After opening the day marginally higher, stock markets in India have continued their momentum. Sectoral indices are trading on a positive note with stocks in the telecom sector and IT sector witnessing maximum buying interest.

The BSE Sensex is trading up 205 points (up 0.7%) and the NSE Nifty is trading up 60 points (up 0.6%). The BSE Mid Cap index is trading up by 0.4%, while the BSE Small Cap index is trading up by 0.6%. The rupee is trading at 64.49 to the US$.

As per an article in Business Standard, after in-principle approval for strategic disinvestment in Air India, the Centre might move swiftly on its next round of strategic sales in central public-sector enterprises (CPSEs).

The list includes divesting 100% stake in Ennore Port, Dredging Corp of India, Hindustan Lifecare and Karnataka Antibiotics and Pharmaceuticals, and 51% stake in Hooghly Dock and Port Engineers.

In the Budget 2017-18, the government set an ambitious divestment target of Rs 725 billion. How much of this gets achieved remains to be seen.

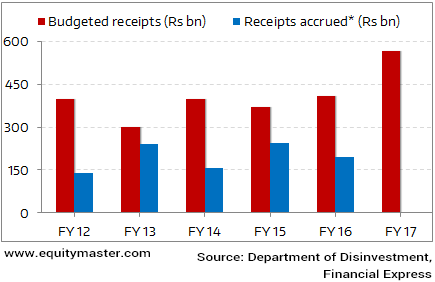

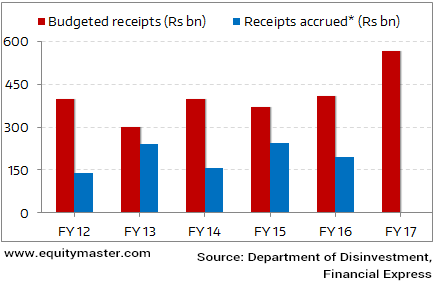

As per media reports, the government collected over Rs 460 billion through divestment in 2016-17. If one looks back, the government has failed to meet its divestment target over the past few years, as can be seen in the chart below:

Disinvestment Realisations Fall Short of Target

In the news from IPO space, AU Small Finance Bank made a stellar debut on BSE today by listing at Rs 525 per share. This meant a premium of 47% over its issue price of Rs 358 per share.

AU Small Finance Bank Limited (AU SFB) is a small finance bank that has recently transitioned from retail focused non-banking finance company which primarily served low and middle-income individuals and businesses that have limited or no access to formal banking and finance channels.

The company received a license from RBI to set up small finance bank (SFB) on 20 December 2016 and it is the only NBFC categorised as an asset finance company to obtain such a license. It commenced SFB operations from 19 April 2017.

Leave A Comment