Shanghai Composite – Weakness In China

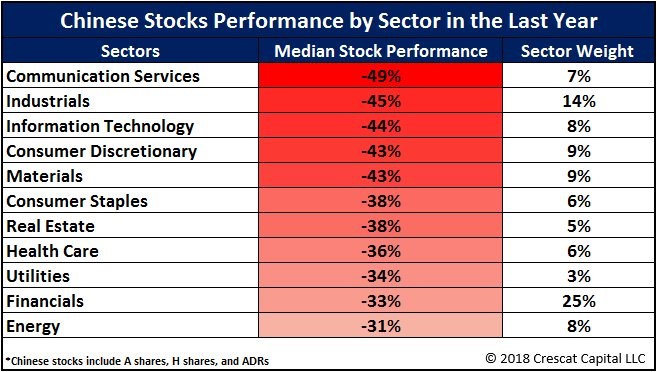

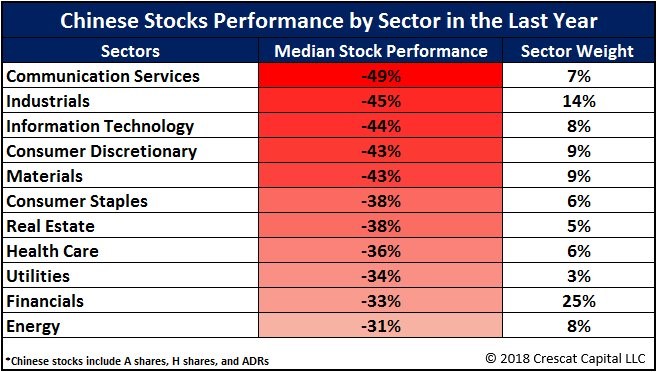

Let’s get back to possibly the biggest topic of the year. That is the crash in Chinese stocks and the weakness in its economy. The table below breaks down the Chinese market’s performance in the past year using the new sectors.

As you can see, the median communication services stock is down 49% as investors are shirking growth. The median tech stock is down 44%.

The financial sector has the highest weight as it is 25%. This means the 33% decline in median financial stocks has helped the index.

Much is made about how the American stock market has outperformed because of its massive internet names. However, in the past year, American internet names have outperformed. That happened in part because the American economy has done well.

When the economy reverses, the high beta tech and communication services stocks will be the first to falter. We’ve seen that play out modestly in the recent October correction.

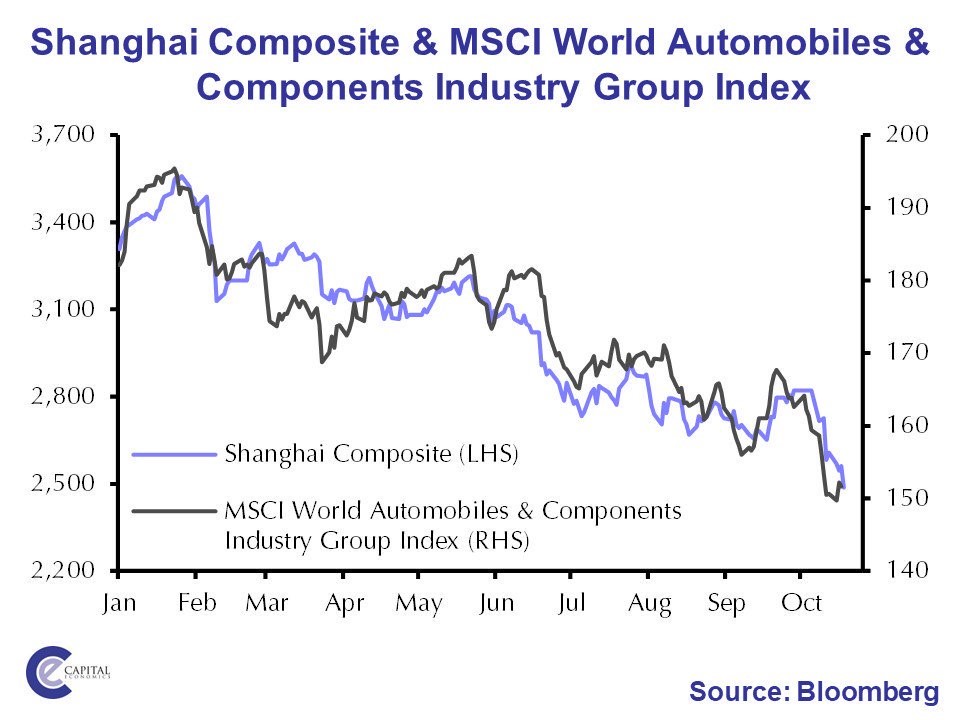

The chart below shows the Shanghai Composite is highly correlated with the MSCI world automobiles and component industry group index.

The Caixin manufacturing index has been falling steadily this year. It fell to a 16 month low in September.

Chinese consumer confidence index is historically elevated. However, has been weakening in the past few reports. It peaked at 124 in February.And it was at 118.6 in the most recent report which was in August.

Chinese fixed investment growth fell to 5.3% in August which is its slowest level on record. The peak this year was 7.9% in January and February. I’m interested to see the readings since then. The slowdown will be combined with the negative impacts from the trade war.

Clearly, the Chinese stock market knows more negative data is coming.

Shanghai Composite – Stocks Present Another Buying Opportunity

S&P 500 gave back most of its gains from Tuesday on Thursday as it fell 1.44%. Nasdaq was the worst hit as it fell 2.06%. Russell 2000 fell 1.82% and VIX increased 15.29%. I’m very bullish on stocks in the next month. B I’m neutral for the next 12 months because of the negative setup I see in 2019.

Leave A Comment