The latest weekly sentiment/positioning survey on Twitter revealed a continuation of some very interesting trends and a new record in bearish sentiment on bonds and a highest-equal bullish reading for stocks. If you thought that was interesting, the detail only gets better.

For a copy of the survey historical data click here. Note, the survey asks respondents if they are bullish or bearish for primarily “fundamentals” or “technicals” rationale.

There has been a clear trend to ever more bullish sentiment on equities, and ever more bearish sentiment on bonds. Much of this has been driven by a reassessment of the fundamentals (see chart 2), where there has been a consistent move in equity and bond sentiment – consistent because better equity fundamentals (macroeconomic) are typically bearish for bonds.

The main takeaways from the latest survey results are:

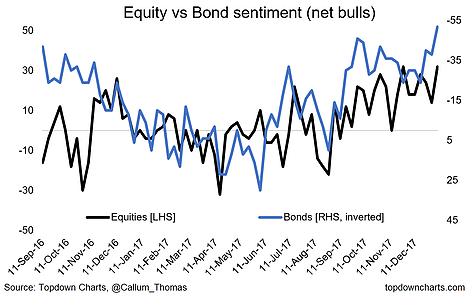

1. Bonds vs Equities: The first chart shows bond and equity net-bullish sentiment (bonds is inverted because bonds typically are negatively correlated with stocks), and there has been a consistent trend across the past year. The latest results have bond net-bulls at the lowest on record, and equities at the highest-equal reading. These kind of extremes are worth paying close attention to.

2. Fundamentals: A good follow-on chart, shows the smoothed net-bullish “fundamentals” sentiment. The reassessment of the fundamentals since the low point in June last year has been simply profound. The fact that it is consistent across stocks and bonds, and is also largely consistent with the data we track showing improving momentum in the global economy suggests there is probably sound basis for this outlook – even if it may have reached extreme levels.

Leave A Comment