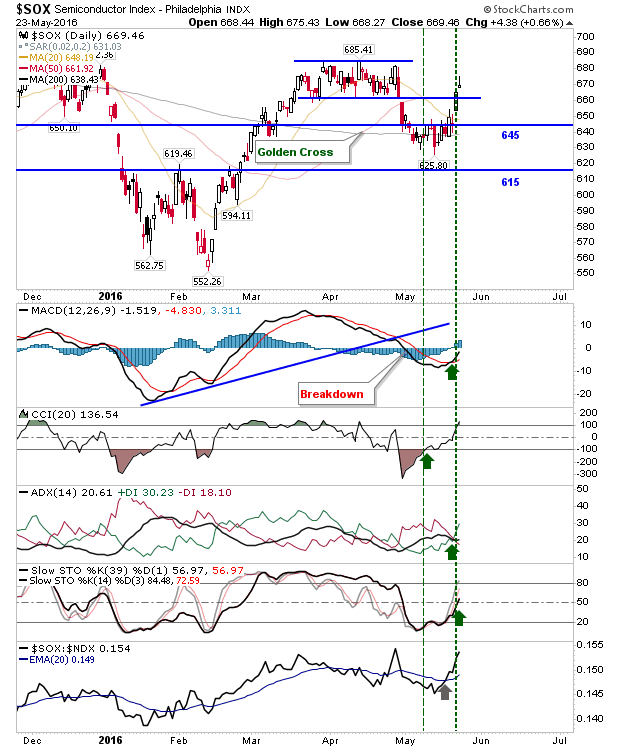

Today was really a non-event. Friday’s gains were great, but it was going to be hard to see more of the same today. This lack of action hit high flying Semiconductors after a positive gap open had made it look like another good day was in store. Other indices did very little.

Semiconductors finished with a bearish ‘inverse hammer’; some may look to the mid-line of stochastics [39,1] as a confirmation of this, but I suspect the index has done enough to return net bullish, which technicals – as of today – have confirmed. Time to buy pullbacks.

The S&P didn’t do enough to negate the breakdown, but the sell off wasn’t enough to suggest bears have done enough to defend their short positions.

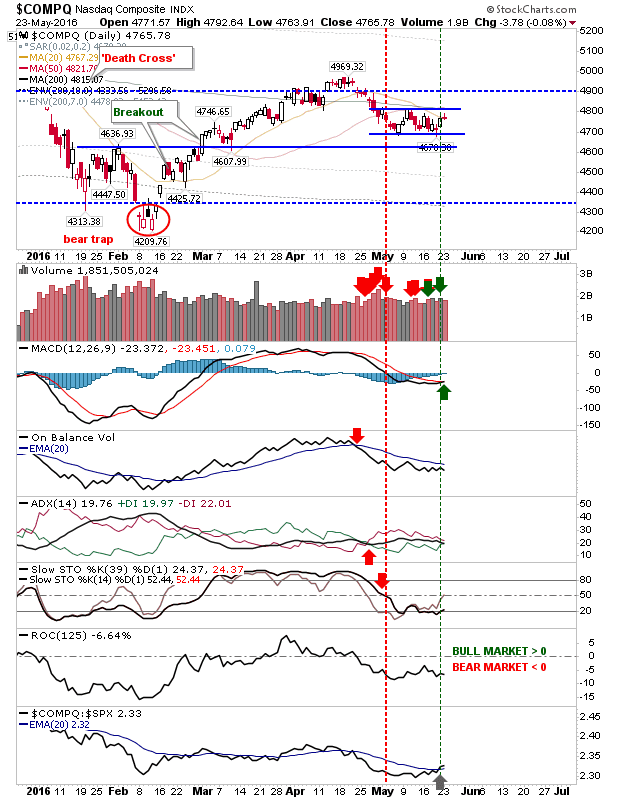

The Nasdaq finished flat inside the current trading range. There wasn’t much damage done, and if Semiconductors were able to continue their advance, then a move back above 5,000 would’t look so far fetched for the Nasdaq. The MACD trigger ‘buy’ was a positive start.

There was little to say about the Russell 2000. Today’s action remained above the channel line, but below converged moving averages; a real non-day.

Again, stay focused on the Semiconductor Index. While I remain stubborn (foolish) on what I think markets need a solid 40% trim from all-time highs to reset the cyclical bull market count inside the March 2009 secular bull market low, action in the Semiconductors is suggesting this dip is about to kick on to new all-time highs. I would like to be right-side on this, but Tech indices may be about to kick me in the shin.

Leave A Comment