A solid day for Semiconductors saw a solid breakout from the recent handle (without a violation of the measuring gap), which even managed to mount a challenge on the September ‘bull trap’. It still has a bit of work to do to get to new highs, but bulls have shown their hand, and now it’s up to others to follow suit. This – to me – looks good for a push to 700s, but even a move back to 600 would offer the possibility of a head-and-shoulder bounce: lots of room for bulls to work with here.

Not to be outdone, the S&P added some points as it looks to breakaway from recent tight action. It wasn’t a slam dunk for bulls, but it does suggest sellers are lacking ammunition to influence things when most market participants (including some die-hard bulls) are expecting a decline. Futures suggest a slightly soft open, but not enough to reverse yesterday’s move.

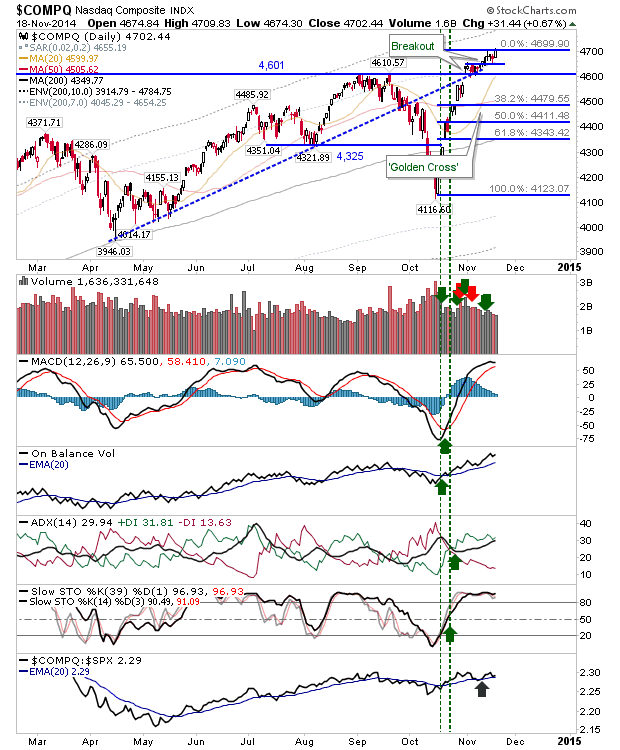

The Nasdaq picked up a little pace too. It has managed to steadily rise over the last few days, so the gain doesn’t look as stark as it does for the S&P. No doubt helped by gains in the Semiconductor Index too.

Small Caps have stalled on former handle support. Given the ‘bull trap’ I would not expect this support level to hold, and a move back to the 200-day MA, and possibly down into Fib retracement levels would be favored. However, it may benefit from strength in other indices.

For today, it will be important gains in the Semiconductors and S&P hold. If bears pick up any momentum, then the Russell 2000 will be the index most vulnerable to sellers.

Leave A Comment