What do these 10 companies – Wal-Mart, Macy’s, Kohl’s, Sears, Target, Best Buy, Office Depot, K-Mart, J.C Penney, Gap – all have in common? Each one of them is closing down a slew of retail storefronts.

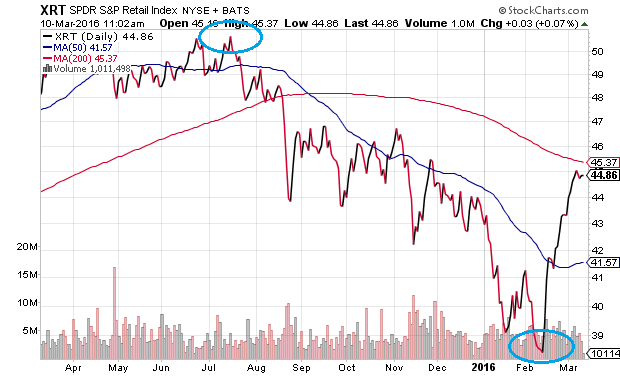

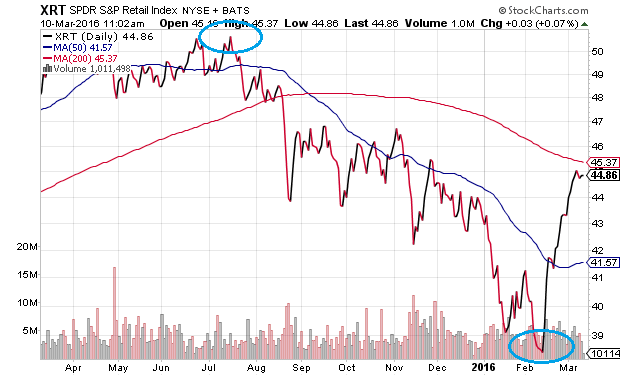

The “talking heads” on CNBC want you to believe that brick-and-mortar woes are merely a reflection of the consumer’s preference to shop online. Maybe. Or perhaps shuttering the doors will help boost the bottom-line profitability of retail company shareholders. After all, the SPDR S&P Retail ETF (XRT) has bounced an astonishing 17.5% off its bear market lows.

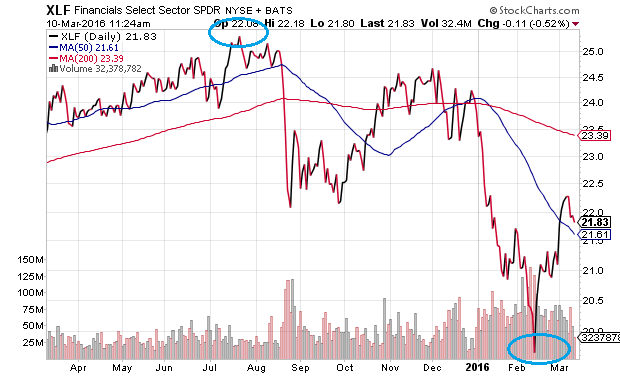

On the other hand, a 24.5% bearish descent for the retail segment does not reflect positively on the well-being of American business. In fact, many influential sectors of the U.S. economy have already descended more than a bearish 20%. There have been peak-to-trough declines ranging from 20%-40% in energy, materials, transporters, biotechnology as well as financial institutions. The bear market rally in SPDR Sector Select Financials (XLF) still leaves the influential sector in correction territory, roughly 12% beneath its July pinnacle.

Perhaps ironically, the business media excitedly embraced the 7th birthday of the bull market yesterday (3/9/16). What was missing from the exuberance? The S&P 500 traded at 1989 back in July of 2014. That’s 20 months ago. More critically, 42% of S&P 500 components remain mired in bear market territory, even after the 10% bounce off of the February lows. And what if the S&P 500 should ultimately drop 20% prior to reclaiming its May 2015 record high of 2130? In that case, the bull market would have ended ten months ago at an age of six years, two months.

Not surprisingly, the very same folks who believed the bear market was unstoppable at the February lows – S&P 500 at 1829 – shifted back to the bull camp the minute the S&P 500 closed above 2000. Did the fundamental backdrop on three consecutive quarters of declining earnings per share (EPS) change to justify the bullishness? Hardly. Hadn’t they ever seen how bear market rallies work? Where broad market gauges could jump 10%, 15%, even 18% in the middle of a bearish downtrend? Apparently not.

Leave A Comment