In a shot in the arm to the oilfield services sector, in August Schlumberger SLB announced it was acquiring Cameron International CAM for $66 per share — a 56% premium to its previous share price. The entire oilfield services sector traded up on the announcement. It hurt me personally as I was holding puts on CAM and had already started counting my profits.

Most merger agreements include a material adverse change “MAC” clause which allows the buyer to terminate the transaction in case of a material adverse change to the business of the seller. A material adverse change can be interpreted broadly, including but not limited to, a loss of a large client, the expiry of a patent or trademark deemed important to the business, or a sharp reduction in prices.

The world has changed since the deal was announced. I believe there is a real possibility that Schlumberger could or “should” invoke its MAC out. Here’s why:

Oil Prices Have Fallen

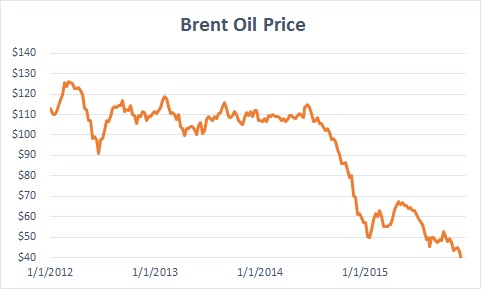

Oil prices diverged to the downside in Q2 2014; coincidentally, that’s also when the Fed began to taper its bond buying program, or at least speak earnestly about it.

When the Cameron deal was announced brent oil prices hovered around $50. They have since fallen below $37 — a decline of over 25%. Looked at another way, average oil prices have fallen by 13% from $52 in Q3 2015 to $45 in Q4 2015. That means Schlumberger and Cameron’s clients are realizing less revenue for each barrel of oil since the deal was struck. They could share that pain with Cameron by cutting E&P further or asking for price concessions.

Fed Rate Hike, China Currency Devaluation

Last week the Fed hike rates for the first time in nearly a decade. Though the hike was on 25bps, it signals the end of Fed stimulus for now. U.S. GDP has grown steadily since the financial crisis of 2008/2009, but that was under a zero interest rate environment. Sans Fed stimulus and no semblance of fiscal policy to spur the economy, I expect GDP growth to slow from here. Secondly, since the hike, the S&P 500 SPY has fallen nearly 4%. At a minimum, the assets that the Fed put on individuals’ balance sheets by spurring the stock market or commercial real estate will also likely decline.

Leave A Comment