With memories of last week’s high-volume, post-Fed, quad-witching selloff fading fast, overnight the Santa rally defined as no volume, no breadth levitation, has continued for a third day and moments ago European stocks rose to their best level of the day, with the Stoxx Europe 600 Index headed for its biggest advance in a week, while US equity futures ramped on the European open as they traditionally do, and then again hit session highs minutes ago, as holiday volumes are in meltdown mode, and odd lots can move the E-mini by 1 point.

Helping the European move higher was an increase in industrial metal prices as well as a rise in oil prices after yesterday’s API oil inventory drawdown report. Still, the Stoxx 600 has declined 5.9% this month, on track for its worst December since 2002. The gauge has gained almost 6 percent this year, poised for a fourth straight annual gain.

“The huge rebound in some oil and basic-material stocks really fuels the rally today and people are buying the laggards of this year.” Benno Galliker, a trader at Luzerner Kantonalbank AG in Lucerne, Switzerland told Bloomberg. “It’s usual for the market to go higher the day before Christmas holidays, and the volumes are very thin so you can easily move the market.”

Sure enough, the volume of shares traded on Stoxx 600 companies was almost a third lower than the 30-day average, as the Christmas holiday neared. Some European markets are closed on Thursday, while others have shorter trading days. Most will reopen on Dec. 28, while U.K. markets do so on Dec. 29.

Chinese brokerage firms soared however while the SHCOMP was set to close at its best level of the day, an unexpected selloff in the last 30 minutes of trading promptly pushed it to the lows.

The Stoxx Europe 600 Index added 1.7 percent to 362.90 at 10:32 a.m. in London, as all 19 industry groups advanced. West Texas Intermediate February oil futures rose 0.9 percent to $36.46 per barrel.

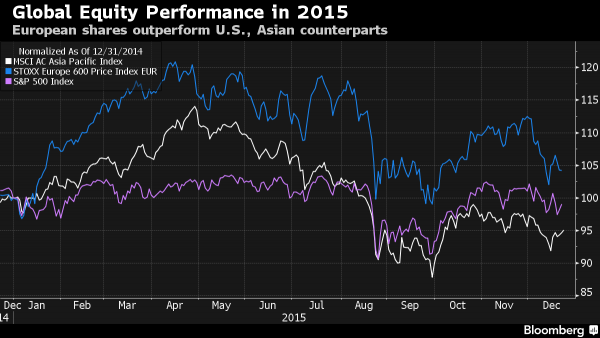

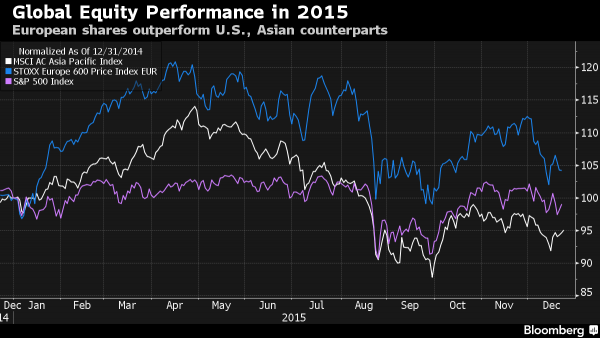

With just a handful of trading sessions left in the year, this is how the major global markets look as 2015 is about to close. As of this moment, and in keeping with the Christmas spirit, the biggest question is whether the S&P500 will close green or red for the year.

That is YTD. This is where the key indices trade as of this moment.

Looking closer at Asian equity markets, stocks tracked the gains seen on Wall St. after US stocks experienced a “Santa Rally”, while the continued recovery in commodities also underpinned sentiment with crude climbing on the API drawdown. Large mining names and energy stocks led the ASX 200 (+0.9%) higher while financials outperformed in that China is to remove private equity management licenses from 17 banks. Japanese markets were closed due to the Emperor’s Birthday public holiday.

Top Asian News:

Leave A Comment