY was down 0.1458% to trade at 117.3313 Yen, moving away from the session low of 117.27 Yen.

Risk Aversion Overshadowing Fed Intentions

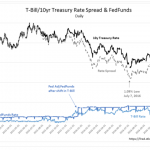

After the US President ordered missile strikes against Syria, investors have become concerned that North Korea’s actions could spur another show of military might from the United States. As a result, 10-year US Treasury yields declined which resulted in broad pressure on the greenback. Analysts say that though FX traders open positions based on the likelihood of a Fed rate hike and curtailment of Quantitative Easing, traders are position squaring as risk aversion gains traction.

Leave A Comment