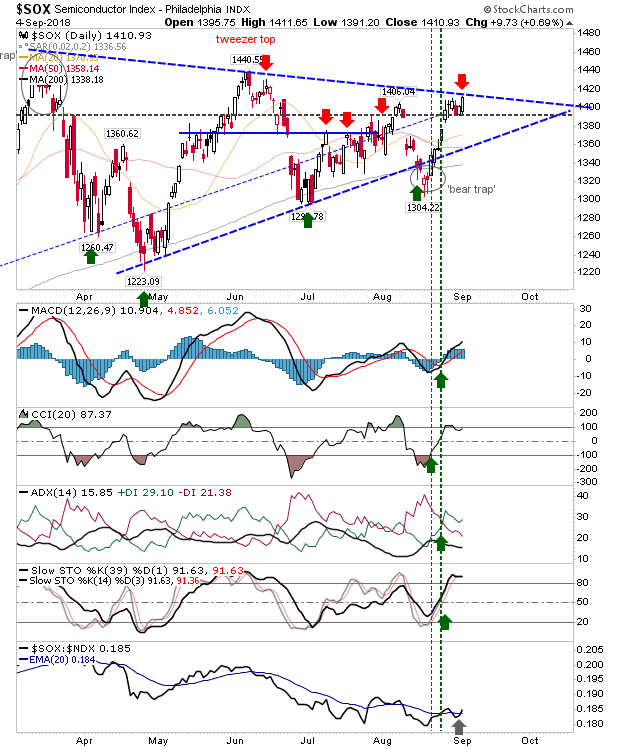

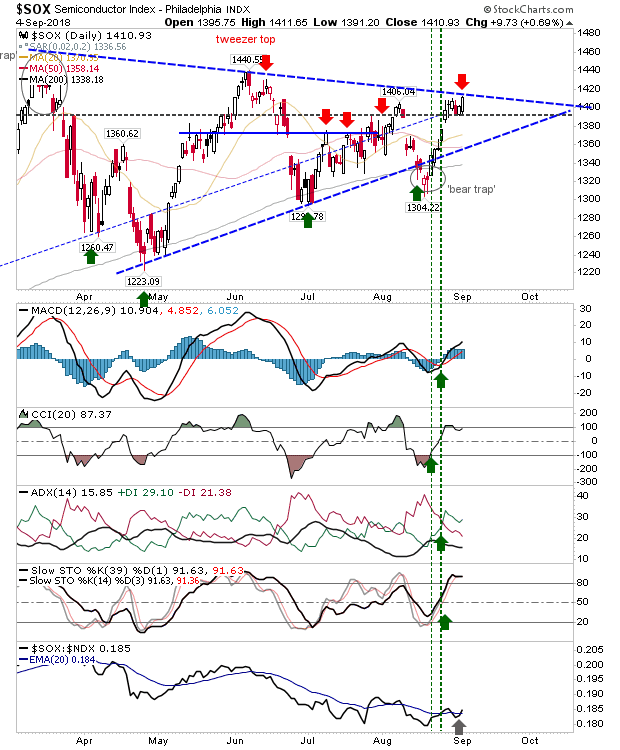

There wasn’t a whole lot to work with Tuesday. The only index showing potential was the Semiconductor Index; it managed to clear congestion from the last four days as it tagged resistance. While the resistance tag may be viewed as a shorting opportunity the move looks like one to drive a break of the triangle.

The Russell 2000 experienced a minor sell-off although it ranked the biggest fall on the day. The index remains well above breakout support despite the hugging of channel support-turned-resistance; a sell-off before a break of 1,742 looks more likely but let price be your guide.

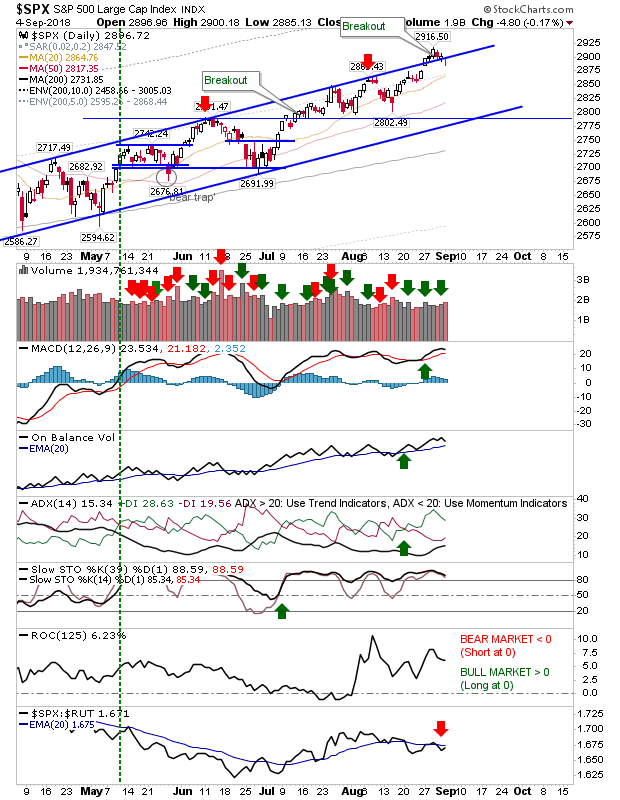

The S&P finished with a small doji at channel resistance-turned-support. Buyers still have an opportunity for a short-term momentum play.

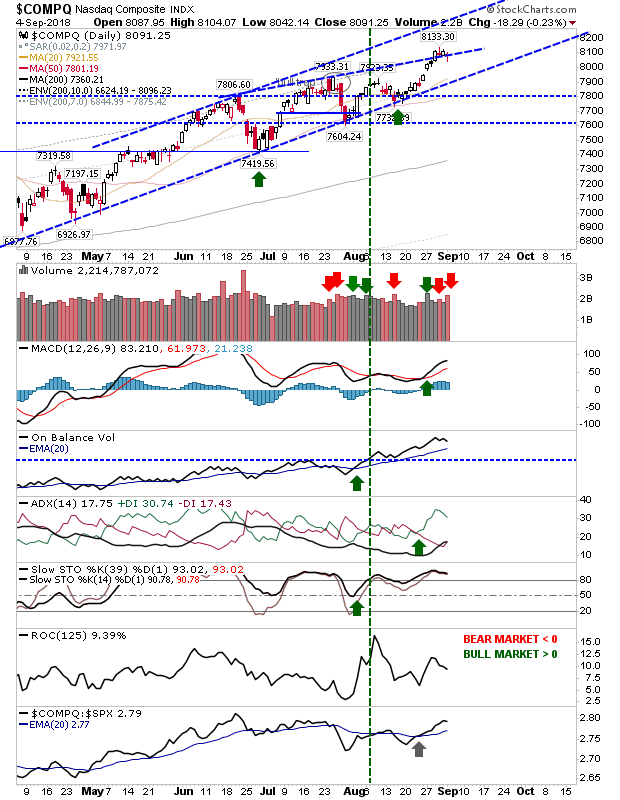

The Nasdaq experienced a heavier volume sell-off but like the S&P closed with a doji. There is a minor buying opportunity here for a move to larger channel resistance.

Leave A Comment