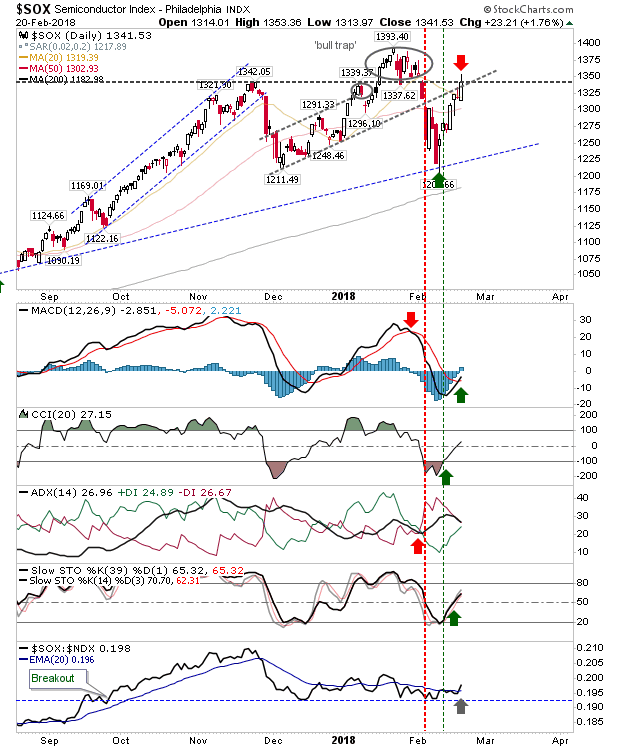

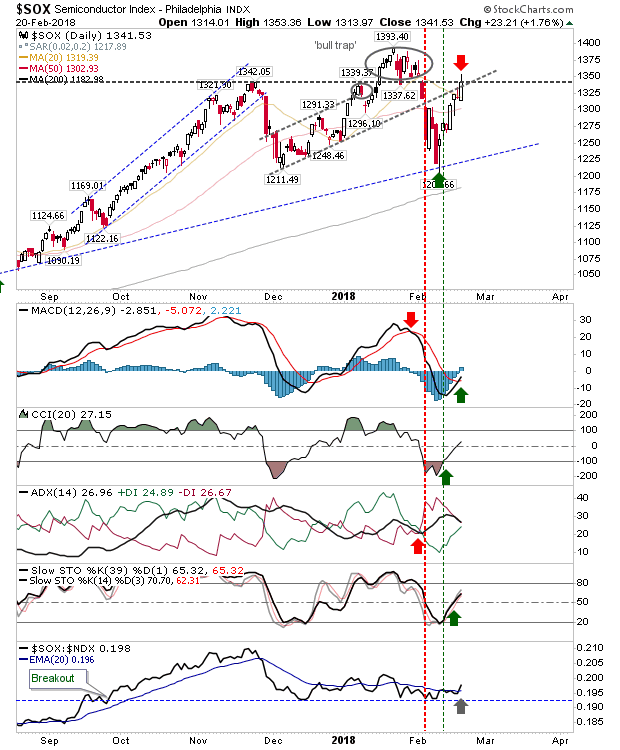

Markets were set up for sellers with most indices experiencing broad selling. However, the one index which looked set up best for shorts – the Semiconductor Index – actually managed to gain. Anyone taking up Friday’s short in the latter Index will have been stopped out but another shorting opportunity may have presented itself. Technicals haven’t returned to becoming net bullish but only the ADX remains to shift.

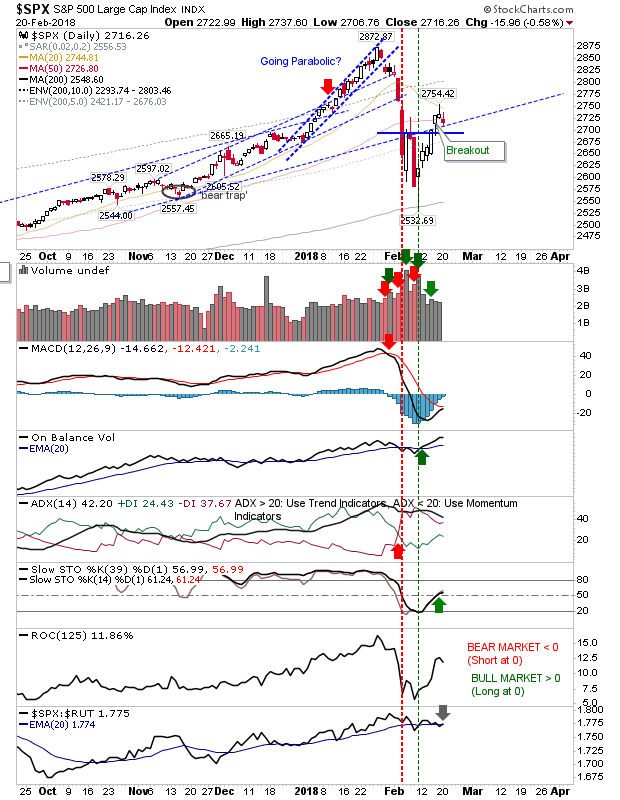

The S&P eased a little lower but didn’t return below what was channel support. Technicals are a mix of bullish (On-Balance-Volume and Stochastics) and bearish (MACD and ADX).Today’s losses weren’t significant but more is needed if a new downleg is to emerge from here.

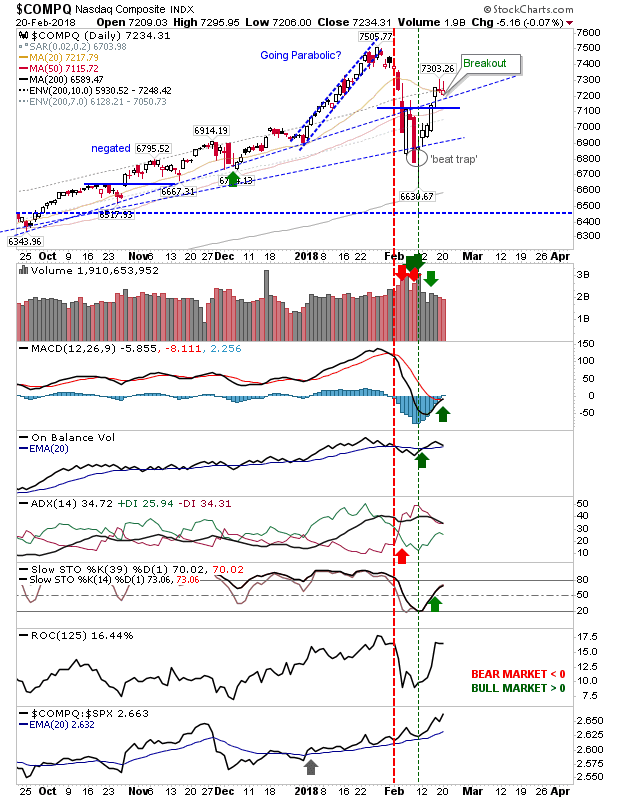

The Nasdaq finished flat on the day but it hasn’t yet signaled a swing top as the S&P looks to be suggesting. Again, a bearish ADX is up against bullish MACD, On-Balance-Volume and Stochastics.Relative performance took another swing higher (a new 6-month high) which suggests if buyers do come back it will be Tech averages to lead them higher (as gains in the Semiconductor Index seem to suggest).

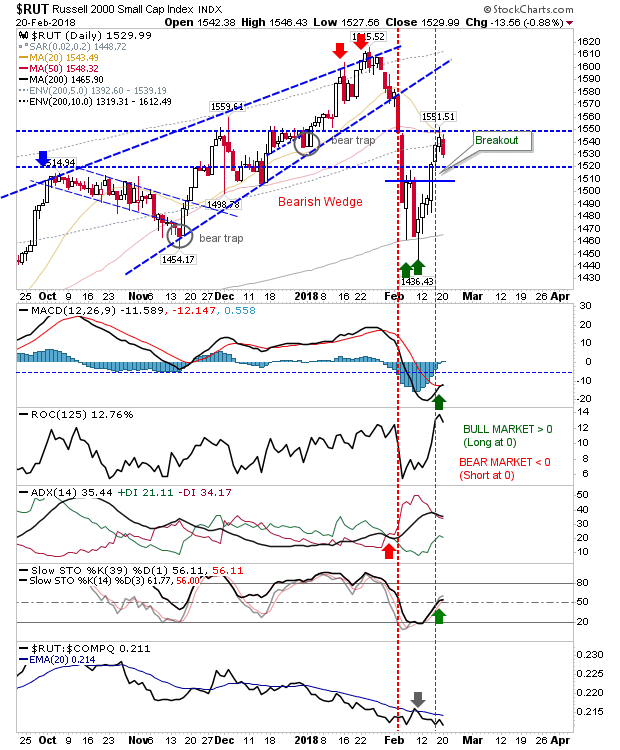

The Russell 2000 experienced broader selling as relative performance accelerated lower. The swing low breakout has not been reversed so bulls still have the edge.

For tomorrow, keep an eye on the swing low breakouts. None have been reversed, although the Dow Jones is looking most vulnerable. Semiconductors have gone against the grain from what had looked a picture-perfect short; further gains will generate a fresh breakout – attracting new longs – alongside yet another round of short covering.

Leave A Comment