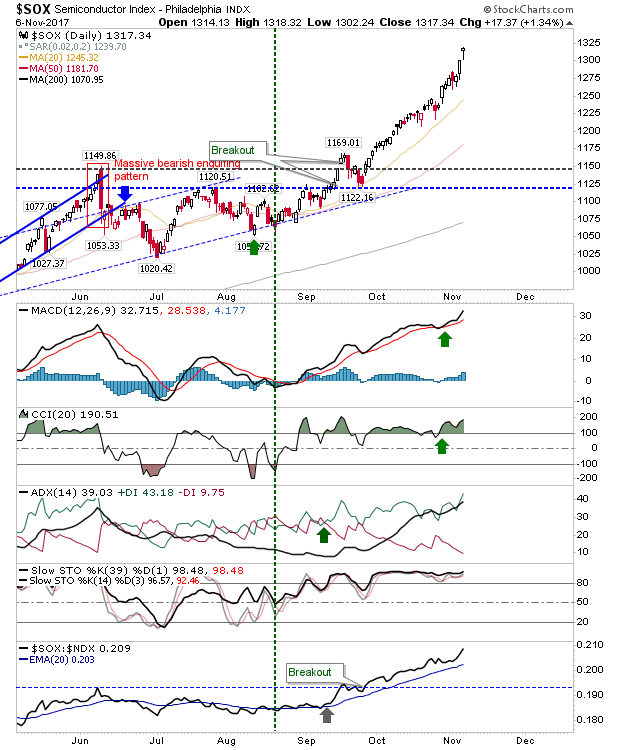

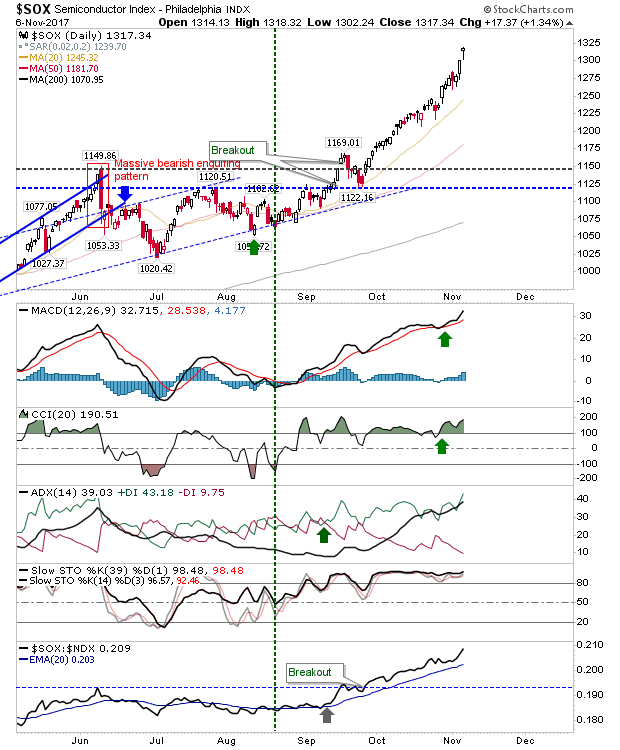

More gains for the market kept the rally intact which leaves little to add today. The only potential cloud on the horizon is the Semiconductor Index. Today finished with a gap higher with a bearish hammer which may become a bearish shooting star if there is a gap down and further losses by the close tomorrow. The rally from September lacks a pullback so some form of sell off is anticipated.

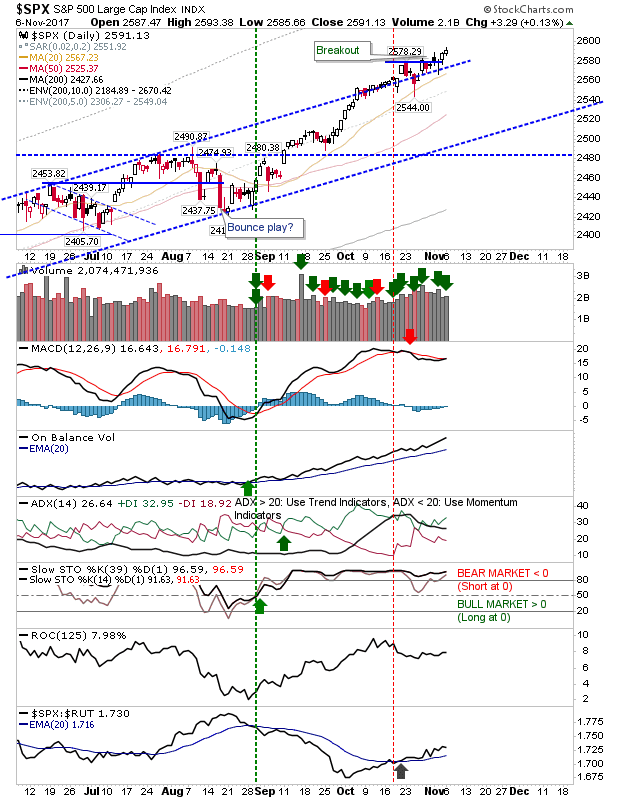

The S&P edged a small gain but not quite a MACD trigger ‘buy’

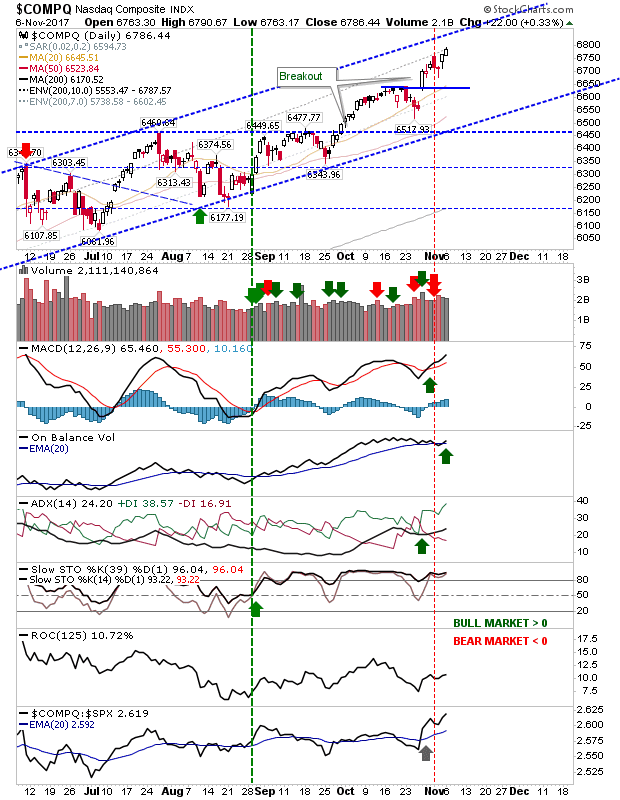

The Nasdaq made it closer to channel resistance and remains the upside target.

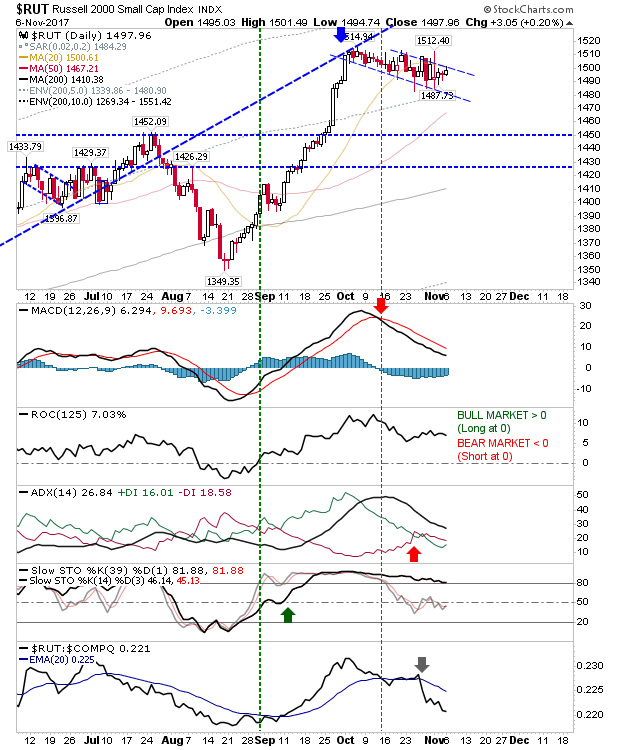

The Russell 2000 looks ready to break out of its ‘bull’ flag. Today left the index at channel resistance; tomorrow could deliver a breakout. Watch this closely.

Keep an eye on pre-market trading; weakness in lead indices has the potential to set up a bearish ‘shooting star’ in the Semiconductor Index. In a bullish pre-market, look for the breakout in the ‘bull’ flag from the Russell 2000..

Leave A Comment