Positioning

SecureWorks (SWCX) describes themselves as “holistic” approach that works better than the myriad “point products” which provide protection but still offer “holes” that hackers can exploit to breach security measures.

During a recent conference on advanced enterprise technologies hosted by PwC it became clear that the next generation of information security solutions would need to rely on machine learning and “AI” methods to build effective solutions to security threats. First we had IBM’s Watson winning Jeopardy and recently we had Google’s AlphaGo emerge as the Go champion. Light bulbs have gone off all over the information security space and there is a quiet rush to exploit this technology to combat hackers.

SecureWorks is in the “Managed Security Service Provider or MSSP” space as it is defined by organizations like Gartner group. It’s a bit different from security technology providers like Palo Alto Networks (PANW) and Check Point Software (CHKP) which are implemented and managed by the customer. The MSSP solution is a bit more like outsourcing. As such it’s really an add-on to typical information security solutions.

It’s a bit unclear however how the positioning of SecureWorks will evolve over time. We address it as an issue below but they are more of a “hybrid” since they resell third-party technology within their service offering and also have a couple of their own proprietary software products (for network intrusion detection and endpoint threat detection.)

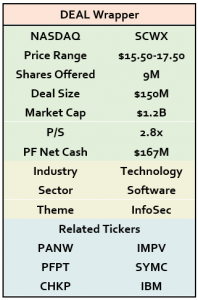

Investors will like the solid enterprise positioning, recurring revenue stream and mature management team. The valuation is reasonable and the demand for information security software will stay strong for years to come. At the proposed valuation the P/S multiple of 2.8x is certainly reasonable given the growth and recurring revenue profile of the company. Their losses however are fairly staggering so a major question will be how quickly management can make the company more operationally efficient and prepare for greater competition.

Leave A Comment