Calculated “inflation” in Europe disappointed again in March, as for the second month in a row the HICP rate was below zero. There had been some hope after the German version turned just slightly positive that it would herald a different sign for the rest of Europe. Instead, inflation rates in other places were mostly the same; Spain stuck at -1% for the second month; France at -0.1% February and March; and Italy dropping slightly to balance out Germany, -0.3% in March from -0.2% the month prior. In reality, there isn’t the slightest bit of difference in any of these numbers as they all suggest the same, continuous monetary mistake.

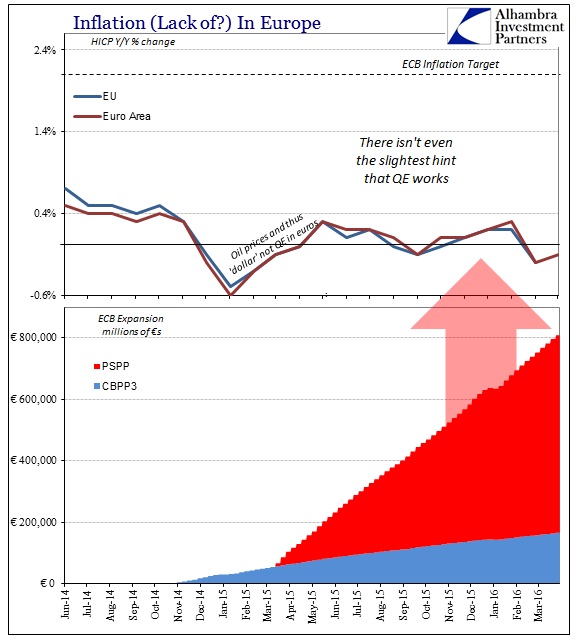

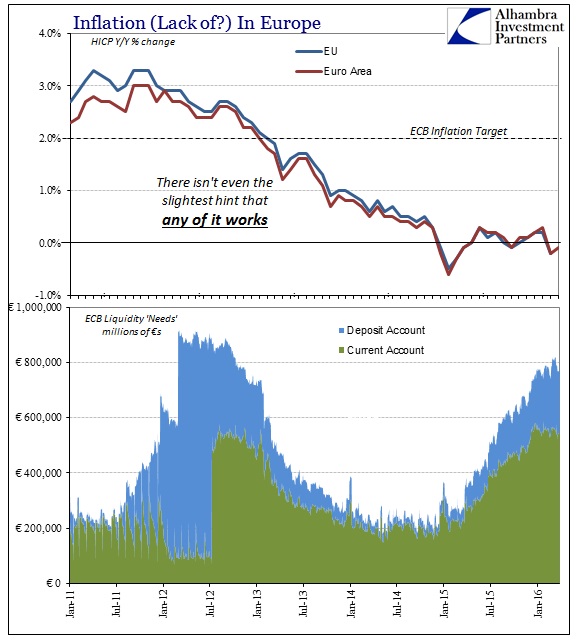

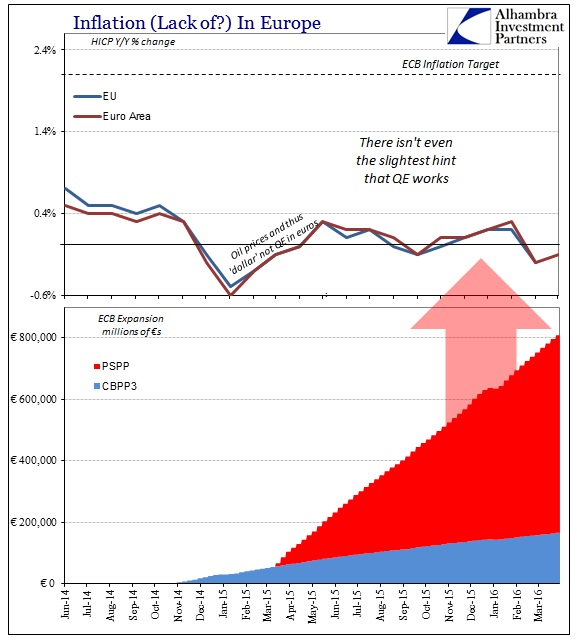

Monetary policy is supposed to be the dominant setting for inflation through expectations of (as always) money printing via various balance sheet expansion schemes. Whatever you think the effort, that is the intent and it is stamped on every press release accompanying the initial announcement of all the various programs. The ECB has employed a number of them in constant fashion over the years and has come up short every single time. The latest, the combined PSPP (QE) and CBPP3 (third time at covered bonds), has totaled more than €800 billion to date; and inflation is no closer 2%, instead still stuck around zero.

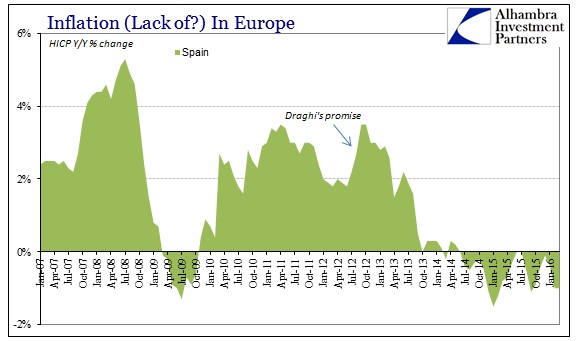

But where monetary policy leaves absolutely no imprint, “something” else does and it is easy to observe in almost every part of the inflation breakdowns. Starting with Spain, a country that is supposed to be among the shining examples of Draghi’s 2012 promise to “do what it takes”, its calculated HICP rate only moved higher in the first two months after the unofficial proclamation. Then, just like its government bond yields, inflation conspicuously dropped and has never recovered. Lower interest rates have not provided the intended monetary lift.

Over in Germany, the Continent’s powerhouse, the inflation trajectory is far more simple and easy. The HICP rate holds like the rest of Europe to nothing of monetary policies, from the LTRO’s and SMP’s to now NIRP, QE and whatever other madness the ECB finds fit to fail at. The starting point of that disinflationary slide, however, suggests that European inflation is not without monetary causation – it just doesn’t originate with any central bank.

Leave A Comment