Sectors bullish as a whole, but still with some notable laggards.

Financials suck, I’ve played them sporadically throughout the year, and every time, the gains have meager. Energy I have been incredibly skeptical of, though I have played them with much more success, I have stood by on its current rally because the sector itself has been so sketchy for much of this year, and while it is breaking out of consolidation, I would be careful of buying here as it is quite oversold and needs to, at the very least, flag for a bit.

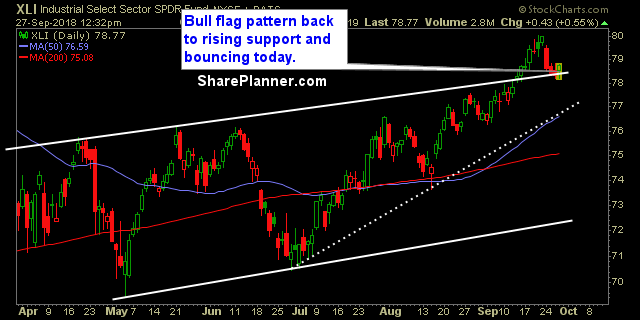

The best play right now looks to be Industrials from a risk/reward standpoint. I booked some profits yesterday in Jacobs Engineering for a +3.8% profit yesterday, but I think there is a solid bounce playing out today off key support, and should it follow through tomorrow, could make for some ideal trade setups in the sector as a result.

Here’s what I see as the top 3 sectors right now:

The 3 worst sectors are:

Let’s review the sectors:

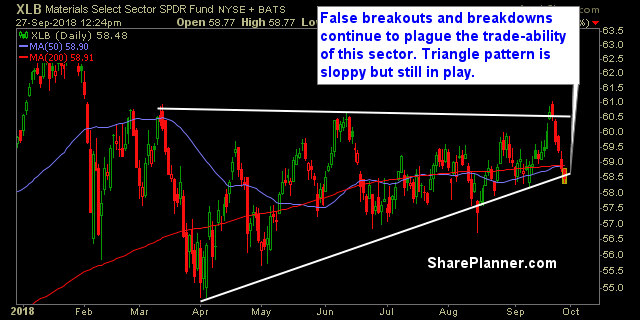

Basic Materials (XLB)

Energy (XLE)

Financials (XLF)

Industrials (XLI)

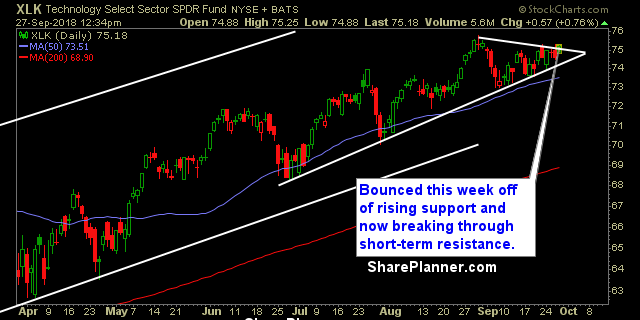

Technology (XLK)

Consumer Staples (XLP)

Utilities (XLU)

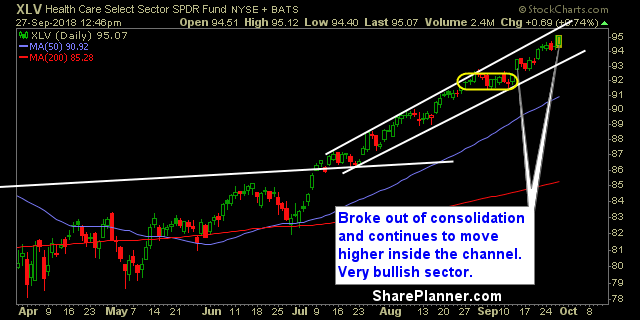

Health Care (XLV)

Consumer Disretionary (XLY)

Leave A Comment