Dividends are undoubtedly great ways to juice the returns of your portfolio.

If you look at the S&P 500’s return over the last 10 years, it’s up 58%. Not too bad.

However, when you look at the total return, which includes dividends, it’s up 95%. That’s the difference of $370,000 on a million-dollar portfolio. But, imagine if you had weeded out the questionable dividend paying stocks beforehand.

Unlike what most of the media would have you believe, not all dividends are created equal. Still, investors find themselves reaching for yield as the S&P 500 average dividend clocks in at just 1.9%.

A high dividend yield, or even a multi-decade streak of dividend increases, doesn’t ensure the stock price will go up over time. Many dividend greats go through years of declines.

With that in mind, there are a number of large-cap stocks and well-known dividend payers that are likely in your portfolio but should be sold immediately. Here are the top 5 dividend stocks to sell today:

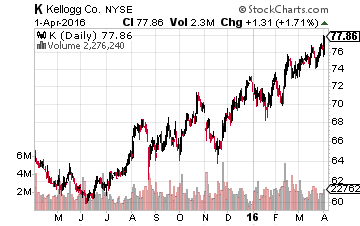

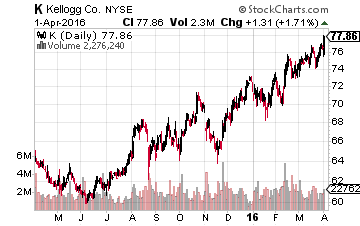

No. 1 Dividend To Sell Today: Kellogg Company (NYSE: K)

Kellogg is a household name and offers a 2.6% dividend yield. However, the rapid change in how we eat breakfast is soon to catch up to Kellogg. Unlike some breakfast foods companies, Kellogg has failed to embrace change. The rise of Greek yogurt and healthier breakfast bars continues to eat away at the cereal industry’s proverbial place at the table.

Kellogg’s own initiative to cater to the healthy and organic market hasn’t played out as expected, with its Kashi brand sales declining over the last couple years. Ultimately, Kellogg is losing its pricing power across all its products including snacks, frozen foods, and cereals.

Its profit margin, which has fallen below 5%, is now at multi-decade lows. Kellogg also trades at a rather rich valuation at close to 20 times next year’s earnings estimates.

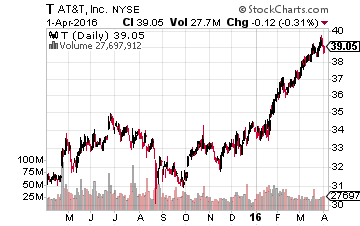

No. 2 Dividend To Sell Today: AT&T (NYSE: T)

Don’t let the near 5% dividend yield fool you, AT&T relies heavily on phone services that are facing more and more competition. AT&T also relies heavily on Apple (NASDAQ: AAPL) iPhone sales, making the potential slowdown in iPhone sales troublesome for AT&T.

Leave A Comment