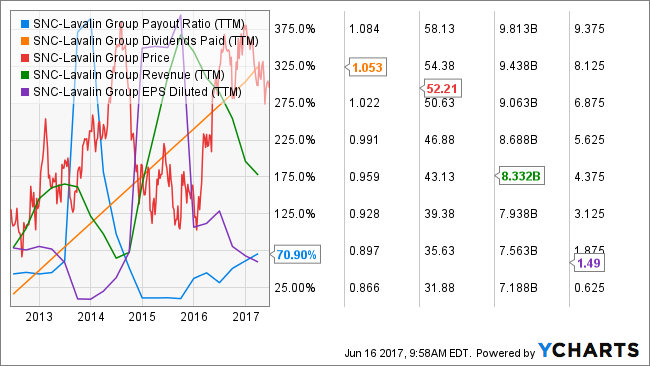

Back in April 2015, I made a bold move in my portfolio; I sold Scotiabank (BNS.TO)(BNS) to buy SNC-Lavalin (SNC.TO)(SNCAF). Many readers weren’t too sure about this move, but I’ve proven that I was right 2 years after the trade:

Source: Ycharts

While SNC outperformed BNS all the way, it is clear on this graph I should have sold SNC a year ago and a few weeks ago. But the investment thesis behind my purchase was still valid a year ago:

“I believe the moment charges will be settled, investors will look at the SNC $12B order book and forget about the past. After all, even with the current shadow over its head, the company continues to win contracts around the world. Their expertise is among the most solid in the world in their field. The problem came from greedy management looking to cut corners. This must be punished, but there are solid engineers working at SNC and the company should survive this storm.”

The RCMP legal pursuits threats are fading away and the company has nicely recover. However, I’m selling SNC for two reasons:

#1 The macroeconomic context has changed

The oil recovery is nowhere close to happening and SNC has important participation in this industry. The company shows an additional risk in the event of any market correction. I know SNC is not solid enough to convince investors during a market crash. Therefore, my chances of losing most of my profit are obvious. After all, my goal with SNC was to hold it for a short period of time and realize an interesting profit. With over 35% total return on the trade in 2 years, I think this goal has been achieved.

#2 I found a better investment

It has been harder than usual to get excited with buying opportunities lately. The market is highly priced and most great companies are following the parade. The easy money is off the table.

A few months ago, I spent lots of time analyzing the retail industry. This analysis incited me to sell Walmart (WMT) in November 2016. The main reason why I sold WMT is I believed they will not be able to compete against Amazon (AMZN) and other retail techno. On June 16th, 2017, AMZN just announced the acquisition of Whole Food (WFM) for $13.7 billion. Here’s the immediate reaction on the stock market on that day of opening:

Leave A Comment