With so much skepticism being raised about crypto-currencies and bitcoin in particular, one would think that short interest in the investment trust that is meant to track bitcoin would be higher. However, based on the latest short interest figures released after the close last night, short interest in the Bitcoin Investment Trust (GBTC) has actually been on the decline during the most recent leg higher. Before reading too much into this data, we would note that GBTC is hardly a perfect method for tracking the performance of bitcoin. Over time, the security has traded at very wide premiums to its NAV. Also, the ETF is not very liquid, and because it doesn’t trade on any of the major exchanges, some firms do not allow clients to short it.

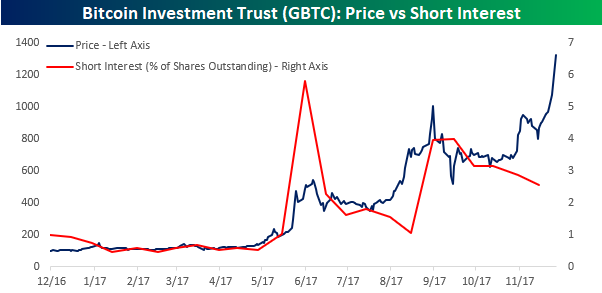

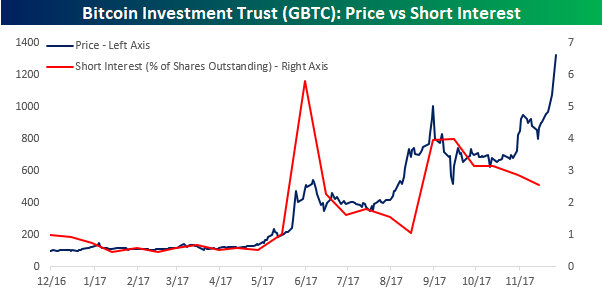

With all of those caveats in place, though, the chart below compares the price of GBTC over the last year to short interest in the ETF expressed as a percentage of total shares outstanding.During this period, short interest figures have generally tracked price pretty closely; when prices have increased, short interest rises and vice versa. Since the middle of October, though, we’ve seen short interest and price move in opposite directions. While the price of GBTC has doubled, short interest has declined from 3.2% of shares outstanding to 2.6%. Have investors who were brave enough (or foolish enough depending on your perspective) to short GBTC finally cried uncle, or are they just waiting to reload for when the trust reaches higher prices? We would note that back in August we saw a similar situation where short interest spiked just as GBTC first headed towards $1,000 ahead of what ended up being a short-term peak in price.

Leave A Comment