March 19, 2018, concludes the 180-day lockup period on Best Incorporated (NYSE: BSTI).

When the lockup period ends for Best Inc., its pre-IPO shareholders and insiders will finally have the chance to sell large blocks of previously-restricted stock. Just 12.2 of shares outstanding are currently freely transferable.

(Source: F-1/A)

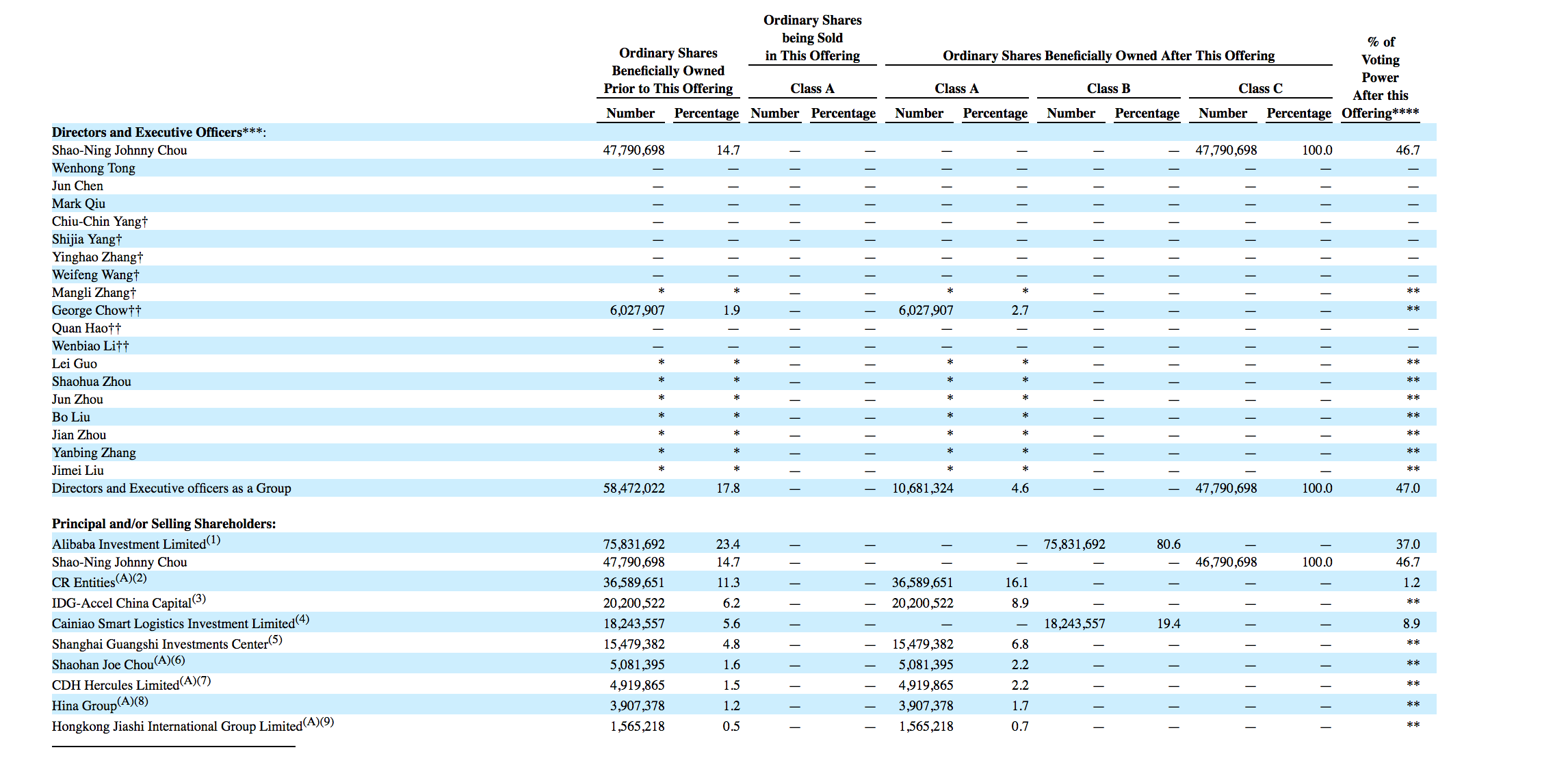

A sudden increase in shares traded on the secondary market will likely negatively impact the stock price of Best Inc. in the short term. This group of pre-IPO shareholders and insiders is comprised of numerous individuals and 10 corporate entities.

(Source: F-1/A)

Currently BSTI trades in the $10.50 to $11 range, slightly higher than its IPO price of $10. However, this price is down significantly from its high of $12.05 on September 25, just five days after the release of the IPO.

Business Overview: Smart Supply Chain Service Provider in China

Best Inc. operates as a smart supply chain service provider in the People’s Republic of China. The company’s proprietary technology platform gives its ecosystem users the ability to operate their business with a variety of SaaS-based applications. Its applications include store management, smart warehouses, sorting line automation, swap bodies, and network and route optimization. The company also offers door-to-door integrated cross-border supply chain services such as international express, less-than-truckload, reverse logistics, fulfillment, and freight forwarding via its network, and warehouse and transportation partners. Best Inc. also operates a real-time bidding platform for sourcing truckload capacity from independent transportation providers and agents, and it offers store management services for convenience stores and last-mile B2C services like bill payment, laundry services, and parcel delivery and pick-up. Another business area includes a variety of value-added services, including customized financial services, such as equipment and fleet finance leases.

Leave A Comment