After opening the day on a positive note, the Indian share markets have continued their momentum and are presently trading in the green. Sectoral indices are trading on a positive note with stocks in the realty sector and healthcare sector witnessing maximum buying interest.

The BSE Sensex is trading up 214 points (up 0.8%) and the NSE Nifty is trading up 63 points (up 0.7%). The BSE Mid Cap index is trading up 0.9%, while the BSE Small Cap index is trading up 1%. The rupee is trading at 67.20 to the US$.

Participants in the Indian share markets are keeping tabs on the RBI monetary policy review scheduled on 8th February.

This bi-monthly monetary policy is RBI’s second policy after November’s note ban. It comes at a time when banks are flushed with funds post the demonetization exercise. Owing to this, many expect that the Reserve Bank of India (RBI) will keep the key interest rates unchanged in its monetary policy review.

However, there are also arguments contrary to the above expectations. With services sector contracting for the third straight month in January, there are hopes that the RBI could be accommodative and could slash the policy rate.

Now, as you know, rate hikes and cuts never really disappoint or enthuse us. For in no way do they impact our long term views on stocks.

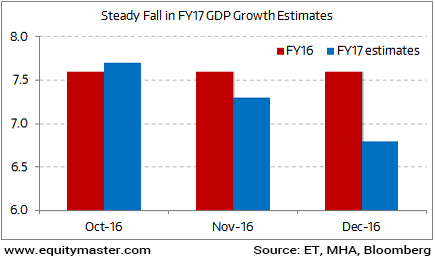

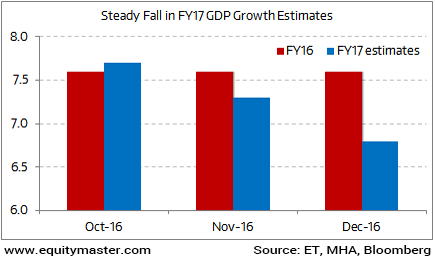

The shortage in money supply due to demonetization has led to a slowdown in consumption impacting India Inc. This in turn has put a question mark on the GDP growth.

India’s GDP Growth Could Decelerate Sharply

The economy will not gain momentum from the rate cut alone. To set the paralyzed demand into motion, there needs to be more action beyond cuts in interest rates.

So irrespective of the market reaction to the RBI’s decision, just test the safety of your stocks and buy the safest ones.

In another news, overseas investors have turned net buyers in February and pumped in over Rs 23 billion in the capital market over the last three sessions.

Leave A Comment