Everyone is Bullish. Everyone is Bearish.

Two phrases often heard in markets, and often accompanied by following quote, courtesy of Warren Buffett:

Be fearful when others are greedy and greedy when others are fearful.

Great saying, but what exactly does it mean? How do you know when “others are greedy or fearful”? And how do you turn “being fearful or greedy” into an investment strategy?

As is turns out, it’s a bit more challenging than you might think.

First, you need to define fear and greed. There are a number of different ways to do so, including:

If your goal is to simply state that people seem to be fearful or greedy, any of these might suffice. But if your objective is to develop a long-term strategy around such sentiment, the definition should be a quantitative metric with enough history to determine its efficacy.

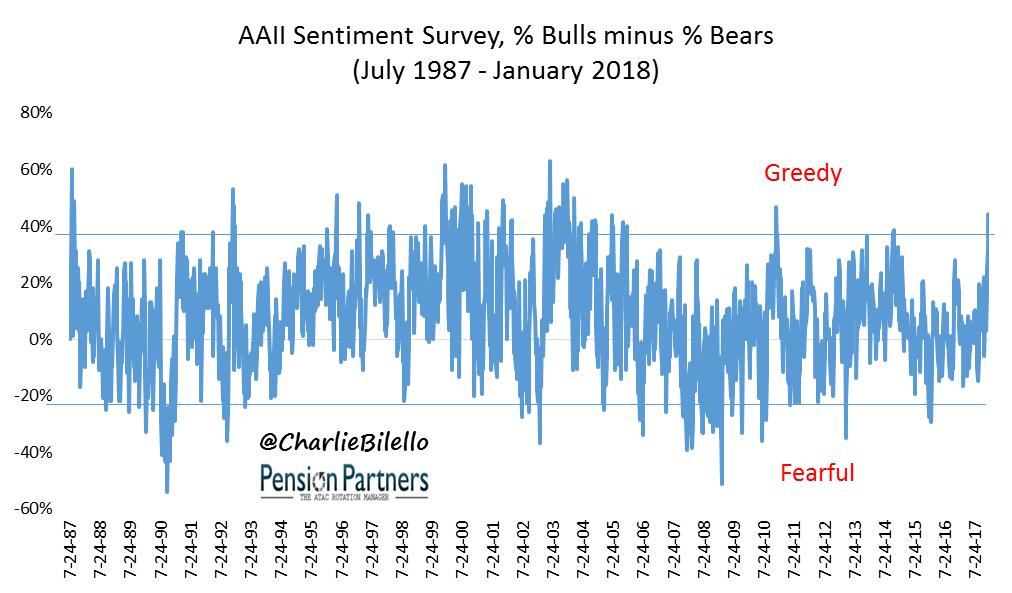

In this post, we’ll focus on the American Association of Individual Investors (AAII) survey which asks investors how they feel about the direction of the stock market over the next six months. We have weekly data for this poll going back to 1987, broken down by the percentage of investors who are bullish, bearish, or neutral in their outlook.

Next, we need to define “greedy and fearful.” This is no easy task. Do we look the % of bulls, the % of bears, or some combination thereof?

In this post, I’ve chosen to look at the spread between bulls and bears. When the spread is high, investors tend to be greedier. When the spread is low, investors tend to be more fearful.

Data Source: American Association of Individual Investors (AAII).

But what is high and what is low? That’s a subjective assessment. To some, it may be above/below the 80th/20th % percentile. To others, it may be above/below the 99th/1st percentile.

Leave A Comment