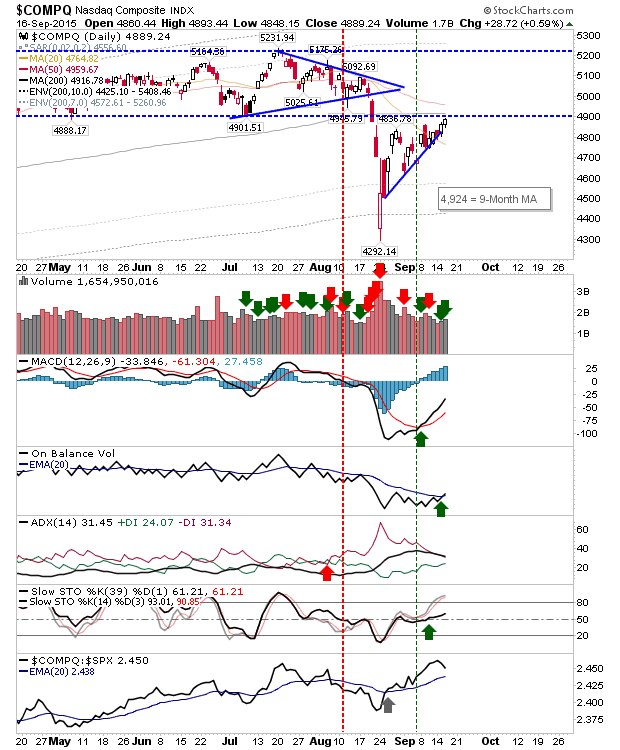

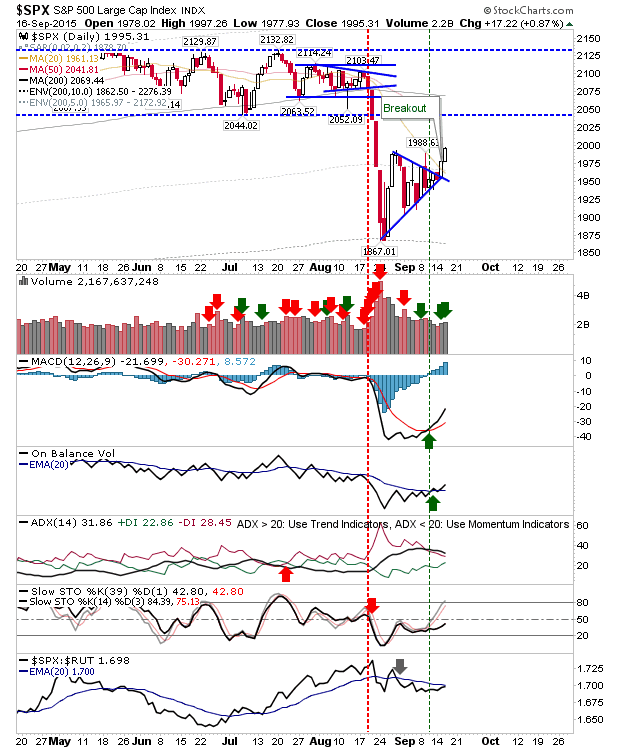

The more this rally distances itself from the prior consolidation, the greater the chance the Fed decision (irrespective of rate raise or not) will act as a ‘sell the news’ catalyst. Markets have gained in what ranks as accumulation, but volume is still relatively light compared to the selling which cut through the markets in August.

The Nasdaq is knocking on the door of the prior trading range, and the get-out-at-breakeven crowd will probably be looking to bail out. Add to this overhead resistance of the 50-day and 200-day MAs adds another level of supply to consider. Traders who were smart enough to buy near the spike low will also be looking to bank some handsome profits.

The S&P has room for further gains before it encounters the supply levels currently in play for the Nasdaq. While things look easier for sellers in the Nasdaq, here it looks easier for buyers.

The Russell 2000 also did well, although it maintains its underperformance relative to the Nasdaq, and is losing ground against the S&P. The laggard hasn’t extended too far from rising support, and would need a few more days like today before it will challenge the 50-day MA. Value players will probably keep an eye on this index.

Sellers will be looking again, but the rate decision will inject volatility and may well see a fake move before the real trend establishes.

Leave A Comment