Investor preferences shift between active and passive investing in a cyclical manner. Periods where the market has a strong tailwind of momentum behind it tend to attract a greater demand for passive strategies especially when that momentum carries on for a prolonged period of time. Alternatively, periods of market turbulence tend to swing sentiment back to active investing as a means of avoiding the risk of large losses. In the most recent bullish cycle the combination of market direction and the availability of index-friendly instruments like exchange-traded funds (ETFs) have resulted in an unprecedented shift towards passive strategies and securities.

To clarify the difference between the two investment approaches, active investing seeks to outperform the market by beating a benchmark such as the Dow Jones Industrial Average or the Barclays Aggregate bond index. Passive investing on the other hand pursues a strategy that mimics a benchmark index and attempts to replicate its performance. It is a contrast that has been effectively described by Ed Easterling of Crestmont Research as rowing (active) versus sailing (passive). Active investors are engaged in constant evaluation of companies and their fundamentals as means of finding value investment opportunities while passive investors are at the grace (or mercy) of the winds of the market wherever they may blow.

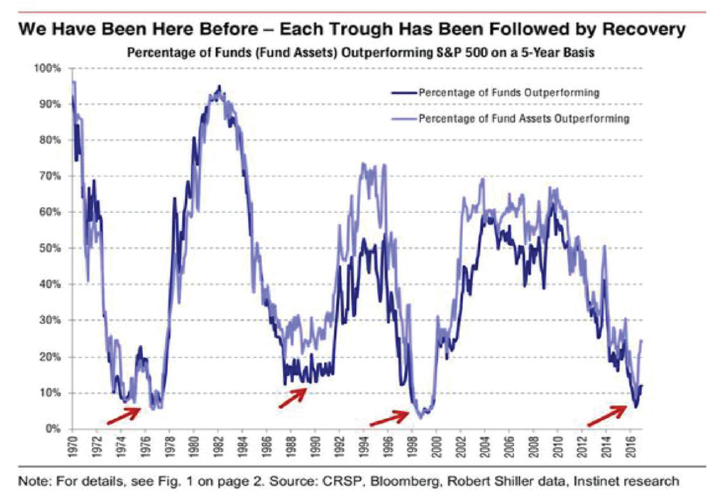

The graph below highlights the underperformance of active strategies versus the S&P 500 index in past years which further explains the growing popularity of passive investing.

This article is primarily focused on fixed-income passive investing, however, many of the issues brought up in this article can be applied to most asset class ETFs and securities that allow ease of passive investing.

How Passive Investing Works

The mechanics of passive investing in the stock market are straight-forward. Select an equity index to which you would like to gain exposure, for example the S&P 500 or the MSCI China Index, and then buy the stocks in the proper amounts that are tracked in that index to replicate the performance. Done manually this can be a complex and cumbersome exercise especially when trying to replicate the index of a less-liquid market. As the market moves and the value of the securities underlying the index change, one must rebalance their holdings to remain aligned with the index. For a deeper understanding of the many factors that make replicating an index diffiuclut please read our article The Myths of Stocks for the Long Run Part V.

The advent of index mutual funds and more recently exchange-traded funds handle the complexities of multiple holdings, weightings, and rebalancing allowing an investor to simply pay a small fee, buy a ticker and essentially own an index. An investor’s ability to obtain general equity exposure or to build a portfolio with customized exposures has never been easier with the proliferation of ETFs.

To offer some perspective about just how many ETFs are available, consider there are 38 ETFs available that are focused on U.S. energy stocks and over 132 ETF’s hold Exxon Mobil (XOM) shares. Looking abroad to less liquid markets, one would find ten U.S. incorporated funds holding Indian stocks. The simplicity and customizability currently offered in the market is quite powerful.

Leave A Comment