Whatever happened to that whole “reflation” trade theme that everyone seemed to be talking about a year ago? Well, judging by some of the charts in this blog, it looks like the reflation theme is still very much well and alive, with traders displaying extreme confidence in the reflationary outlook. It also seems as though this confidence is at least for now justified. But other than that, we go through some of the usual charts from the weekly positioning/outlook surveys I conduct on Twitter (differentiating the outlook based on technicals vs fundamentals).

The key takeaways from the weekly sentiment snapshot are:

-Equity investors remain bullish fundamentals, and about neutral on the technicals picture.

-There remains a slight disconnect between bond investors and equity investors on the fundamentals, but the reflation theme seems well and alive.

-The reflation speculative futures positioning indicator implies extreme confidence among traders.

-The solid showing across a couple of key PMI indicators seems to justify this confidence, at least for now.

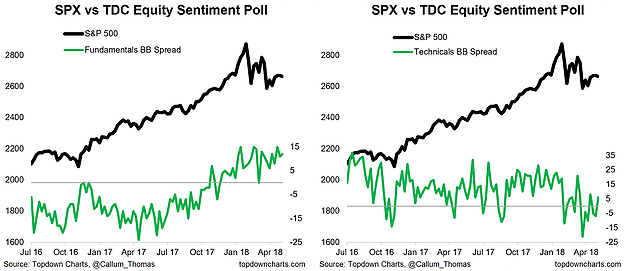

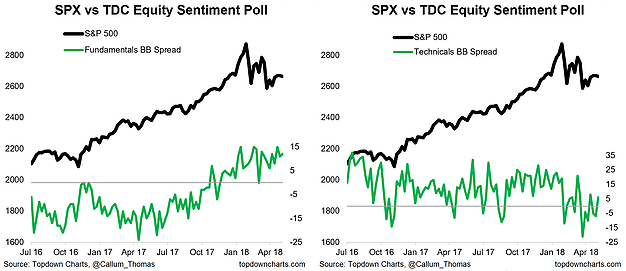

1. Equity Technicals vs Fundamentals Sentiment: As usual, starting with a comparison between equity investors’ perceptions around the “fundamental” vs “technicals” outlook, the conclusion remains that investors are still bullish on the fundamentals while less enthused about the technicals picture. In fairness, the technicals sentiment is probably more around neutral… which makes sense given the short term tactical setup there, which I talked about in the weekly S&P500 ChartStorm.

2. Equity vs Bond Fundamentals: Focusing on the fundamentals, the gap between bond investors and equity investors is closing. Equity investor perception of the fundamentals remains at solid levels, while bond investors are slowly coming around to a more bearish fundamentals view on bonds (recall, much of the time what’s good for bonds is bad for stocks, and what’s bad for bonds fundamentally speaking is usually good for stocks i.e. a better growth and inflation outlook). It’s hard to blame equity investors for being so optimistic given the trend in corporate earnings, but as for bond investors, it brings to mind the almost forgotten theme of “reflation”.

Leave A Comment