Hot chip giant and Apple supplier Broadcom Ltd (NASDAQ:AVGO) is a clear market favorite right now. In the last three months, the stock has received an incredible 23 back-to-back analyst buy ratings. AVGO has already soared by 55% year-to-date and top analysts say there is still plenty of upside potential left. Let’s take a closer look at just why you should make this a key stock to track right now.

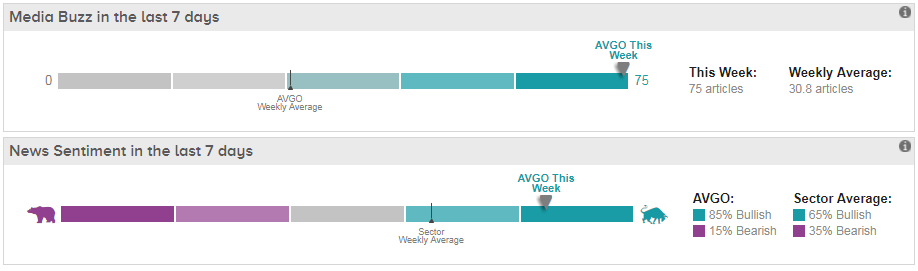

Media Buzz

First, AVGO has been generating some serious media buzz over the last week. Check out here how the number of articles generated on AVGO has exploded in the last 7 days:

Indeed Broadcom has just made a number of big announcements- including reports that it plans to make an acquisition bid for smartphone chip supplier Qualcomm Inc (NASDAQ:QCOM). If the deal was successful it would create a $200-billion company and be the biggest tech acquisition ever. “It’s a smart move that would make Broadcom into a tech juggernaut,” GBH Insights analyst Daniel Ives tells Reuters.

Only a couple of days previously, AVGO pre-announced positive Q4 earnings results. The company disclosed that it expects revenue at the higher end of its previous guidance calling for $4.8B +/- $75M range. While there was no additional commentary from management to explain these results, the upside is likely the result of AVGO’s 40% content increase in Apple’s iPhone 8 and iPhone X.

Word on the Street

Given all these juicy updates, it is hardly surprising that the stock has received a slew of recent buy ratings (7 in the last week). One of the most bullish analysts is five-star JP Morgan analyst Harlan Sur. He came out with one of the stock’s highest price targets of $315 (15% upside potential from current share price) on November 3.

He says that due to strong near-term demand trends, management is very likely to raise the annual dividend by 50% to $6 in early December. At the same time, he believes that AVGO will move its legal headquarters back to the US with or without the implementation of proposed tax reforms. This should enable the $5.5bn Brocade Communications deal to close in two weeks says Sur.

Leave A Comment