In recent weeks, signs of greater inflationary pressures have increased. Although acceleration of inflation is no sure thing, business leaders should be aware of the risk of higher inflation and have contingency plans in place.

Here are some items I’ve noticed over the past 30 days (writing on 11/11/2018):

Interest rates on 10-year treasury bonds up from 2.39 to 2.55. (FRED database)

Gold has increased from $1241 an ounce to $1320. (Kitco)

Oil has increased from $57.14 to $63.75(MarketsInsider)

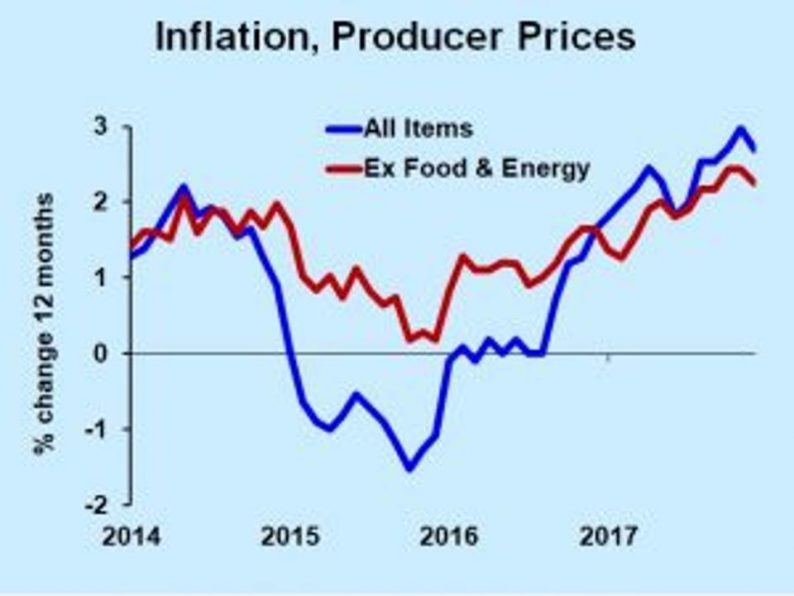

Dr. Bill Conerly using data from Bureau of Labor Statistics

Producer price index change

None of these measures are causes of inflation, but rather indicators of inflationary expectations or pressures.

Monthly data is less pronounced so far, but tending upward. Wage inflation crept up more than usual last month. (Bureau of Labor Statistics). Wage increases are not a cause of inflation but may be a reflection of excessive stimulus within the economy.

The global outlook is being revised upwards by the economists surveyed by FocusEconomics.

Business strategy—and especially contingency plans—should reflect the possibility of higher inflation. It’s not a certainty by any means, but definitely a possibility. Here are things to think about.

Hesitate to commit to long-term price agreements. Sometimes it’s worthwhile to provide customers with a fixed price, but be cautious right now. If you do commit to a fixed price, make sure it’s a pretty high price. Alternatively, add in a price-adjustment clause that reflects your costs. That may be tied to labor costs, fuel, or other resources used to produce the goods or services you sell. This guarantees to your customers that you won’t gouge them if the market tightens, but protects you from selling at a loss if your costs increase.

Look for long-term deals with your own suppliers. If they will commit to today’s prices, great. Be aware, though, that a commitment that turns out to be grossly unprofitable in the future is likely to be litigated. It may still be worthwhile—you’ll probably be able to extract a significant concession in exchange for renegotiating terms. The lesson is that you can’t bank on the supply agreement lasting too long.

Leave A Comment