The ECRI index is pointing higher, and the small caps are still holding above an uptrend line. These indicators are favorable, even though the summer weakness in the ECRI index may be indicating a spotty economy in the months ahead.

The weak M2 growth is a concern.

This index is very sensitive to the mood of the stock market, and as a result it shows the market cycles very nicely. Each of the blue highlighted areas show a medium-term market correction, and now the index is turning down again.

The Dow indexes are a concern again. The Industrials couldn’t look better, but the Transports have turned lower and are testing the uptrend line.

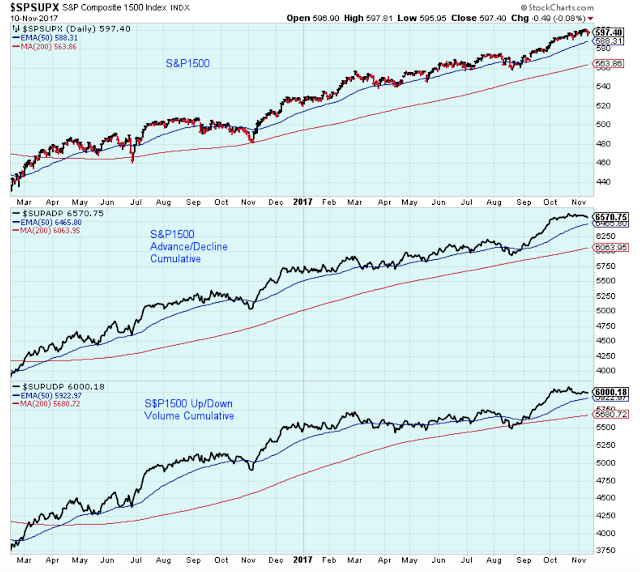

Not all the charts are negative. This chart looks healthy, and it is probably the most important chart of the ones I have shown. What we are really looking for is higher stock prices, and there is nothing here to complain about.

Outlook

I think it is time to start getting concerned about the next general market correction.

Leave A Comment