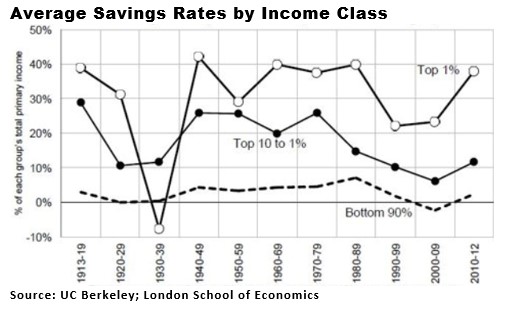

In this article, we’ll extend the conversation about savings that we began in a previous article. As you can see from the chart below, even though the Fed funds rate has been raised 5 times in this business cycle, the national interest rate on non-jumbo deposits, which are less than $100,000, has barely budged.

Interest Rates On Savings Accounts Are Low Despite Fed Rate Hikes

This has occurred because when the Fed funds rate was near zero the banks had interest rates too high by having them above zero. The banks decided they’d lose deposits and customers if they charged to have money in a savings account. The Fed funds rate increasing helps their net interest margins because it increases the difference between lending rates and borrowing rates, but at the same time the flattening yield curve hurts them because banks typically make long term loans and borrow in the short term.

There are some who have the thesis that people save more money to make up for the low interest rates. That’s difficult to justify because the savings rate has been in decline for the past few decades along with interest rates. In the past two years, the savings rate has declined to near record lows while the interest rate on savings accounts is near zero. Lower interest rates make it cheaper to borrow and lever up. If interest rates were to increase in the next few years, there would be a seismic shift in consumer’s spending habits as they’d borrow less.

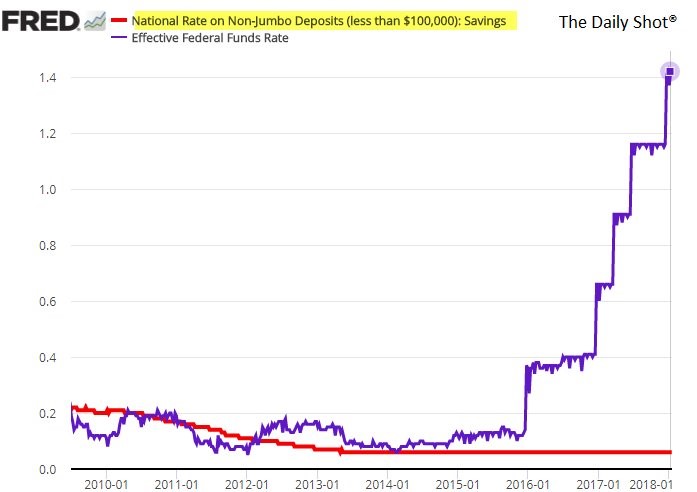

Higher Income Saves More

The chart below shows the savings rates of each income class.

The Rich Save More

The top 1% have almost always saved the most, usually above 30% of their income. The next 9% save less, but still usually save above 10% of their income. The bottom 90% barely save at all as the percentage is always below 10%. It’s interesting to think about if the rich are well off because they save money, or they save money because they have so much of it. It certainly helps to have extra money as it shows from this chart, but it’s still possible to create a good life and save money if you are in the bottom 90%. The key is to budget wisely and make sure you spend your time correctly. If you want evidence of the importance of budgeting and wise financial planning, check the news for all the celebrities who have gone broke.

Leave A Comment