The Shanghai Composite Index had its worst day of the year Thursday, down 2.3%. After beginning a well-defined price uptrend that started in May 2017, Wednesday’s move could trigger sensitive momentum algorithms to exit long positions, particularly those formulas that focus on price channel patterns and downside deviation consistency models. But beyond the algorithmic factors, there are fundamental concerns, notes a Deutsche Bank report. Some of these issues are long-term and involve slower moving central planning models while others are shorter term in basis.

Regulation is a short-term concern of Chinese investors

Hong Kong stocks have been moving meaningful higher recently. The Hang Seng Index closed up 2.3% on the week, its fourth week of advances, pushing the index above the 30,000 mark for the first time in 10 years. Up nearly 35% on the year, Hong Kong stocks have benefited from investments emanating from mainland China, according to Goldman Sachs Chief China Equity Strategist Kinger Lau, who is forecasting 32,000 by year-end.

The Shanghai Composite, however, hasn’t been so lucky, indicating a degree of idiosyncratic factors rather than larger regional issues taking stocks lower.

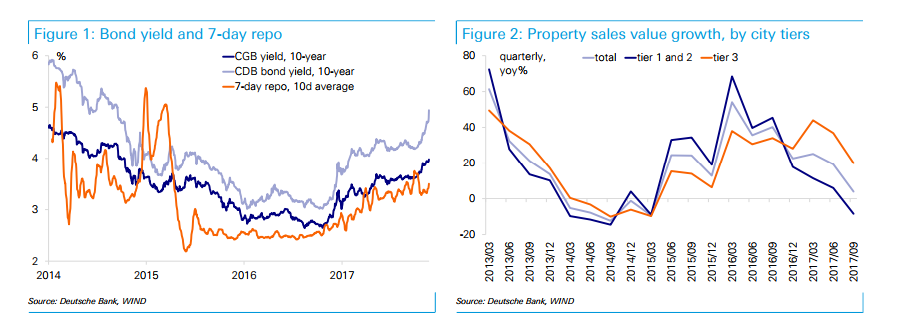

Perhaps the most immediate factor driving the Shanghai stock market lower Thursday was a regulatory concern.Deutsche Bank Chief Chinese Economist Zhiwei Zhang credits the move lower to concern for tightening regulation in the asset management sector.

“Tight liquidity and escalating regulatory oversight are the excuse to sell,” Wang Zheng, chief investment officer at Jingxi Investment Management in Shanghai, was quoted as saying. “The most important thing is that those institutional investors want to be the earliest to cash out of these stocks with outsize gains to be ranked among the top as the year-end is coming nearer.”

But Deutsche Bank notes a more pervasive force impacting markets, one whose influence is not immediately seen.

Leave A Comment