Today I deleted Skechers U.S.A. (NYSE:SKX), AMN Healthcare Services (NYSE:AHS), WellCare Health Plans (NYSE:WCG), Threshold Pharmaceuticals (NASDAQ:THLD) and FactSet Research Systems (NYSE:FDS) for the Barchart Van Meerten New High portfolio for negative price momentum.

Skechers U.S.A.

Barchart technical indicators:

32% Barchart technical sell signals

Trend Spotter sell signal

Below its 20 and 50 day moving averages

20.64% off its recent high

Relative Strength Index 37.26%

Recently traded at 131.98 which is below its 50 day moving average of 140.98

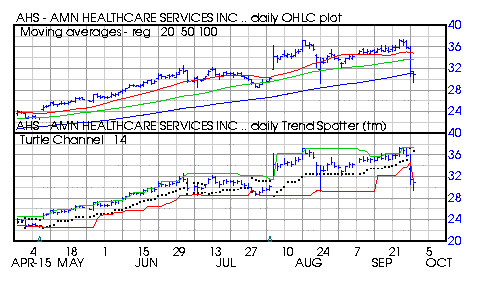

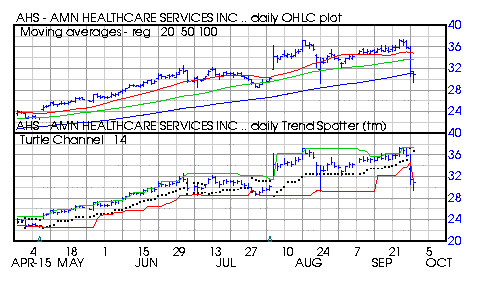

AMN Healthcare Services

Barchart technical indicators:

32% Barchart technical sell signals

Trend Spotter sell signal

Below its 20, 50 and 100 day moving averages

16.73% off its recent high

Relative Strength Index 22.11%

Recently traded at 30.52 which is below its 50 day moving average of 33.67

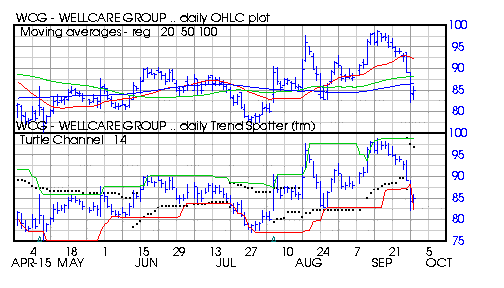

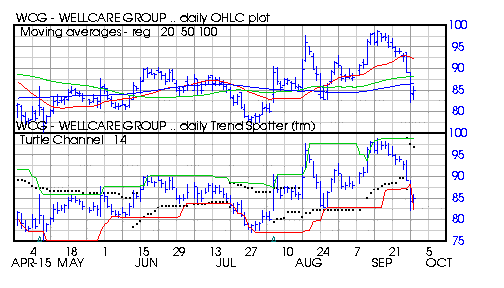

WellCare Health Plans

Barchart technical indicators:

32% Barchart technical sell signals

Trend Spotter sell signal

Below its 20, 50 and 100 day moving averages

13.59% off its recent high

Relative Strength Index 38.60%

Recently traded at 83.80 which is below its 50 day moving average of 88.09

Threshold Pharmaceutical

Barchart technical indicators:

40% Barchart technical sell signals

Trend Spotter sell signal

Below its 20, 50 and 100 day moving averages

22.54% off its recent high

Relative Strength Index 39.41%

Recently traded at 4.08 with a 50 day moving average of 4.36

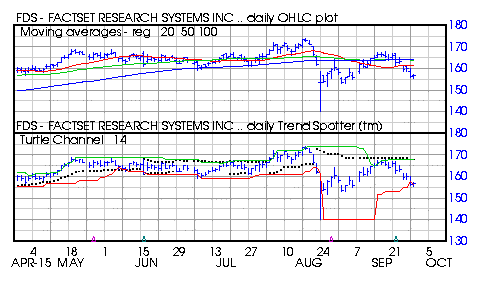

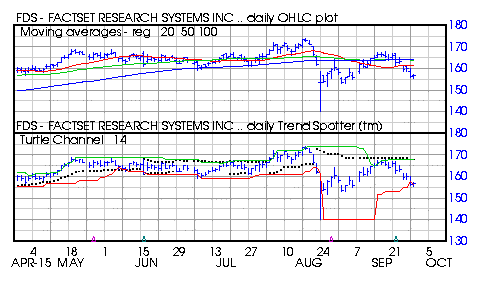

FactSet Research Systems

Barchart technical indicators:

88% Barchart technical sell signals

Trend Spotter sell signal

Below its 20, 50 and 100 day moving averages

9.90% off its recent high

Relative Strength Index 39.64%

Recently traded at 156.27 which is below its 50 day moving average of 163.74

Leave A Comment